Soil Health and Agriculture: Towards Reconciliation

What are the best solutions to improve soil health and address the challenge of making sustainability mainstream in agriculture?

Gabriel Méhaignerie

TL;DR

Soil health is a growing issue, with an impact both on climate and our global food systems. A growing number of solutions are fertile ground for VC investments.

Maintaining soil health is essential for environmental conservation and sustaining the global food chain.

Current agricultural methods have disrupted soil health and the natural soil carbon cycle, transforming vast stretches of arable land into significant sources of greenhouse gas emissions. Agriculture accounts for 12% of global GHG emissions, with half coming from agricultural fields.

Efforts such as Soil Organic Carbon (SOC) are a positive step in the right direction, but the associated carbon credits alone might not be the ideal solution, as stakeholder interests are misaligned, considering the scale of deployment needed.

Enhancing soil health can notably increase a farmer’s profits by reducing dependence on costly fertilizers and water, while simultaneously increasing resilience to weather fluctuations.

Several promising companies are devising tools that offer farmers tangible ROI, enabling the adoption of sustainable practices without compromising yields and revenue. Some exciting verticals are soil microbiome restoration and enhancement or crop engineering.

Introduction

Tracing the journey of agriculture is like flipping through the pages of a long history book. From our ancestors’ nomadic ways to their decision to put down roots and farm, we’ve seen some breakthrough innovations. Fast forward to the 20th century, when modern agriculture took the stage: the Green Revolution ushered in impressive advances like synthetic fertilizers and high-yield crops, helping us feed millions (see Figure 1 below), where around half of the global population is fed by synthetic fertilizers.

World population with & without synthetic fertilizer use (Our World In Data)

However, these strides came at a cost. Our environment, particularly our soil and water, felt the pressure of these advancements. This created significant disturbances to the natural soil carbon cycle and significantly altered soil health. Over 12,000 years, such conversions released approximately 110 billion tCO2eq from the topsoil, equivalent to 80 years of current US emissions.

In this article, we’re zeroing in on what are the best tools to rapidly scale agriculture towards sustainability and resilience, and which companies we think can enable this transition.

Rice Fields in Ubud, Indonesia (hotel.com)

Some Context About Soil Health

Why is Soil Health Important?

Soil is a complex ecosystem crucial for food production. Threatened by the impact of human activity and climate change, potential agricultural losses could range from 20–80% because of improper soil health. Fertilizer use is increasing to maintain yields, affecting the soil. Given the slow regeneration of topsoil, preserving its health is essential. Healthy soils not only boost agricultural yields but also enhance farm profitability, with well-maintained soil leading to reduced costs. Furthermore, the rich biodiversity in the soil is instrumental for nutrient cycling and overall fertility. In modern agriculture, healthy soil also provides accurate data for tools, including AI, optimizing crop yields and informing farmers’ decisions. Thus, soil health is fundamental for sustainable and prosperous agriculture.

What Is The Soil Carbon Cycle and Why Is It Broken?

Carbon is the linchpin of living systems, leading to its field of study: organic chemistry. Soil, intriguingly, holds the largest portion of active carbon on Earth. In undisturbed natural settings, soil’s CO2 absorption is around equal to its CO2 emission. Plants absorb atmospheric carbon, converting it into plant tissue which eventually returns to the soil. Soil organisms, consuming and transforming those plant tissues, release CO2 through respiration. This is the essence of the carbon cycle.

Diagram of the Soil Carbon Cycle — simplified (Colorado State University)

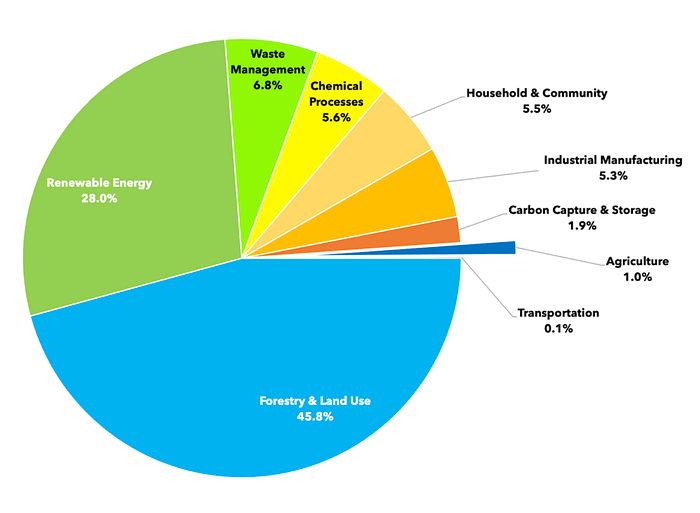

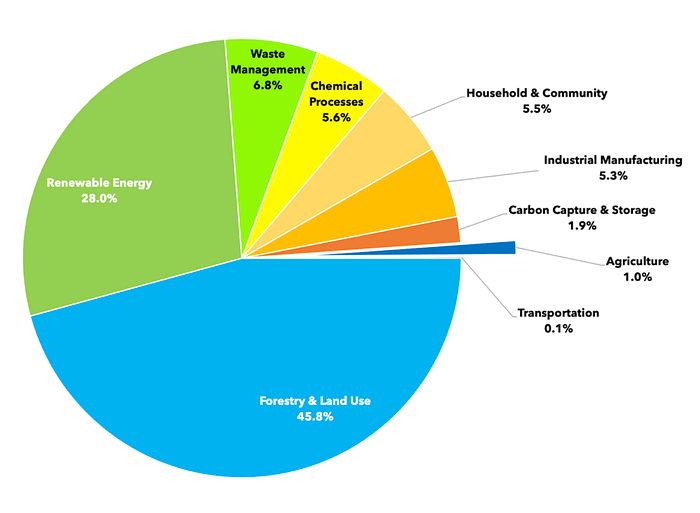

Transforming ecosystems into farmland disrupts this balance. Over 12,000 years, such conversions released approximately 110 billion tCO2eq from the topsoil. To put it in perspective, that’s like 80 years of current US emissions. Presently, European soils are releasing emissions at 64Mt C02eq/year. Within global GHG emissions, agriculture is responsible for 12% of global GHG emissions and agricultural soils contribute to over 40% of those total agriculture emissions (the rest mostly comes from enteric fermentation or methane from cattle).

Total GHG emissions from agriculture in the European Union in 2015 (Eurostat). Enteric fermentation is methane emission from cattle.

We have also notably lagged efforts to improve farming practices and make them more efficient. Fertilizer application efficiency has mostly stagnated in the last 40 years (see Figure below).

Nitrogen (main ingredient in fertilizers) Use Efficiency yearly in specific countries (Our World In Data)

Impact of Climate Change

Climate change is putting a strain on agriculture, with extreme weather events leaving a direct impact on crop yield. As we know, the number of extreme weather events will only increase with global warming.

Impact of extreme weather event on yearly maize crop yield in the US (EPA)

We’re at a crossroads: the need to scale sustainable farming is pressing to restore soil health: not just to reduce agriculture’s carbon footprint, but to bolster its resilience against climate change.

However, adopting sustainable farming practices is not straightforward, as we will explore below. A prevalent approach is soil carbon sequestration and its associated carbon credits, but that comes with challenges that might limit the large-scale application needed to transition to more sustainable agriculture. We might need to take a step back and appreciate the larger benefits that come with improving soil health.

Soil Organic Carbon Sequestration & The Misalignment of Carbon Credits

Recent agricultural practices have disrupted the natural carbon cycle of the soil and altered its health dramatically. Increasing the soil’s ability to sequester carbon is the North Star of Regenerative Agriculture Practices because it has the advantage of being an impartial measurement that fits within the global carbon market while being a good indicator of soil health.

The Importance of Soil Organic Carbon Sequestration

Agricultural soils, covering 10% of Earth, are ripe for carbon sequestration. If done correctly, soil organic carbon sequestration could effectively act as a negative emissions technology, pulling CO2 from our atmosphere and returning agriculture towards less net positive emitter of GHGs. Some studies estimate that soil carbon sequestration could be scaled up to sequester 2–5 GtCO2 per year by 2050, with a cumulative potential of 104–130 GtCO2 by the end of the century. Through optimal practices, agricultural soils could become net carbon sinks, offsetting 16–26% of annual EU agricultural emissions.

Scenario of Global Sequestration Potential of Soil Organic Carbon on Cropland Soils (Nature)

Historically, despite agriculture becoming more carbon-emitting due to intensified practices, soil organic carbon has remained a benchmark. Its role as a carbon capture technology is paramount, and it acts as a barometer for sustainable practices.

