Health Compliance: The Next Investment Frontier

The intersection of technology and regulation is reshaping healthcare, with Software as a Service (SaaS) solutions at the forefront. One sector, Healthcare Compliance, is experiencing remarkable growth driven by innovation and a string of new regulations. The new legislation has significantly impacted two areas: medical devices and patient data management.

Katharina Neisinger

We delve into the transformative trends, regulatory challenges, and investment potential in the dynamic world of MedTech SaaS and healthcare compliance.

Overview

Transformative Trends

Generative AI: The models have been used to analyze medical data, assist in diagnostics, and discover new drug candidates. It has also been used as virtual assistants to automate routine back-office tasks which is a time waste for most healthcare practitioners.

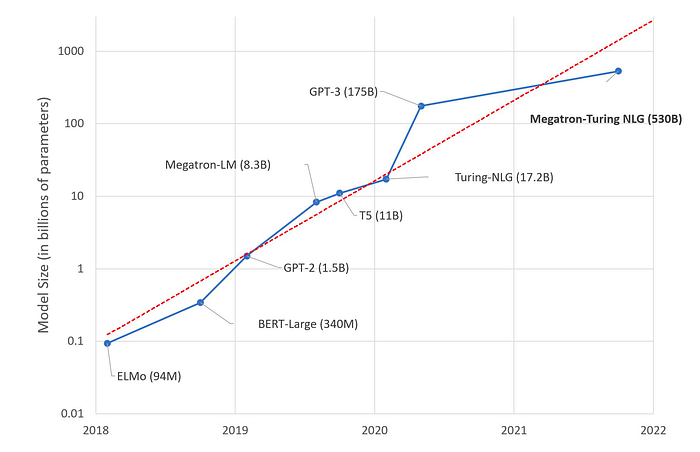

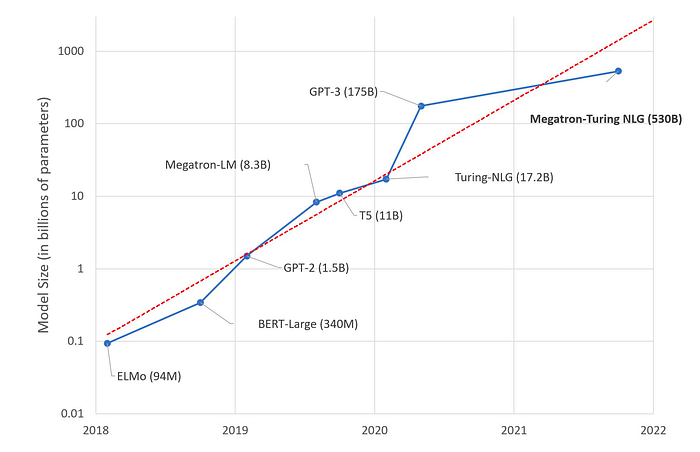

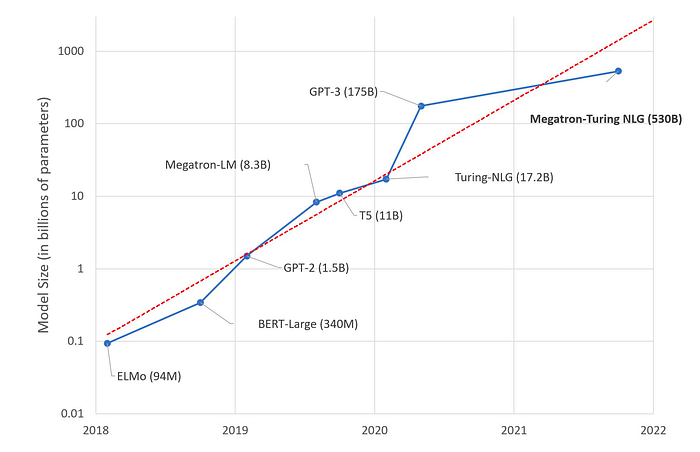

Large language models (LLM): Are a crucial part of Generative AI. It is a type of language model notable for its ability to achieve general-purpose language understanding and generation. LLMs acquire these abilities by using massive amounts of data to learn billions of parameters during training and consuming large computational resources during their training and operation.