Focusing on soil organic carbon brings several advantages. Firstly, soils rich in organic carbon are generally more fertile, supporting better plant growth compared to carbon-depleted soils. Secondly, focusing on SOC can enhance the potential of soil ecosystem services, as it might encourage governance at various levels to implement better soil management practices.

So, focusing on soil carbon sequestration offers a standardized assessment of sustainable agriculture that can be integrated into overall emissions reduction policies. Soil carbon sequestration serves as a guiding principle, steering agriculture towards more sustainable practices. However, it falls short of providing a clear roadmap on how to achieve this noble goal.”

Limitations of Soil Carbon Capture in Sustainable Farming

Soil health is a vast topic, with carbon sequestration being just one component. An array of factors, from physical properties to biodiversity, collectively influence soil health and focusing solely on soil carbon might not be the most viable way to integrate sustainable practices at the necessary scales.

Soil Carbon measures offer an accurate but incomplete picture. Solely focusing on soil carbon sequestration can obscure other vital soil health components such as nutrient availability, microbial diversity, soil structure, and water-holding capacity. Truly healthy soil requires a balance of these elements. For example, it is difficult to account for the potential overuse of fertilizers (as they run off in water streams) or poorly managed irrigation when looking at SOC contents.

Additionally, while carbon sequestration might bolster soil fertility, factors like nutrient cycling, pest and disease management, and water availability are pivotal for high crop yields and are not directly accounted for in soil organic carbon measurements. Ignoring these elements might curb crop yields.

Farmers Face Heavy Hurdles When Relying on Soil Carbon Credits With Unclear Economic Upside

As is often the case, the responsibility falls once more on the farmers to carry out the different practices, pilling up on top of the many burdens they already face.

Many farmers, especially in developing regions, focus on immediate returns and food security. Adopting practices for the sole purpose of carbon sequestration might not resonate with their immediate needs. Such changes could be economically taxing, with upfront costs and questionable returns given the current carbon credit system. The mismatch between the incentives for farmers and F&B brands is evident, with the implementation of regenerative practices facing hurdles like upfront soil sampling costs, potential short-term yield reductions, and the uncertain market price of nature-based carbon credits.

Farmers are not well supported to face the many Implementation Complexities. Transitioning to practices that heighten soil carbon sequestration might not be straightforward. These practices differ in feasibility based on location, resource availability, and expertise. Furthermore, merely issuing credits without guiding farmers on implementation falls short in the long term.

Challenges in Permanence and Measurement

In terms of permanence, one significant limitation is the vulnerability of the stored carbon to microbial consumption and transformation of plant-derived carbon. Looking only at SOC content, practices have to be maintained for a very long term to sustain sequestration and permanence. If a farmer applies no-tilling practices for 5 years but then is forced to till the field once, most of the sequestered SOC can be lost.

Regarding measurement, the process of determining the amount of carbon sequestered in soils is intricate, and obtaining reliable measurements can be challenging. This makes it difficult to accurately measure the potential of soil to sequester carbon over extended periods. Accurate measurements require advanced techniques based on soil sampling and expensive lab analysis, which hinders its large-scale deployment.

Difficult Unit Economics For Soil Carbon Credits

The Carbon by Indigo program sold credit at $40 per credit. With farmers retaining 75% of this revenue, they can earn up to $30 for every credit generated. This might sound good on paper, but the overall impact is limited for farmers.

A hectare of cropland typically produces around 0.1 credits per year. Therefore, for a 1,000-hectare farm generating approximately 100 credits annually, and at $40 per credit, a farmer would earn an added income of just $3,000 yearly for their soil carbon efforts. Considering the cost of growing wheat in the UK is around €1000/ha, the returns from the carbon credits are not so significant.

The costs of MRV as also high, as discussed above, as easily accessible, accurate, and inexpensive MRV solutions do not exist. Remote sensing costs around €0.5/ha while soil sampling combined with lab analysis costs around €20–50/ha per year. This accounts for more than 15% of the credit price.

Looking at the potential benefits of only the carbon credits does not cover the opportunity cost of changing practices for the farmers. This could greatly hinder the widespread adoption of regenerative practices in agriculture.In essence, sole reliance on soil carbon credits may not drive widespread adoption of sustainable farming because SOC is inherently associated with carbon credits, an appealing solution for corporates but far from ideal for farmers. This would prevent the widespread adoption that is required for sustainable farming practices.

Promoting Soil Health to Enable Sustainable Agriculture Practices

Farmers are at the frontline of climate change, grappling with unpredictable weather patterns and soil degradation. More than ever, they seek dependable solutions that offer quick and consistent returns to maintain their crop yields. The real interest for farmers lies in boosting their resilience against the severe impacts of climate change, such as droughts, extreme heat, and erratic rainfall patterns. By doing so, they can ensure more stable revenues. Fortunately, regenerative agriculture is the key to achieving this resilience, and every solution must underscore this point.

Regenerative Agriculture Practices Diagram (Soil for Life)

The Urgent Need for Reframing Our Approach to Soil Health

Soil isn’t just dirt — it’s a rich, complex microbial ecosystem teeming with bacteria, fungi, and other microorganisms that are vital for plant health and our food production. However, the menace of soil erosion, exacerbated by human actions and climate change, threatens this delicate balance, potentially causing agricultural yield losses ranging from 20% to 80%. Given that new topsoil forms at a snail’s pace of only 0.25–1.5mm per year, soil effectively becomes a non-renewable resource. The health of this vital resource is determined by myriad factors, including moisture levels, pH, vegetation cover, and the intricate dance of microbial interactions.

A change in perspective can shift the narrative. While researchers often delve into the nuances of “climate-smart soils,” focusing on their greenhouse gas balances, it might resonate more with farmers if we talked about “weather-proofing soils”. This would emphasize soils’ augmented abilities to retain water, efficiently recycle nutrients, and support diversified crops even as climates shift. The essence is not to lose sight of the overarching goal: ensuring that soil health approaches have the most significant societal impact.

Regenerative agriculture practices and their associated implementation complexity level

Building Resilience and Increasing Revenues with Regenerative Practices

Germany’s embrace of regenerative agriculture showcases its long-term economic promise. After 6 to 10 years of consistent implementation, farmers have witnessed profit surges of approximately 60%. This is no minor feat. The advantages manifest in various forms: fortified soil structure, augmented yields, bolstered soil fertility, and a jump in land valuation. Furthermore, regenerative agriculture acts as a great buffer against extreme weather events, insulating the entire agri-food system and ensuring future food supplies remain unhindered. This method holds the potential to slash yield losses by half during years plagued by adverse weather conditions.

Potential revenue gains for farmers switching to Regen Ag practices in Germany (BCG analysis)

The Socio-Economic Co-Benefits of Healthy Soils

Adopting regenerative agriculture practices goes far beyond carbon credits. The socio-ecological rewards are manifold: a significant dent in the carbon footprint (estimated savings of €8 billion annually) and marked improvements in water quality (savings of around €0.5 billion annually). These practices don’t just elevate the environmental stature of food companies; they align with stringent environmental regulations and polish their public image. If Germany’s food supply chain is to be transformed, it necessitates a united front, with stakeholders collaborating at every step. By championing regenerative agriculture, farmers, society, and the entire food industry stand to gain, creating a symbiotic relationship that benefits all.

Potential socio-economic benefits of Regen Ag practices in Germany (BCG analysis)

Hence, the financial advantages are much more appealing when integrating the larger picture of soil health for farmers. Regenerative agriculture practices allow for a reduction of overhead costs and better resilience against extreme weather events. Companies that can support farmers on that path can generate a much higher return on investment than just carbon credits.

Market Trends

Overall, the growing attention to soil carbon is evident, but we are still very far from the scaling needed to reach significant magnitudes. The offsets associated with soil carbon have been slow to pick up and while insetting is becoming a priority for several F&B companies, its full rollout is yet to be done. VC investment has remained limited in that space, mostly driven by a few larger late-stage deals.

The Soil Carbon Credit Market: A Slow Take-Off

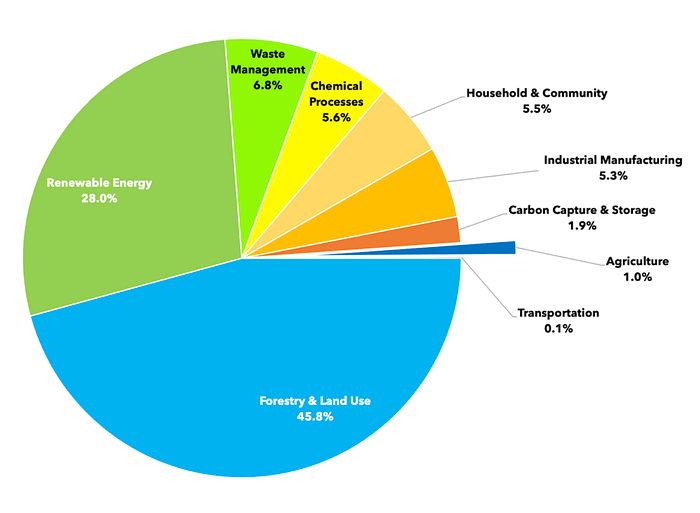

Percentage share of carbon credits issued by area of scope of projects (AgFunder)

Countries like the US and Australia have incorporated soil carbon sequestration into their climate policies, leading to a surge in soil carbon projects. Especially in Australia, the large average surface area of farms has driven this growth. Yet, the market has been slow to mature. The challenges are manifold: from the inherent complexities of the projects, substantial upfront costs, and potential yield reductions, to the variability in standards for quantifying soil carbon. There are also issues with additionality and permanence, limiting projects to those who have yet to adopt sustainable practices and raising concerns about the longevity of carbon storage.

Soil Carbon Project registration year on year in Australia (S&P Global)

Moreover, for projects to be viable on a large scale, they often require aggregating fields to determine baseline carbon levels. Another obstacle to wide adoption is the current low carbon prices, which are reportedly not profitable unless they exceed $30+ per ton of CO2e. This has been highlighted by the “Carbon by Indigo” program, which initially sold credits at $20, then increased to $27 and $40, with farmers only receiving 75% of this revenue. In essence, either higher credit prices or additional incentives are essential for broader farmer participation.

Insetting: The New Focus for Major Food and Beverage Companies

Specific pledges from prominent F&B companies like Nestle and Danone shed light on the implementation strategies. While Nestle is focusing on a reward structure for farmers, Danone is financing every step of the farmer’s transition, which can be intricate.

Instead of relying solely on offsetting carbon, large FMCG & F&B companies, especially in the EU & US, are now turning their attention to insetting. They are launching initiatives and guidelines to diminish emissions via regenerative agricultural practices.

Cumulative commitments for SBTi insetting pledges (SBTi report)

Leading food and beverage companies are heavily invested in this shift. 55% of the top 100 F&B companies are part of the SBTi pledge, with the majority operating in Europe. These pledges are not just on paper; they’re backed by partnerships with specific project developers. To put things in perspective, our estimates indicate that the top 100 F&B companies in the EU and NA have committed to converting 21 million hectares to regenerative agriculture. However, compared to the total farmed land, 157m ha in the EU and 150m ha in the US, this figure remains modest, particularly as many of these commitments are yet to be realized.

Specific pledges from prominent F&B companies like Nestle and Danone shed light on the implementation strategies. While Nestle is focusing on a reward structure for farmers, Danone is financing every step of the farmer’s transition, which can be intricate.

Venture Capital’s Slow Move On Regenerative Agriculture

Recent VC investments in regenerative agriculture have been propelled mainly by a few large players. Agreena’s $50m funding round in March 2023 stands out. Yet, a look back at June 2022 reveals the combined enterprise value of the regenerative agriculture market stood at $6.1B, with 90% contributed by unicorns like Indigo and Pivot Bio. VC investments have been fluctuating, but Pivot Bio’s staggering $430M Series D suggests untapped opportunities. However, the decline in market size, primarily due to a 94% drop in Indigo’s valuation, offers a sobering counterpoint.

EU Regulations Pushing For Soil Health TransparencyEurope’s adoption of regenerative agriculture is supported by a regulatory push toward more sustainable farming. European policies are nudging farmers towards diversifying their crops, and introducing permanent and perennial crops, thus enhancing biodiversity. The EU’s objective, outlined in their directive, is to achieve healthy soil conditions by 2050, aligning with the EU Zero Pollution ambition. Reports, such as the one by the European Court of Auditors, emphasize the urgency of improving soil health. The EU Soil Strategy for 2030 underscores the commitment to safeguard, rejuvenate, and sustainably utilize soils.

What Is Interesting for Pace Ventures?

Using only carbon credits doesn’t fully meet farmers’ needs and jeopardizes long-term stability. Any successful technology must offer a reliable and speedy return on investment, helping farmers enhance their resilience to climate change without financial burden.

At Pace Ventures, we prioritize solutions that guarantee a concrete ROI via sustainable practices. This naturally involves improving soil health without sacrificing yield.

A winning market entry strategy needs to tailor its approach to farmers specifically. Having a founder with a background in agriculture is usually a prerequisite to building credibility. It’s vital to understand the nuances of the agricultural purchasing arena, which often involves incorporating trusted advisors and adapting to seasonal patterns. Collaborating with influential stakeholders in the value chain is typically the best approach to connecting with farmers at a grassroots level, leveraging the extensive networks that most Food & Beverage companies have with local farmer communities.

Improving Irrigation To Reduce Exposure To Crop Failures

Agriculture accounts for 70% of global water consumption. With clear inefficiencies, there’s a pressing need for innovative water-saving solutions. Two crucial advancements leading this change are remote sensing and precision irrigation. When implemented effectively, these can drastically reduce water consumption, promising rapid returns for farmers, especially in water-limited regions. Proper irrigation is essential for soil health. Most farmers could reduce their water costs with improved irrigation solutions.

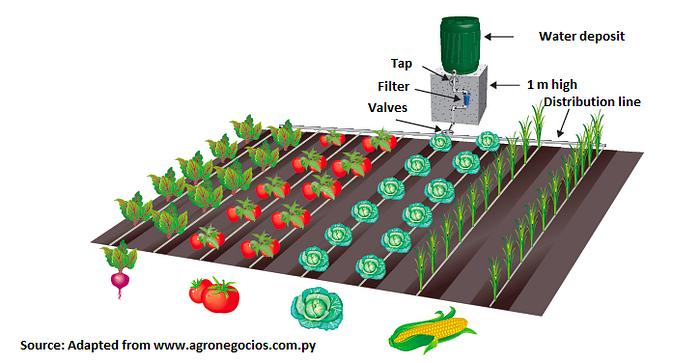

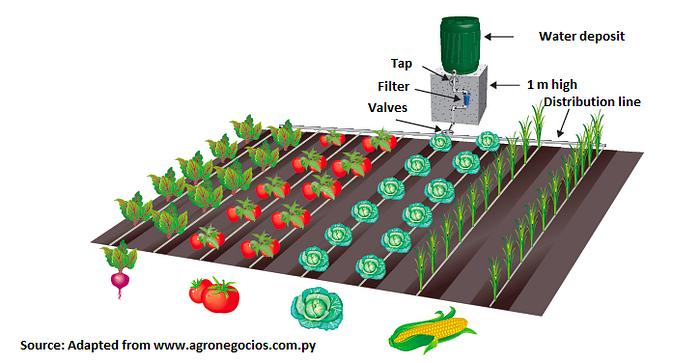

Drip Irrigation: Efficient and Effective

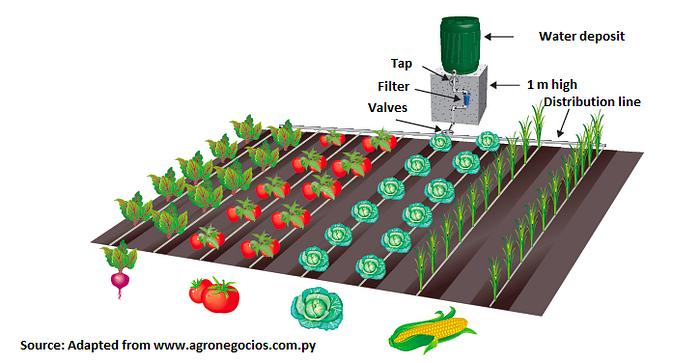

Drip irrigation, a method that uses tubing emitters placed near plant roots, maintains ideal moisture levels, boosting crop quality and yield. A standout in this arena is the N-Drip System. It not only promises a 33% increase in yield but also reduces water and energy use by 70%. The approach also combats environmental challenges like land depletion and topsoil erosion. Other innovators in this space include Telaqua, Soilsense, Lumo, and Saturas.

Drip Irrigation diagram representation (UN Climate Technology Center)

Sustainable Rice Irrigation: Alternative Wetting & Drying

Rice farming’s environmental cost is high, consuming about 2,500 liters of water per kilogram and contributing to 11% of global methane emissions. The Alternative Wetting and Drying (AWD) technique is a solution, allowing fields to dry intermittently, reducing water use by 38% and methane emissions by 85%. Assisting this change are Crop Models and Remote Sensing, optimizing irrigation, and predicting crop water needs. Leading the charge in this space are CultYvate and Mitti Labs, with the latter using geospatial data to issue carbon credits and reward farmers in India.