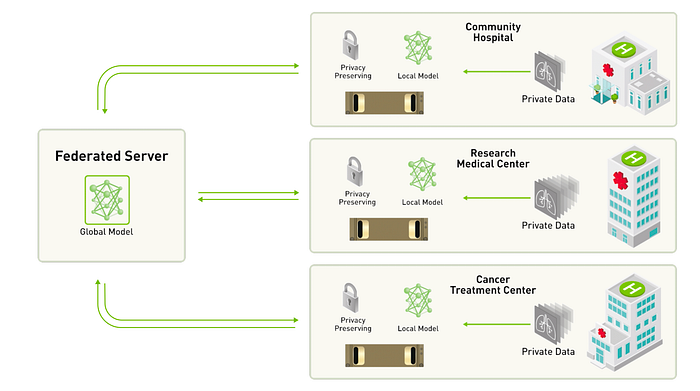

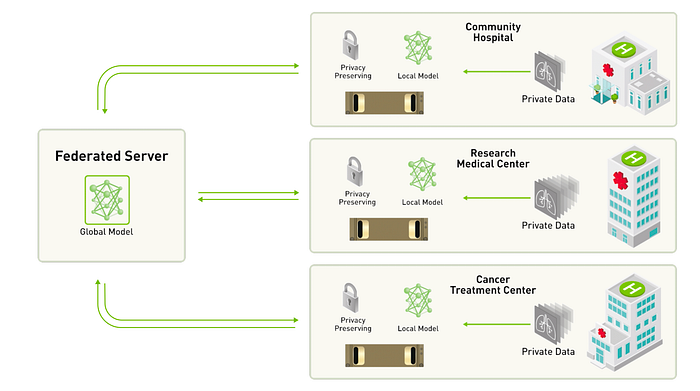

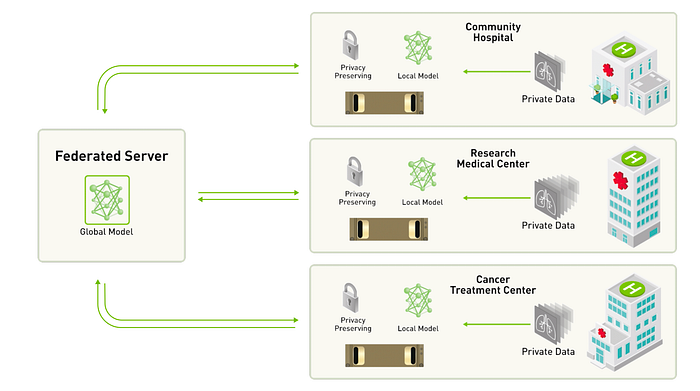

Federated Learning (FL): A decentralized approach to training AI/ML models. This approach allows models to be trained on the user's device/servers, without exchanging the raw data, which helps address privacy and security concerns. So instead of sending data to train the algo on a central server (traditional approach), an algo is sent to train directly on the user's device.

Regulatory Game-Changers

Two sets of legislation are noteworthy to call out:

The EU’s Medical Device Regulation Act (effective since 2021) has transformed the medical device industry with rigorous regulations.

The General Data Protection Regulation (GDPR) has tightened the reins on health and patient data management, emphasizing data governance.

Investment Potential & Venture Capital’s Interest

Venture capitalists are increasingly drawn to this high-growth niche due to:

SaaS Appeal: SaaS models are favored in uncertain times given their recurring nature.

Robust Regulations: Stringent regulations provide confidence and standardization. New regulations can also create significant barriers to entry for new players.

Explosive Growth: We have a growing aging population. As such, MedTech compliance, spanning medical devices and data management, is booming alongside increasing demographic trends.