More Robust Crops Through Genomic Engineering

GMOs, with DNA altered through genetic engineering, have drastically impacted agriculture. Their introduction has led to a 37% decrease in chemical pesticide usage, a 22% increase in crop yields, and a 68% boost in farmer profits. Despite these benefits, traditional GMO techniques are plagued by lengthy development durations (sometimes a decade), significant costs (about $20m for trait identification), and a 75% decline in crop diversity since the 1900s.

However, the agricultural landscape is shifting. Innovations like the CRISPR-Cas9 methodology and the inclusion of Machine Learning have transformed the sector. Modern genomic engineering tools like CRISPR offer many advantages, like the exclusion of foreign genes (addressing some GMO reservations), reduction of unintended side effects, and much shorter developmental timelines. When fused with AI, these strategies have great potential to create crops with improved yields, increased climate adaptability, and specialized trait cultivation.

Companies Fusing Machine Learning & Genomic Data

US-based Series A company Living Carbon and Israel-based ClimateCrop, amplify a plant’s CO2 absorption capacity by refining the photosynthesis process through genomic engineering. Wild bio, originating from Oxford and in its pre-seed stage, leverages the resilience of wild plants to enhance crop yields. Late-stage Enko and Seed-stage Avalo, use Machine Learning to identify the ideal DNA sequences for desired plant characteristics. Biographica, a pre-seed UK-based, relies on graph-based machine learning to discover target genes for new plant traits. Phytoform Labs, a UK-based Series A company, focuses on reducing the time for new plant trait identification from years to months.

EU’s Evolving Regulatory Horizon

The rapid evolution in this sector faces European roadblocks due to strict GMO policies. As of now, both original GMOs and modern gene-editing tools like CRISPR are subject to similar regulatory scrutiny. Even though the scientific realm continues to advocate for alterations, emphasizing gene editing’s role in furthering the EU’s green goals, the guidelines persist in their restrictiveness. Yet talks are underway to update the EU regulations, aiming to differentiate between conventional GMOs and contemporary gene-editing techniques.

Increasing Efficiency of Inputs For Restoring Soil Health

Alarmingly, even with the widespread application of pesticides, a staggering 20–40% of global crops fall prey to diseases and 40% of fertilizer is applied in excess globally, going directly to water streams. These losses resonate not only in terms of environmental and health repercussions but also burden farmers, especially given the erratic pricing of fertilizers. Finally, fertilizer production alone accounts for 1–2% of the global GHG emissions.

In response, innovative companies are pioneering sustainable solutions to minimize agricultural inputs. Robigo ($10m seed round, US-based, MIT spinoff) used machine learning and genetic engineering to craft microbes that can protect crops from diseases. Ascribe Bio (US-based, raised $3m last year) makes natural crop protection products based on soil microbiome molecules. Both solutions can be sprayed onto crops like traditional pesticides but without their negative environmental impact. FaBio (early-stage, UK-based) specializes in sustainable bioproducts rooted in soil microbiology, with a primary focus on disease management. Puna Bio ($3.7m raised in 2022, Argentina-based) utilizes ancient extremophiles from the La Puna desert to improve soil health. Their groundbreaking seed coating consistently enhances yields in fertile soils and even facilitates cultivation in challenging terrains and degraded soils.

Finally, addressing the rampant consumption of nutrients and fertilizers, Agreed uses geospatial analytics and machine learning to monitor nutrient flow and pollution, paving the way for sustainable practices that not only restore soil fertility but also amplify profitability.

Soil Microbiome Enhancement

The soil microbiome is pivotal for fertile soil but recent intensive agricultural practices have considerably diminished the diversity of the soil microbiome. This diminished resilience causes declines in a decline in yield, requiring an increased reliance on fertilizers and pesticides, thus perpetuating a vicious cycle.

Soil Microbiome diagram (Nature)

Many companies are now focusing on improving soil health at the microbial level. Different strategies are being used, including enhancing individual microbes or managing the whole microbiome community.

Loam Bio (based in Australia, raised funds in Series B last February) is promoting microbial soil sequestration as an effective way to remove carbon and benefit both the environment and agriculture. They are achieving this by treating seeds with microbes that work together with plants to increase soil carbon storage and produce nutrient-rich crops.

CroBio (based in the UK, in the pre-seed stage) uses bacteria that produce cellulose and apply them directly to plant roots. This method encourages soil carbon retention and better water conservation by making use of carbon-rich materials created by these bacteria.

Pivot Bio (US-based, Series D) developed a solution that bypasses the need for fertilizers, supplying crops with the necessary nitrogen through a specific bacterium that converts directly nitrogen from the air to a form that plants can use. Kula Bio (US-based, Series A) is working on a similar solution.

Boost Biomes (US-based, seed stage) has a platform for discovering new microbial products that, when applied to soil, enhance crop resilience.

Finally, Concert Bio (based in the UK, seed stage) is working to improve entire communities of soil microbes. They aim to bring significant improvements, given the wide range of microbial diversity found in soils, which have been largely degraded in farming lands.

Boosting The Carbon Intake Through Material Addition

In order to improve the carbon intake of soil, combating soil erosion is done by either adding inputs or enhancing biomass growth

Addressing Soil Erosion:

Biochar, created by pyrolyzing organic waste materials with limited oxygen, serves various roles including enhancing soil fertility, improving water retention, and aiding in carbon sequestration. Notable companies in this field are Carbofex and Carbo Culture, both situated in Finland, specializing in transforming biomass into biochar for agricultural use.

Enhanced rock weathering, alternatively, accelerates natural rock decay processes by distributing ground silicate rocks like basalt on land. This method releases vital nutrients that enrich the soil and promote plant growth, besides improving water retention and counteracting soil acidification. Companies like Everest Carbon (with a base in the US and operations in India) and Eion (US-based, recently funded with a 12 million series A) are leading in this domain.

Both methods involve adding materials to fields to prevent erosion and are dependent on the specific soil characteristics and location. These companies generate substantial revenue from carbon credits, though monitoring and scalability concerns can present operational hurdles.

Boosting Biomass Production:

Companies such as Rhizocore (based in Scotland) and Andes (US-based) focus on enhancing natural biomass production to upraise soil carbon sequestration. Rhizocore uses indigenous fungi in specially designed pellets to foster tree growth, while Andes promotes Microbial Carbon Mineralization by introducing beneficial microbes into the soil along with crop seeds to speed up the conversion of CO2 to minerals. These minerals then move deep into the soil, facilitating continuous CO2 removal.

Regen Ag Resilience Practices: Supporting Decision-making For Farmers

Transitioning to regenerative agriculture poses economic and practical challenges for farmers. Klim, based in Berlin, and Agreena, based in Denmark, both offer platforms that provide farmers with carbon credits as a reward for implementing regenerative practices.

Agreena’s credit issuance possibilities (Agreena)

However, Agreena’s approach might not fully cater to the yield maintenance challenges during this shift. A potential remedy is the data and insights provided by companies like Propagate, which aids in integrating perennial crops, and Ceres Imagery, offering analytical tools for precision farming. Holo aims to facilitate this transition with a comprehensive farm OS, while GreenO connects farmers to key players in the food value chain, assisting in data monetization.

Efficient Data & MRV Practices: Essential for Farming Decisions

Navigating the complex terrain of Measuring, Reporting, and Verification (MRV) in Regen Ag is critical. The industry currently grapples with a trade-off between cost and accuracy when it comes to soil analysis methods. While remote sensing offers a cost-effective solution, it lacks precision; on the other hand, direct soil assessments offer greater accuracy but at a steep price.

Several companies are bridging this gap by offering farmers detailed soil health data using innovative technologies and sensors. These industry leaders aim to provide insightful yet affordable solutions, focusing on data that fosters higher yields and climate adaptability.

In the market, model-based firms like Loamin and EarthOptics are at the forefront, blending AI and remote sensing to offer affordable monitoring solutions. They integrate various innovative technologies such as satellite imagery and specialized sensors to facilitate consistent and cost-effective soil health monitoring.

Furthermore, companies are developing in-situ solutions, generating unique and affordable datasets. Entities such as Yard Stick and Stenon leverage cost-effective IoT devices for direct soil data collection. These firms are revolutionizing the sector by offering platforms that not only facilitate data analysis but significantly reduce operational costs.

Lastly, there are those focusing on lab-based innovations, seeking to extract maximum value from lab analysis procedures. A prime example is Biome Makers, a firm that concentrates on providing cost-effective yet accurate soil analysis. This company stands as a beacon in the lab solutions sector, aiding farmers in enhancing soil health through detailed data garnered from the lab-level analysis.