The Market and Compliance Nexus: Why Is Now the Right Time?

Three trends have gained importance that have created an ideal compliance junction and opportunity for companies in the space

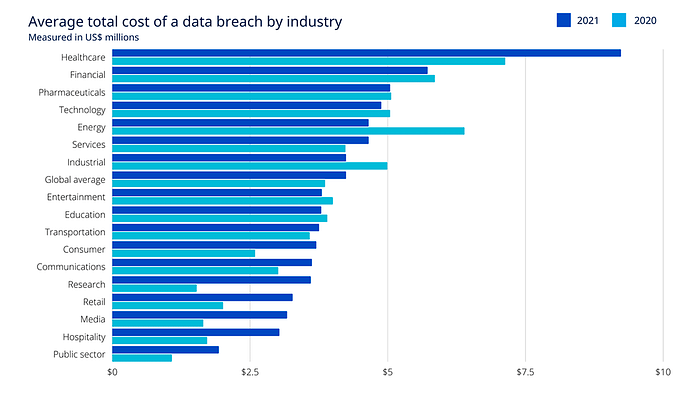

First, an uptake in data breaches has highlighted the urgent need for stronger compliance standards in healthcare.

Second, recent compliance regulations affect both physical hardware and data management in Europe. These regulations address pressing issues of uniformity in compliance among member states for hardware and more stringent requirements at the data level.

And third is the adoption of AI models, which provide a real game-changer and open opportunities for new entrants. Through AI, with LLMs and new ways of accessing data, like Federated Learning (FL), companies are enhancing data treatment and tapping into previously inaccessible data sources. This progress is replacing outdated manual methods and creating secure pathways for data access.

In short, these developments are creating practical, profitable opportunities for businesses savvy enough to navigate the evolving landscape of healthcare compliance.

Strong growth of data and related tools have made compliance and security critical in the healthcare industry

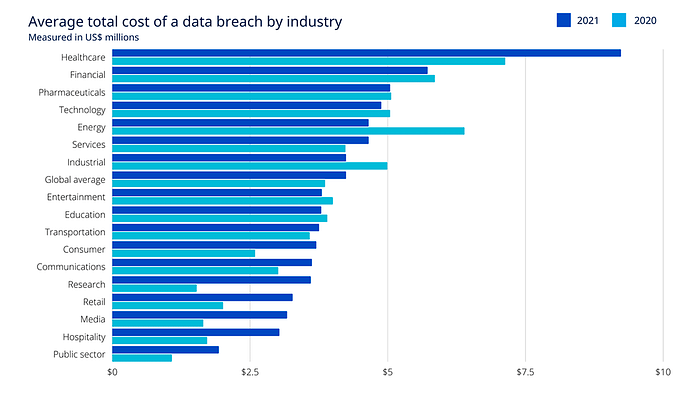

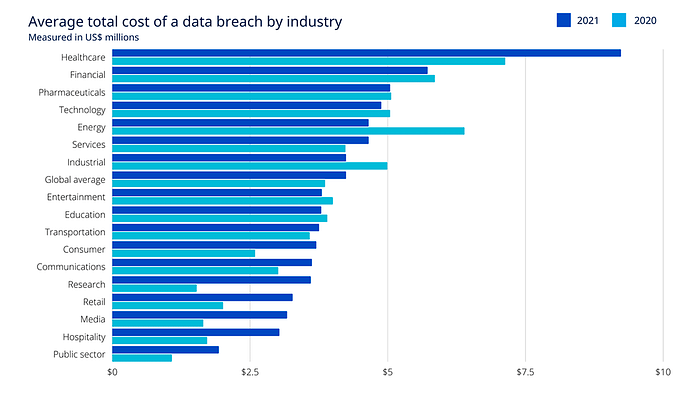

Average cost of data breaches per industry (source)

The healthcare industry is facing increasing cybersecurity threats, with attacks growing by 22% and nearly all organizations experiencing data breaches, largely due to reliance on outdated IT systems. Despite budget hesitations, the need to replace these legacy systems is evident to prevent costly incidents. Healthcare data breaches are the most costly of all industries, costing on average $8 million. In Europe, to add insult to injury, heavy fines are imposed for non-compliance in the event of data breaches, like the healthcare data processing company Dedalus's fine of €1.5 million in France after a data breach. MedTech and Healthcare SaaS are stepping in with efficient compliance tools to mitigate these risks, promising more secure data management and protection against breaches and hefty fines. These advanced tools are becoming essential for healthcare entities aiming to safeguard sensitive data and maintain compliance in a landscape marked by escalating cyber threats.

Landmark compliance regulations in the healthcare space at the physical and at the data governance level

Navigating healthcare compliance is becoming increasingly complex with new regulations at both the physical and data levels, significantly impacting stakeholders and investors. Two key legislations, the EU’s Medical Device Regulation (MDR) and the General Data Protection Regulation (GDPR), have set high compliance bars.

The MDR, active since 2020, mandates strict quality and safety standards for medical devices, aiming to streamline procedures and boost the EU industry’s global competitiveness, mainly through uniform regulation across all member states. It simplifies administrative processes, offers legal clarity, and increases the overall system’s credibility. These changes, particularly beneficial for SMEs, lower the entry barriers for startups.

Meanwhile, GDPR enforces tight control over personal health data processing, although its implementation has resulted in a fragmented approach across EU nations, complicating cross-border healthcare activities. Yet, it’s an essential framework, necessitating robust data governance practices in healthcare.

Recent and upcoming regulations, including the Data Governance Act and the anticipated EU Data Act, aim to reinforce trust in the healthcare data economy. These laws are designed to break data monopolies and democratize data access, favoring a more open, harmonized market. While they pose challenges — like potential constraints on AI innovation — they also represent significant tailwinds for a unified data economy, opening new avenues for startups and investors by fostering a more accessible data landscape in healthcare.

New technologies have unlocked competitive solutions for Compliance and Quality management

The healthcare sector is increasingly embracing artificial intelligence, specifically LLMs and FL, to adhere to compliance and roll out transformative solutions. A notable 70% of healthcare executives are investing in AI for compliance, complemented by a 38% surge in telehealth regulatory platforms during the pandemic.

LLMs are deep learning algorithms capable of recognizing, summarizing, translating, predicting, and generating content using large datasets. They also require very large datasets to train on and are characterized by a very large number of parameters in the model. In the last years, there has been an exponential increase in the number of parameters in a model, from 94 million for the ELMo in 2018 to GPT-3 using 175 billion in late 2020. Able to deliver insights from both large and unstructured data, LLMs facilitate various critical tasks in healthcare. They can quickly and accurately label medical text, which can improve healthcare documentation dramatically. This is essential in medical device regulation, requiring post-market surveillance for related medical devices a company is developing. LLMs can match trial criteria to patient attributes in electronic medical records, expanding patient recruitment. They can also recover missing patient data from unstructured text, reducing dataset bias. They can also provide compliance on privacy regarding patient data through the identification and redaction of protected healthcare information or personally identifiable information effectively.

However, their adoption is not without challenges, requiring substantial investment, extensive expertise, and access to large datasets, usually associated with advanced infrastructure.

Federated Learning is a promising solution to provide access to large datasets while limiting data sharing due to sensitivity, and privacy concerns, and preserving the business value of healthcare data. FL is a collaborative learning paradigm that addresses data governance and privacy by training algorithms without sharing data.Essentially, FL is a decentralized approach to training machine learning models. It doesn’t require an exchange of data from client devices to global servers. Instead, the raw data on edge devices is used to train the model locally, increasing data privacy. The final model is formed in a shared manner by aggregating the local updates.FL allows to circumvent conventional hurdles associated with data sharing in healthcare due to privacy and regulatory concerns. By allowing algorithm training without direct data access, FL ensures patient data privacy, thereby empowering precision medicine, unbiased medical decisions, and rare disease research without necessitating centralized data repositories.In this dynamic, LLMs leverage intricate healthcare data, ensuring stringent compliance and security measures are met. Concurrently, FL provides the structural backbone for secure, compliant data access, amplifying the effectiveness of LLMs in a mutually reinforcing synergy that marks the future of AI in healthcare compliance.