Conclusion

Soil health and carbon sequestration are central to sustainable agriculture, emphasizing the necessity for precise and economical measurement strategies. A rising number of companies are entering this sector, bringing a range of technologies and data analysis tools. While many are focusing on soil organic carbon measurement, sustainable agriculture extends beyond this. It demands a comprehensive approach that considers soil health and crop yield, along with addressing broader issues like climate change effects, socio-economic implications, and practical implementation challenges. Navigating the intricate journey of sustainable farming requires a balanced evaluation of its numerous benefits and possible trade-offs.

We want to hear from you!

We are curious to hear your thoughts and ideas. If you’re working on Soil Health applications or anything related to sustainable agriculture technologies, please reach out to us.

TL;DR

Soil health is a growing issue, with an impact both on climate and our global food systems. A growing number of solutions are fertile ground for VC investments.

Maintaining soil health is essential for environmental conservation and sustaining the global food chain.

Current agricultural methods have disrupted soil health and the natural soil carbon cycle, transforming vast stretches of arable land into significant sources of greenhouse gas emissions. Agriculture accounts for 12% of global GHG emissions, with half coming from agricultural fields.

Efforts such as Soil Organic Carbon (SOC) are a positive step in the right direction, but the associated carbon credits alone might not be the ideal solution, as stakeholder interests are misaligned, considering the scale of deployment needed.

Enhancing soil health can notably increase a farmer’s profits by reducing dependence on costly fertilizers and water, while simultaneously increasing resilience to weather fluctuations.

Several promising companies are devising tools that offer farmers tangible ROI, enabling the adoption of sustainable practices without compromising yields and revenue. Some exciting verticals are soil microbiome restoration and enhancement or crop engineering.

Introduction

Tracing the journey of agriculture is like flipping through the pages of a long history book. From our ancestors’ nomadic ways to their decision to put down roots and farm, we’ve seen some breakthrough innovations. Fast forward to the 20th century, when modern agriculture took the stage: the Green Revolution ushered in impressive advances like synthetic fertilizers and high-yield crops, helping us feed millions (see Figure 1 below), where around half of the global population is fed by synthetic fertilizers.

World population with & without synthetic fertilizer use (Our World In Data)

However, these strides came at a cost. Our environment, particularly our soil and water, felt the pressure of these advancements. This created significant disturbances to the natural soil carbon cycle and significantly altered soil health. Over 12,000 years, such conversions released approximately 110 billion tCO2eq from the topsoil, equivalent to 80 years of current US emissions.

In this article, we’re zeroing in on what are the best tools to rapidly scale agriculture towards sustainability and resilience, and which companies we think can enable this transition.

Rice Fields in Ubud, Indonesia (hotel.com)

Some Context About Soil Health

Why is Soil Health Important?

Soil is a complex ecosystem crucial for food production. Threatened by the impact of human activity and climate change, potential agricultural losses could range from 20–80% because of improper soil health. Fertilizer use is increasing to maintain yields, affecting the soil. Given the slow regeneration of topsoil, preserving its health is essential. Healthy soils not only boost agricultural yields but also enhance farm profitability, with well-maintained soil leading to reduced costs. Furthermore, the rich biodiversity in the soil is instrumental for nutrient cycling and overall fertility. In modern agriculture, healthy soil also provides accurate data for tools, including AI, optimizing crop yields and informing farmers’ decisions. Thus, soil health is fundamental for sustainable and prosperous agriculture.

What Is The Soil Carbon Cycle and Why Is It Broken?

Carbon is the linchpin of living systems, leading to its field of study: organic chemistry. Soil, intriguingly, holds the largest portion of active carbon on Earth. In undisturbed natural settings, soil’s CO2 absorption is around equal to its CO2 emission. Plants absorb atmospheric carbon, converting it into plant tissue which eventually returns to the soil. Soil organisms, consuming and transforming those plant tissues, release CO2 through respiration. This is the essence of the carbon cycle.

Diagram of the Soil Carbon Cycle — simplified (Colorado State University)

Transforming ecosystems into farmland disrupts this balance. Over 12,000 years, such conversions released approximately 110 billion tCO2eq from the topsoil. To put it in perspective, that’s like 80 years of current US emissions. Presently, European soils are releasing emissions at 64Mt C02eq/year. Within global GHG emissions, agriculture is responsible for 12% of global GHG emissions and agricultural soils contribute to over 40% of those total agriculture emissions (the rest mostly comes from enteric fermentation or methane from cattle).

Total GHG emissions from agriculture in the European Union in 2015 (Eurostat). Enteric fermentation is methane emission from cattle.

We have also notably lagged efforts to improve farming practices and make them more efficient. Fertilizer application efficiency has mostly stagnated in the last 40 years (see Figure below).

Nitrogen (main ingredient in fertilizers) Use Efficiency yearly in specific countries (Our World In Data)

Impact of Climate Change

Climate change is putting a strain on agriculture, with extreme weather events leaving a direct impact on crop yield. As we know, the number of extreme weather events will only increase with global warming.

Impact of extreme weather event on yearly maize crop yield in the US (EPA)

We’re at a crossroads: the need to scale sustainable farming is pressing to restore soil health: not just to reduce agriculture’s carbon footprint, but to bolster its resilience against climate change.

However, adopting sustainable farming practices is not straightforward, as we will explore below. A prevalent approach is soil carbon sequestration and its associated carbon credits, but that comes with challenges that might limit the large-scale application needed to transition to more sustainable agriculture. We might need to take a step back and appreciate the larger benefits that come with improving soil health.

Soil Organic Carbon Sequestration & The Misalignment of Carbon Credits

Recent agricultural practices have disrupted the natural carbon cycle of the soil and altered its health dramatically. Increasing the soil’s ability to sequester carbon is the North Star of Regenerative Agriculture Practices because it has the advantage of being an impartial measurement that fits within the global carbon market while being a good indicator of soil health.

The Importance of Soil Organic Carbon Sequestration

Agricultural soils, covering 10% of Earth, are ripe for carbon sequestration. If done correctly, soil organic carbon sequestration could effectively act as a negative emissions technology, pulling CO2 from our atmosphere and returning agriculture towards less net positive emitter of GHGs. Some studies estimate that soil carbon sequestration could be scaled up to sequester 2–5 GtCO2 per year by 2050, with a cumulative potential of 104–130 GtCO2 by the end of the century. Through optimal practices, agricultural soils could become net carbon sinks, offsetting 16–26% of annual EU agricultural emissions.

Scenario of Global Sequestration Potential of Soil Organic Carbon on Cropland Soils (Nature)

Historically, despite agriculture becoming more carbon-emitting due to intensified practices, soil organic carbon has remained a benchmark. Its role as a carbon capture technology is paramount, and it acts as a barometer for sustainable practices.

Focusing on soil organic carbon brings several advantages. Firstly, soils rich in organic carbon are generally more fertile, supporting better plant growth compared to carbon-depleted soils. Secondly, focusing on SOC can enhance the potential of soil ecosystem services, as it might encourage governance at various levels to implement better soil management practices.

So, focusing on soil carbon sequestration offers a standardized assessment of sustainable agriculture that can be integrated into overall emissions reduction policies. Soil carbon sequestration serves as a guiding principle, steering agriculture towards more sustainable practices. However, it falls short of providing a clear roadmap on how to achieve this noble goal.”

Limitations of Soil Carbon Capture in Sustainable Farming

Soil health is a vast topic, with carbon sequestration being just one component. An array of factors, from physical properties to biodiversity, collectively influence soil health and focusing solely on soil carbon might not be the most viable way to integrate sustainable practices at the necessary scales.

Soil Carbon measures offer an accurate but incomplete picture. Solely focusing on soil carbon sequestration can obscure other vital soil health components such as nutrient availability, microbial diversity, soil structure, and water-holding capacity. Truly healthy soil requires a balance of these elements. For example, it is difficult to account for the potential overuse of fertilizers (as they run off in water streams) or poorly managed irrigation when looking at SOC contents.

Additionally, while carbon sequestration might bolster soil fertility, factors like nutrient cycling, pest and disease management, and water availability are pivotal for high crop yields and are not directly accounted for in soil organic carbon measurements. Ignoring these elements might curb crop yields.

Farmers Face Heavy Hurdles When Relying on Soil Carbon Credits With Unclear Economic Upside

As is often the case, the responsibility falls once more on the farmers to carry out the different practices, pilling up on top of the many burdens they already face.

Many farmers, especially in developing regions, focus on immediate returns and food security. Adopting practices for the sole purpose of carbon sequestration might not resonate with their immediate needs. Such changes could be economically taxing, with upfront costs and questionable returns given the current carbon credit system. The mismatch between the incentives for farmers and F&B brands is evident, with the implementation of regenerative practices facing hurdles like upfront soil sampling costs, potential short-term yield reductions, and the uncertain market price of nature-based carbon credits.