Venture Capital Opportunities

The AI and healthcare industry is burgeoning, yet its full capabilities hinge on the assurance of compliance and security for large-scale adoption. Currently valued at US$14.6 billion in 2023, the market projects a CAGR of 47.6% through 2028. Simultaneously, the clinical trials sector stands at US$60 billion, highlighting the substantial potential for growth and innovation.

FL emerges as one pivotal force in this scenario, essentially unlocking secure, regulation-adherent AI implementations in healthcare. Its role becomes particularly consequential in the medical device market, a prominent sector employing over 500,000 individuals across 25,000 companies in Europe alone. Despite its significance, the sector faces a major impediment due to reliance on legacy systems and conventional consulting practices for compliance, necessitating a shift towards more advanced, unified solutions.

Here, LLMs stand to revolutionize the compliance landscape, particularly by enhancing continuous post-market monitoring and transitioning the sector from traditional consulting methodologies to automated, platform-based solutions. This technological pivot doesn’t replace professional teams or consultants but optimizes their productivity, allowing focus on intricate, higher-value tasks.

The impacts are manifold:

Startups experience reduced compliance costs via automation, making market entry more feasible.

Consultants leverage these advanced tools or platforms for improved efficiency.

Large medtech organizations benefit similarly, streamlining compliance processes.

The recent EU Medical Device Regulation standardization amplifies these advantages, particularly for EU startups, by providing a unified market, thereby magnifying entry incentives.

In this light, investment in MedTech SaaS compliance, anticipating a 10% annual growth, becomes a lucrative venture. It underscores the indispensable nature of compliance in healthcare, suggesting that contributions to this realm could yield significant dividends, both financially and in healthcare innovation.

Key Players Answering Those Pain Points

In the MedTech space, AI-native startups are disrupting the status quo and enabling a leapfrog in productivity that are innovating

The landscape of medical technology is experiencing seismic shifts thanks to the advent of AI. Where once stood traditional methods, now AI-native startups are paving the way for groundbreaking advancements, streamlining processes that once heavily relied on human labor.

Central to this transformation are behemoths like Medtronic and Veeva Systems, commanding impressive market capitalizations of $96 billion and $33 billion, respectively. They’ve set the stage in MedTech SaaS compliance, but the real game-changers may be the new entrants who are leveraging sophisticated AI tools to revolutionize the sector. These tools, particularly advanced large language models, are automating tasks traditionally performed by consultants, marking a paradigm shift in how operations are run. This change isn’t just about cutting costs; it’s about enhancing accuracy and allowing human experts to concentrate on complex, high-value aspects of regulatory compliance.

Flinn Comply, founded in 2022 in Vienna and backed in their pre-seed by Speedinvest and SquareOne, offers comprehensive compliance and quality management solutions specifically designed to meet the needs of medical device companies.

Formly.ai, founded in 2022 and based in Berlin, provides easy and intuitive certification roadmaps tailored to any type of medical device and allows the creation of certification documents with AI. Their solution is addressed to both companies and certification consultants to streamline their processes.

Rimsys, established in 2017 in Pittsburgh and supported through a series A funding round including Bessemer, specializes in regulatory management software, catering to the specific requirements of medical device manufacturers.

Certivity, established in 2021 in Munich, seed-stage, offers compliance and quality management software that is finely tuned to address the unique needs of life sciences and medical device companies.

Qualio, founded in 2012 in San Francisco and supported through a series B funding round including Frontline Ventures and Tiger Global, delivers cloud-based quality management software uniquely customized for life sciences and medical device companies.