Farmers are not well supported to face the many Implementation Complexities. Transitioning to practices that heighten soil carbon sequestration might not be straightforward. These practices differ in feasibility based on location, resource availability, and expertise. Furthermore, merely issuing credits without guiding farmers on implementation falls short in the long term.

Challenges in Permanence and Measurement

In terms of permanence, one significant limitation is the vulnerability of the stored carbon to microbial consumption and transformation of plant-derived carbon. Looking only at SOC content, practices have to be maintained for a very long term to sustain sequestration and permanence. If a farmer applies no-tilling practices for 5 years but then is forced to till the field once, most of the sequestered SOC can be lost.

Regarding measurement, the process of determining the amount of carbon sequestered in soils is intricate, and obtaining reliable measurements can be challenging. This makes it difficult to accurately measure the potential of soil to sequester carbon over extended periods. Accurate measurements require advanced techniques based on soil sampling and expensive lab analysis, which hinders its large-scale deployment.

Difficult Unit Economics For Soil Carbon Credits

The Carbon by Indigo program sold credit at $40 per credit. With farmers retaining 75% of this revenue, they can earn up to $30 for every credit generated. This might sound good on paper, but the overall impact is limited for farmers.

A hectare of cropland typically produces around 0.1 credits per year. Therefore, for a 1,000-hectare farm generating approximately 100 credits annually, and at $40 per credit, a farmer would earn an added income of just $3,000 yearly for their soil carbon efforts. Considering the cost of growing wheat in the UK is around €1000/ha, the returns from the carbon credits are not so significant.

The costs of MRV as also high, as discussed above, as easily accessible, accurate, and inexpensive MRV solutions do not exist. Remote sensing costs around €0.5/ha while soil sampling combined with lab analysis costs around €20–50/ha per year. This accounts for more than 15% of the credit price.

Looking at the potential benefits of only the carbon credits does not cover the opportunity cost of changing practices for the farmers. This could greatly hinder the widespread adoption of regenerative practices in agriculture.In essence, sole reliance on soil carbon credits may not drive widespread adoption of sustainable farming because SOC is inherently associated with carbon credits, an appealing solution for corporates but far from ideal for farmers. This would prevent the widespread adoption that is required for sustainable farming practices.

Promoting Soil Health to Enable Sustainable Agriculture Practices

Farmers are at the frontline of climate change, grappling with unpredictable weather patterns and soil degradation. More than ever, they seek dependable solutions that offer quick and consistent returns to maintain their crop yields. The real interest for farmers lies in boosting their resilience against the severe impacts of climate change, such as droughts, extreme heat, and erratic rainfall patterns. By doing so, they can ensure more stable revenues. Fortunately, regenerative agriculture is the key to achieving this resilience, and every solution must underscore this point.

Regenerative Agriculture Practices Diagram (Soil for Life)

The Urgent Need for Reframing Our Approach to Soil Health

Soil isn’t just dirt — it’s a rich, complex microbial ecosystem teeming with bacteria, fungi, and other microorganisms that are vital for plant health and our food production. However, the menace of soil erosion, exacerbated by human actions and climate change, threatens this delicate balance, potentially causing agricultural yield losses ranging from 20% to 80%. Given that new topsoil forms at a snail’s pace of only 0.25–1.5mm per year, soil effectively becomes a non-renewable resource. The health of this vital resource is determined by myriad factors, including moisture levels, pH, vegetation cover, and the intricate dance of microbial interactions.

A change in perspective can shift the narrative. While researchers often delve into the nuances of “climate-smart soils,” focusing on their greenhouse gas balances, it might resonate more with farmers if we talked about “weather-proofing soils”. This would emphasize soils’ augmented abilities to retain water, efficiently recycle nutrients, and support diversified crops even as climates shift. The essence is not to lose sight of the overarching goal: ensuring that soil health approaches have the most significant societal impact.

Regenerative agriculture practices and their associated implementation complexity level

Building Resilience and Increasing Revenues with Regenerative Practices

Germany’s embrace of regenerative agriculture showcases its long-term economic promise. After 6 to 10 years of consistent implementation, farmers have witnessed profit surges of approximately 60%. This is no minor feat. The advantages manifest in various forms: fortified soil structure, augmented yields, bolstered soil fertility, and a jump in land valuation. Furthermore, regenerative agriculture acts as a great buffer against extreme weather events, insulating the entire agri-food system and ensuring future food supplies remain unhindered. This method holds the potential to slash yield losses by half during years plagued by adverse weather conditions.

Potential revenue gains for farmers switching to Regen Ag practices in Germany (BCG analysis)

The Socio-Economic Co-Benefits of Healthy Soils

Adopting regenerative agriculture practices goes far beyond carbon credits. The socio-ecological rewards are manifold: a significant dent in the carbon footprint (estimated savings of €8 billion annually) and marked improvements in water quality (savings of around €0.5 billion annually). These practices don’t just elevate the environmental stature of food companies; they align with stringent environmental regulations and polish their public image. If Germany’s food supply chain is to be transformed, it necessitates a united front, with stakeholders collaborating at every step. By championing regenerative agriculture, farmers, society, and the entire food industry stand to gain, creating a symbiotic relationship that benefits all.

Potential socio-economic benefits of Regen Ag practices in Germany (BCG analysis)

Hence, the financial advantages are much more appealing when integrating the larger picture of soil health for farmers. Regenerative agriculture practices allow for a reduction of overhead costs and better resilience against extreme weather events. Companies that can support farmers on that path can generate a much higher return on investment than just carbon credits.

Market Trends

Overall, the growing attention to soil carbon is evident, but we are still very far from the scaling needed to reach significant magnitudes. The offsets associated with soil carbon have been slow to pick up and while insetting is becoming a priority for several F&B companies, its full rollout is yet to be done. VC investment has remained limited in that space, mostly driven by a few larger late-stage deals.

The Soil Carbon Credit Market: A Slow Take-Off

Percentage share of carbon credits issued by area of scope of projects (AgFunder)

Countries like the US and Australia have incorporated soil carbon sequestration into their climate policies, leading to a surge in soil carbon projects. Especially in Australia, the large average surface area of farms has driven this growth. Yet, the market has been slow to mature. The challenges are manifold: from the inherent complexities of the projects, substantial upfront costs, and potential yield reductions, to the variability in standards for quantifying soil carbon. There are also issues with additionality and permanence, limiting projects to those who have yet to adopt sustainable practices and raising concerns about the longevity of carbon storage.

Soil Carbon Project registration year on year in Australia (S&P Global)

Moreover, for projects to be viable on a large scale, they often require aggregating fields to determine baseline carbon levels. Another obstacle to wide adoption is the current low carbon prices, which are reportedly not profitable unless they exceed $30+ per ton of CO2e. This has been highlighted by the “Carbon by Indigo” program, which initially sold credits at $20, then increased to $27 and $40, with farmers only receiving 75% of this revenue. In essence, either higher credit prices or additional incentives are essential for broader farmer participation.

Insetting: The New Focus for Major Food and Beverage Companies

Specific pledges from prominent F&B companies like Nestle and Danone shed light on the implementation strategies. While Nestle is focusing on a reward structure for farmers, Danone is financing every step of the farmer’s transition, which can be intricate.

Instead of relying solely on offsetting carbon, large FMCG & F&B companies, especially in the EU & US, are now turning their attention to insetting. They are launching initiatives and guidelines to diminish emissions via regenerative agricultural practices.

Cumulative commitments for SBTi insetting pledges (SBTi report)

Leading food and beverage companies are heavily invested in this shift. 55% of the top 100 F&B companies are part of the SBTi pledge, with the majority operating in Europe. These pledges are not just on paper; they’re backed by partnerships with specific project developers. To put things in perspective, our estimates indicate that the top 100 F&B companies in the EU and NA have committed to converting 21 million hectares to regenerative agriculture. However, compared to the total farmed land, 157m ha in the EU and 150m ha in the US, this figure remains modest, particularly as many of these commitments are yet to be realized.

Specific pledges from prominent F&B companies like Nestle and Danone shed light on the implementation strategies. While Nestle is focusing on a reward structure for farmers, Danone is financing every step of the farmer’s transition, which can be intricate.

Venture Capital’s Slow Move On Regenerative Agriculture

Recent VC investments in regenerative agriculture have been propelled mainly by a few large players. Agreena’s $50m funding round in March 2023 stands out. Yet, a look back at June 2022 reveals the combined enterprise value of the regenerative agriculture market stood at $6.1B, with 90% contributed by unicorns like Indigo and Pivot Bio. VC investments have been fluctuating, but Pivot Bio’s staggering $430M Series D suggests untapped opportunities. However, the decline in market size, primarily due to a 94% drop in Indigo’s valuation, offers a sobering counterpoint.

EU Regulations Pushing For Soil Health TransparencyEurope’s adoption of regenerative agriculture is supported by a regulatory push toward more sustainable farming. European policies are nudging farmers towards diversifying their crops, and introducing permanent and perennial crops, thus enhancing biodiversity. The EU’s objective, outlined in their directive, is to achieve healthy soil conditions by 2050, aligning with the EU Zero Pollution ambition. Reports, such as the one by the European Court of Auditors, emphasize the urgency of improving soil health. The EU Soil Strategy for 2030 underscores the commitment to safeguard, rejuvenate, and sustainably utilize soils.

What Is Interesting for Pace Ventures?

Using only carbon credits doesn’t fully meet farmers’ needs and jeopardizes long-term stability. Any successful technology must offer a reliable and speedy return on investment, helping farmers enhance their resilience to climate change without financial burden.

At Pace Ventures, we prioritize solutions that guarantee a concrete ROI via sustainable practices. This naturally involves improving soil health without sacrificing yield.

A winning market entry strategy needs to tailor its approach to farmers specifically. Having a founder with a background in agriculture is usually a prerequisite to building credibility. It’s vital to understand the nuances of the agricultural purchasing arena, which often involves incorporating trusted advisors and adapting to seasonal patterns. Collaborating with influential stakeholders in the value chain is typically the best approach to connecting with farmers at a grassroots level, leveraging the extensive networks that most Food & Beverage companies have with local farmer communities.

Improving Irrigation To Reduce Exposure To Crop Failures

Agriculture accounts for 70% of global water consumption. With clear inefficiencies, there’s a pressing need for innovative water-saving solutions. Two crucial advancements leading this change are remote sensing and precision irrigation. When implemented effectively, these can drastically reduce water consumption, promising rapid returns for farmers, especially in water-limited regions. Proper irrigation is essential for soil health. Most farmers could reduce their water costs with improved irrigation solutions.

Drip Irrigation: Efficient and Effective

Drip irrigation, a method that uses tubing emitters placed near plant roots, maintains ideal moisture levels, boosting crop quality and yield. A standout in this arena is the N-Drip System. It not only promises a 33% increase in yield but also reduces water and energy use by 70%. The approach also combats environmental challenges like land depletion and topsoil erosion. Other innovators in this space include Telaqua, Soilsense, Lumo, and Saturas.

Drip Irrigation diagram representation (UN Climate Technology Center)

Sustainable Rice Irrigation: Alternative Wetting & Drying

Rice farming’s environmental cost is high, consuming about 2,500 liters of water per kilogram and contributing to 11% of global methane emissions. The Alternative Wetting and Drying (AWD) technique is a solution, allowing fields to dry intermittently, reducing water use by 38% and methane emissions by 85%. Assisting this change are Crop Models and Remote Sensing, optimizing irrigation, and predicting crop water needs. Leading the charge in this space are CultYvate and Mitti Labs, with the latter using geospatial data to issue carbon credits and reward farmers in India.

More Robust Crops Through Genomic Engineering

GMOs, with DNA altered through genetic engineering, have drastically impacted agriculture. Their introduction has led to a 37% decrease in chemical pesticide usage, a 22% increase in crop yields, and a 68% boost in farmer profits. Despite these benefits, traditional GMO techniques are plagued by lengthy development durations (sometimes a decade), significant costs (about $20m for trait identification), and a 75% decline in crop diversity since the 1900s.

However, the agricultural landscape is shifting. Innovations like the CRISPR-Cas9 methodology and the inclusion of Machine Learning have transformed the sector. Modern genomic engineering tools like CRISPR offer many advantages, like the exclusion of foreign genes (addressing some GMO reservations), reduction of unintended side effects, and much shorter developmental timelines. When fused with AI, these strategies have great potential to create crops with improved yields, increased climate adaptability, and specialized trait cultivation.

Companies Fusing Machine Learning & Genomic Data

US-based Series A company Living Carbon and Israel-based ClimateCrop, amplify a plant’s CO2 absorption capacity by refining the photosynthesis process through genomic engineering. Wild bio, originating from Oxford and in its pre-seed stage, leverages the resilience of wild plants to enhance crop yields. Late-stage Enko and Seed-stage Avalo, use Machine Learning to identify the ideal DNA sequences for desired plant characteristics. Biographica, a pre-seed UK-based, relies on graph-based machine learning to discover target genes for new plant traits. Phytoform Labs, a UK-based Series A company, focuses on reducing the time for new plant trait identification from years to months.

EU’s Evolving Regulatory Horizon

The rapid evolution in this sector faces European roadblocks due to strict GMO policies. As of now, both original GMOs and modern gene-editing tools like CRISPR are subject to similar regulatory scrutiny. Even though the scientific realm continues to advocate for alterations, emphasizing gene editing’s role in furthering the EU’s green goals, the guidelines persist in their restrictiveness. Yet talks are underway to update the EU regulations, aiming to differentiate between conventional GMOs and contemporary gene-editing techniques.

Increasing Efficiency of Inputs For Restoring Soil Health

Alarmingly, even with the widespread application of pesticides, a staggering 20–40% of global crops fall prey to diseases and 40% of fertilizer is applied in excess globally, going directly to water streams. These losses resonate not only in terms of environmental and health repercussions but also burden farmers, especially given the erratic pricing of fertilizers. Finally, fertilizer production alone accounts for 1–2% of the global GHG emissions.

In response, innovative companies are pioneering sustainable solutions to minimize agricultural inputs. Robigo ($10m seed round, US-based, MIT spinoff) used machine learning and genetic engineering to craft microbes that can protect crops from diseases. Ascribe Bio (US-based, raised $3m last year) makes natural crop protection products based on soil microbiome molecules. Both solutions can be sprayed onto crops like traditional pesticides but without their negative environmental impact. FaBio (early-stage, UK-based) specializes in sustainable bioproducts rooted in soil microbiology, with a primary focus on disease management. Puna Bio ($3.7m raised in 2022, Argentina-based) utilizes ancient extremophiles from the La Puna desert to improve soil health. Their groundbreaking seed coating consistently enhances yields in fertile soils and even facilitates cultivation in challenging terrains and degraded soils.

Finally, addressing the rampant consumption of nutrients and fertilizers, Agreed uses geospatial analytics and machine learning to monitor nutrient flow and pollution, paving the way for sustainable practices that not only restore soil fertility but also amplify profitability.

Soil Microbiome Enhancement

The soil microbiome is pivotal for fertile soil but recent intensive agricultural practices have considerably diminished the diversity of the soil microbiome. This diminished resilience causes declines in a decline in yield, requiring an increased reliance on fertilizers and pesticides, thus perpetuating a vicious cycle.

Soil Microbiome diagram (Nature)

Many companies are now focusing on improving soil health at the microbial level. Different strategies are being used, including enhancing individual microbes or managing the whole microbiome community.

Loam Bio (based in Australia, raised funds in Series B last February) is promoting microbial soil sequestration as an effective way to remove carbon and benefit both the environment and agriculture. They are achieving this by treating seeds with microbes that work together with plants to increase soil carbon storage and produce nutrient-rich crops.

CroBio (based in the UK, in the pre-seed stage) uses bacteria that produce cellulose and apply them directly to plant roots. This method encourages soil carbon retention and better water conservation by making use of carbon-rich materials created by these bacteria.

Pivot Bio (US-based, Series D) developed a solution that bypasses the need for fertilizers, supplying crops with the necessary nitrogen through a specific bacterium that converts directly nitrogen from the air to a form that plants can use. Kula Bio (US-based, Series A) is working on a similar solution.

Boost Biomes (US-based, seed stage) has a platform for discovering new microbial products that, when applied to soil, enhance crop resilience.

Finally, Concert Bio (based in the UK, seed stage) is working to improve entire communities of soil microbes. They aim to bring significant improvements, given the wide range of microbial diversity found in soils, which have been largely degraded in farming lands.

Boosting The Carbon Intake Through Material Addition

In order to improve the carbon intake of soil, combating soil erosion is done by either adding inputs or enhancing biomass growth

Addressing Soil Erosion:

Biochar, created by pyrolyzing organic waste materials with limited oxygen, serves various roles including enhancing soil fertility, improving water retention, and aiding in carbon sequestration. Notable companies in this field are Carbofex and Carbo Culture, both situated in Finland, specializing in transforming biomass into biochar for agricultural use.