These companies highlight the growing role of AI in streamlining regulatory compliance and enhancing market competition.

Existing players within data governance and access to large data innovation

Innovation in data governance is reshaping how critical information is shared and managed in the healthcare sector. The rise of AI and advanced technologies is addressing long-standing hurdles in data access and collaboration, particularly in the sensitive realm of patient information.

Central to this evolving landscape are various stakeholders: problem owners (such as pharma companies, healthcare providers, or insurance firms seeking data-driven innovation), data custodians (hospitals, clinics, and health facilities managing patient data), and data scientists or problem solvers (experts extracting actionable insights from complex data).

Historically, these groups have faced significant challenges in exchanging information. Regulatory stringency around patient data makes the process not only cumbersome and costly but also fraught with privacy concerns. Most protocols demand a central database, complicating data access and necessitating repetitive, inefficient hoops for each new project.

Enter federated learning, a revolutionary approach where AI models and data tools are brought to the data custodian’s site, eliminating the need for central data storage. This concept is gaining traction, evidenced by the global federated learning market’s anticipated surge from USD 110.82 million in 2021 to USD 266.77 million by 2030. Its advantages are multifold: compliance with data privacy laws, enhanced security, cost-effective data handling, and more accurate machine learning outcomes.

Several pioneering companies are leading this charge:

This Paris-based Owkin, having secured $80 million in its latest funding round, is propelling drug discovery by uniquely integrating health data via federated learning. Its partnership with healthcare facilities enables the creation of exclusive datasets, fortifying its AI-driven precision medicine endeavors.

Flower, operating out of Hamburg and backed by a recent $3.6 million investment, Flower stands out with its industry-agnostic federated learning repository. Its plug-and-play solution is a boon for data scientists across sectors, including healthcare.

Los Angeles-based FedML, following an $11.5 million funding announced this August, specializes in integrated MAI models with Federated Learning, specifically Generative AI and LLMs. Its platform streamlines the training, deployment, monitoring, and enhancement of machine learning models, whether on-site or cloud-based.

Bitfount, based in the UK and having raised $3.5 million in 2021, provides a platform for secure, privacy-compliant data collaborations without direct data sharing through Federated Learning. Targeting the healthcare sector, its FL solutions are part of a more end-to-end solution for security and compliance in healthcare.

As this technology continues to mature, even tech giants like AWS and Microsoft are joining the fray, recognizing the transformative potential of federated learning in healthcare data management and beyond. The concerted efforts of these entities are setting the stage for unprecedented levels of secure, efficient, and innovative data collaboration in the years to come.

The Road Ahead

The future of MedTech SaaS compliance is exceptionally promising, marked by a confluence of continuous regulatory changes and rapid technological evolution. As healthcare continues its digital transformation, the role of compliance solutions will become increasingly vital. These solutions will not only safeguard patient data but also play a pivotal role in ensuring the quality and safety of patient care. The road ahead is paved with innovation, as compliance SaaS providers continue to adapt and enhance their offerings to meet the ever-evolving needs of the MedTech industry.

In conclusion, MedTech SaaS compliance represents a high-growth niche with a robust financial outlook and profound societal impact. It is a sector where venture capitalists should undoubtedly set their sights, as it is poised to be at the forefront of transformative changes in healthcare compliance. Capitalizing on the industry’s growth not only presents substantial financial opportunities but also enables active participation in shaping the future of healthcare, where innovation and compliance go hand in hand to deliver better patient outcomes and enhanced data security.

We want to hear from you!We are curious to hear your thoughts and ideas. If you’re working on Compliance and Security applications in MedTech or Health Data, please reach out to us.

We delve into the transformative trends, regulatory challenges, and investment potential in the dynamic world of MedTech SaaS and healthcare compliance.

Overview

Transformative Trends

Generative AI: The models have been used to analyze medical data, assist in diagnostics, and discover new drug candidates. It has also been used as virtual assistants to automate routine back-office tasks which is a time waste for most healthcare practitioners.

Large language models (LLM): Are a crucial part of Generative AI. It is a type of language model notable for its ability to achieve general-purpose language understanding and generation. LLMs acquire these abilities by using massive amounts of data to learn billions of parameters during training and consuming large computational resources during their training and operation.

Federated Learning (FL): A decentralized approach to training AI/ML models. This approach allows models to be trained on the user's device/servers, without exchanging the raw data, which helps address privacy and security concerns. So instead of sending data to train the algo on a central server (traditional approach), an algo is sent to train directly on the user's device.

Regulatory Game-Changers

Two sets of legislation are noteworthy to call out:

The EU’s Medical Device Regulation Act (effective since 2021) has transformed the medical device industry with rigorous regulations.

The General Data Protection Regulation (GDPR) has tightened the reins on health and patient data management, emphasizing data governance.

Investment Potential & Venture Capital’s Interest

Venture capitalists are increasingly drawn to this high-growth niche due to:

SaaS Appeal: SaaS models are favored in uncertain times given their recurring nature.

Robust Regulations: Stringent regulations provide confidence and standardization. New regulations can also create significant barriers to entry for new players.

Explosive Growth: We have a growing aging population. As such, MedTech compliance, spanning medical devices and data management, is booming alongside increasing demographic trends.

The Market and Compliance Nexus: Why Is Now the Right Time?

Three trends have gained importance that have created an ideal compliance junction and opportunity for companies in the space

First, an uptake in data breaches has highlighted the urgent need for stronger compliance standards in healthcare.

Second, recent compliance regulations affect both physical hardware and data management in Europe. These regulations address pressing issues of uniformity in compliance among member states for hardware and more stringent requirements at the data level.

And third is the adoption of AI models, which provide a real game-changer and open opportunities for new entrants. Through AI, with LLMs and new ways of accessing data, like Federated Learning (FL), companies are enhancing data treatment and tapping into previously inaccessible data sources. This progress is replacing outdated manual methods and creating secure pathways for data access.

In short, these developments are creating practical, profitable opportunities for businesses savvy enough to navigate the evolving landscape of healthcare compliance.

Strong growth of data and related tools have made compliance and security critical in the healthcare industry

Average cost of data breaches per industry (source)

The healthcare industry is facing increasing cybersecurity threats, with attacks growing by 22% and nearly all organizations experiencing data breaches, largely due to reliance on outdated IT systems. Despite budget hesitations, the need to replace these legacy systems is evident to prevent costly incidents. Healthcare data breaches are the most costly of all industries, costing on average $8 million. In Europe, to add insult to injury, heavy fines are imposed for non-compliance in the event of data breaches, like the healthcare data processing company Dedalus's fine of €1.5 million in France after a data breach. MedTech and Healthcare SaaS are stepping in with efficient compliance tools to mitigate these risks, promising more secure data management and protection against breaches and hefty fines. These advanced tools are becoming essential for healthcare entities aiming to safeguard sensitive data and maintain compliance in a landscape marked by escalating cyber threats.

Landmark compliance regulations in the healthcare space at the physical and at the data governance level

Navigating healthcare compliance is becoming increasingly complex with new regulations at both the physical and data levels, significantly impacting stakeholders and investors. Two key legislations, the EU’s Medical Device Regulation (MDR) and the General Data Protection Regulation (GDPR), have set high compliance bars.

The MDR, active since 2020, mandates strict quality and safety standards for medical devices, aiming to streamline procedures and boost the EU industry’s global competitiveness, mainly through uniform regulation across all member states. It simplifies administrative processes, offers legal clarity, and increases the overall system’s credibility. These changes, particularly beneficial for SMEs, lower the entry barriers for startups.

Meanwhile, GDPR enforces tight control over personal health data processing, although its implementation has resulted in a fragmented approach across EU nations, complicating cross-border healthcare activities. Yet, it’s an essential framework, necessitating robust data governance practices in healthcare.