Enhanced rock weathering, alternatively, accelerates natural rock decay processes by distributing ground silicate rocks like basalt on land. This method releases vital nutrients that enrich the soil and promote plant growth, besides improving water retention and counteracting soil acidification. Companies like Everest Carbon (with a base in the US and operations in India) and Eion (US-based, recently funded with a 12 million series A) are leading in this domain.

Both methods involve adding materials to fields to prevent erosion and are dependent on the specific soil characteristics and location. These companies generate substantial revenue from carbon credits, though monitoring and scalability concerns can present operational hurdles.

Boosting Biomass Production:

Companies such as Rhizocore (based in Scotland) and Andes (US-based) focus on enhancing natural biomass production to upraise soil carbon sequestration. Rhizocore uses indigenous fungi in specially designed pellets to foster tree growth, while Andes promotes Microbial Carbon Mineralization by introducing beneficial microbes into the soil along with crop seeds to speed up the conversion of CO2 to minerals. These minerals then move deep into the soil, facilitating continuous CO2 removal.

Regen Ag Resilience Practices: Supporting Decision-making For Farmers

Transitioning to regenerative agriculture poses economic and practical challenges for farmers. Klim, based in Berlin, and Agreena, based in Denmark, both offer platforms that provide farmers with carbon credits as a reward for implementing regenerative practices.

Agreena’s credit issuance possibilities (Agreena)

However, Agreena’s approach might not fully cater to the yield maintenance challenges during this shift. A potential remedy is the data and insights provided by companies like Propagate, which aids in integrating perennial crops, and Ceres Imagery, offering analytical tools for precision farming. Holo aims to facilitate this transition with a comprehensive farm OS, while GreenO connects farmers to key players in the food value chain, assisting in data monetization.

Efficient Data & MRV Practices: Essential for Farming Decisions

Navigating the complex terrain of Measuring, Reporting, and Verification (MRV) in Regen Ag is critical. The industry currently grapples with a trade-off between cost and accuracy when it comes to soil analysis methods. While remote sensing offers a cost-effective solution, it lacks precision; on the other hand, direct soil assessments offer greater accuracy but at a steep price.

Several companies are bridging this gap by offering farmers detailed soil health data using innovative technologies and sensors. These industry leaders aim to provide insightful yet affordable solutions, focusing on data that fosters higher yields and climate adaptability.

In the market, model-based firms like Loamin and EarthOptics are at the forefront, blending AI and remote sensing to offer affordable monitoring solutions. They integrate various innovative technologies such as satellite imagery and specialized sensors to facilitate consistent and cost-effective soil health monitoring.

Furthermore, companies are developing in-situ solutions, generating unique and affordable datasets. Entities such as Yard Stick and Stenon leverage cost-effective IoT devices for direct soil data collection. These firms are revolutionizing the sector by offering platforms that not only facilitate data analysis but significantly reduce operational costs.

Lastly, there are those focusing on lab-based innovations, seeking to extract maximum value from lab analysis procedures. A prime example is Biome Makers, a firm that concentrates on providing cost-effective yet accurate soil analysis. This company stands as a beacon in the lab solutions sector, aiding farmers in enhancing soil health through detailed data garnered from the lab-level analysis.

Conclusion

Soil health and carbon sequestration are central to sustainable agriculture, emphasizing the necessity for precise and economical measurement strategies. A rising number of companies are entering this sector, bringing a range of technologies and data analysis tools. While many are focusing on soil organic carbon measurement, sustainable agriculture extends beyond this. It demands a comprehensive approach that considers soil health and crop yield, along with addressing broader issues like climate change effects, socio-economic implications, and practical implementation challenges. Navigating the intricate journey of sustainable farming requires a balanced evaluation of its numerous benefits and possible trade-offs.

We want to hear from you!

We are curious to hear your thoughts and ideas. If you’re working on Soil Health applications or anything related to sustainable agriculture technologies, please reach out to us.

TL;DR

Soil health is a growing issue, with an impact both on climate and our global food systems. A growing number of solutions are fertile ground for VC investments.

Maintaining soil health is essential for environmental conservation and sustaining the global food chain.

Current agricultural methods have disrupted soil health and the natural soil carbon cycle, transforming vast stretches of arable land into significant sources of greenhouse gas emissions. Agriculture accounts for 12% of global GHG emissions, with half coming from agricultural fields.

Efforts such as Soil Organic Carbon (SOC) are a positive step in the right direction, but the associated carbon credits alone might not be the ideal solution, as stakeholder interests are misaligned, considering the scale of deployment needed.

Enhancing soil health can notably increase a farmer’s profits by reducing dependence on costly fertilizers and water, while simultaneously increasing resilience to weather fluctuations.

Several promising companies are devising tools that offer farmers tangible ROI, enabling the adoption of sustainable practices without compromising yields and revenue. Some exciting verticals are soil microbiome restoration and enhancement or crop engineering.

Introduction

Tracing the journey of agriculture is like flipping through the pages of a long history book. From our ancestors’ nomadic ways to their decision to put down roots and farm, we’ve seen some breakthrough innovations. Fast forward to the 20th century, when modern agriculture took the stage: the Green Revolution ushered in impressive advances like synthetic fertilizers and high-yield crops, helping us feed millions (see Figure 1 below), where around half of the global population is fed by synthetic fertilizers.

World population with & without synthetic fertilizer use (Our World In Data)

However, these strides came at a cost. Our environment, particularly our soil and water, felt the pressure of these advancements. This created significant disturbances to the natural soil carbon cycle and significantly altered soil health. Over 12,000 years, such conversions released approximately 110 billion tCO2eq from the topsoil, equivalent to 80 years of current US emissions.

In this article, we’re zeroing in on what are the best tools to rapidly scale agriculture towards sustainability and resilience, and which companies we think can enable this transition.

Rice Fields in Ubud, Indonesia (hotel.com)

Some Context About Soil Health

Why is Soil Health Important?

Soil is a complex ecosystem crucial for food production. Threatened by the impact of human activity and climate change, potential agricultural losses could range from 20–80% because of improper soil health. Fertilizer use is increasing to maintain yields, affecting the soil. Given the slow regeneration of topsoil, preserving its health is essential. Healthy soils not only boost agricultural yields but also enhance farm profitability, with well-maintained soil leading to reduced costs. Furthermore, the rich biodiversity in the soil is instrumental for nutrient cycling and overall fertility. In modern agriculture, healthy soil also provides accurate data for tools, including AI, optimizing crop yields and informing farmers’ decisions. Thus, soil health is fundamental for sustainable and prosperous agriculture.

What Is The Soil Carbon Cycle and Why Is It Broken?

Carbon is the linchpin of living systems, leading to its field of study: organic chemistry. Soil, intriguingly, holds the largest portion of active carbon on Earth. In undisturbed natural settings, soil’s CO2 absorption is around equal to its CO2 emission. Plants absorb atmospheric carbon, converting it into plant tissue which eventually returns to the soil. Soil organisms, consuming and transforming those plant tissues, release CO2 through respiration. This is the essence of the carbon cycle.

Diagram of the Soil Carbon Cycle — simplified (Colorado State University)

Transforming ecosystems into farmland disrupts this balance. Over 12,000 years, such conversions released approximately 110 billion tCO2eq from the topsoil. To put it in perspective, that’s like 80 years of current US emissions. Presently, European soils are releasing emissions at 64Mt C02eq/year. Within global GHG emissions, agriculture is responsible for 12% of global GHG emissions and agricultural soils contribute to over 40% of those total agriculture emissions (the rest mostly comes from enteric fermentation or methane from cattle).

Total GHG emissions from agriculture in the European Union in 2015 (Eurostat). Enteric fermentation is methane emission from cattle.

We have also notably lagged efforts to improve farming practices and make them more efficient. Fertilizer application efficiency has mostly stagnated in the last 40 years (see Figure below).

Nitrogen (main ingredient in fertilizers) Use Efficiency yearly in specific countries (Our World In Data)

Impact of Climate Change

Climate change is putting a strain on agriculture, with extreme weather events leaving a direct impact on crop yield. As we know, the number of extreme weather events will only increase with global warming.

Impact of extreme weather event on yearly maize crop yield in the US (EPA)

We’re at a crossroads: the need to scale sustainable farming is pressing to restore soil health: not just to reduce agriculture’s carbon footprint, but to bolster its resilience against climate change.

However, adopting sustainable farming practices is not straightforward, as we will explore below. A prevalent approach is soil carbon sequestration and its associated carbon credits, but that comes with challenges that might limit the large-scale application needed to transition to more sustainable agriculture. We might need to take a step back and appreciate the larger benefits that come with improving soil health.

Soil Organic Carbon Sequestration & The Misalignment of Carbon Credits