Recent and upcoming regulations, including the Data Governance Act and the anticipated EU Data Act, aim to reinforce trust in the healthcare data economy. These laws are designed to break data monopolies and democratize data access, favoring a more open, harmonized market. While they pose challenges — like potential constraints on AI innovation — they also represent significant tailwinds for a unified data economy, opening new avenues for startups and investors by fostering a more accessible data landscape in healthcare.

New technologies have unlocked competitive solutions for Compliance and Quality management

The healthcare sector is increasingly embracing artificial intelligence, specifically LLMs and FL, to adhere to compliance and roll out transformative solutions. A notable 70% of healthcare executives are investing in AI for compliance, complemented by a 38% surge in telehealth regulatory platforms during the pandemic.

LLMs are deep learning algorithms capable of recognizing, summarizing, translating, predicting, and generating content using large datasets. They also require very large datasets to train on and are characterized by a very large number of parameters in the model. In the last years, there has been an exponential increase in the number of parameters in a model, from 94 million for the ELMo in 2018 to GPT-3 using 175 billion in late 2020. Able to deliver insights from both large and unstructured data, LLMs facilitate various critical tasks in healthcare. They can quickly and accurately label medical text, which can improve healthcare documentation dramatically. This is essential in medical device regulation, requiring post-market surveillance for related medical devices a company is developing. LLMs can match trial criteria to patient attributes in electronic medical records, expanding patient recruitment. They can also recover missing patient data from unstructured text, reducing dataset bias. They can also provide compliance on privacy regarding patient data through the identification and redaction of protected healthcare information or personally identifiable information effectively.

However, their adoption is not without challenges, requiring substantial investment, extensive expertise, and access to large datasets, usually associated with advanced infrastructure.

Federated Learning is a promising solution to provide access to large datasets while limiting data sharing due to sensitivity, and privacy concerns, and preserving the business value of healthcare data. FL is a collaborative learning paradigm that addresses data governance and privacy by training algorithms without sharing data.Essentially, FL is a decentralized approach to training machine learning models. It doesn’t require an exchange of data from client devices to global servers. Instead, the raw data on edge devices is used to train the model locally, increasing data privacy. The final model is formed in a shared manner by aggregating the local updates.FL allows to circumvent conventional hurdles associated with data sharing in healthcare due to privacy and regulatory concerns. By allowing algorithm training without direct data access, FL ensures patient data privacy, thereby empowering precision medicine, unbiased medical decisions, and rare disease research without necessitating centralized data repositories.In this dynamic, LLMs leverage intricate healthcare data, ensuring stringent compliance and security measures are met. Concurrently, FL provides the structural backbone for secure, compliant data access, amplifying the effectiveness of LLMs in a mutually reinforcing synergy that marks the future of AI in healthcare compliance.

Venture Capital Opportunities

The AI and healthcare industry is burgeoning, yet its full capabilities hinge on the assurance of compliance and security for large-scale adoption. Currently valued at US$14.6 billion in 2023, the market projects a CAGR of 47.6% through 2028. Simultaneously, the clinical trials sector stands at US$60 billion, highlighting the substantial potential for growth and innovation.

FL emerges as one pivotal force in this scenario, essentially unlocking secure, regulation-adherent AI implementations in healthcare. Its role becomes particularly consequential in the medical device market, a prominent sector employing over 500,000 individuals across 25,000 companies in Europe alone. Despite its significance, the sector faces a major impediment due to reliance on legacy systems and conventional consulting practices for compliance, necessitating a shift towards more advanced, unified solutions.

Here, LLMs stand to revolutionize the compliance landscape, particularly by enhancing continuous post-market monitoring and transitioning the sector from traditional consulting methodologies to automated, platform-based solutions. This technological pivot doesn’t replace professional teams or consultants but optimizes their productivity, allowing focus on intricate, higher-value tasks.

The impacts are manifold:

Startups experience reduced compliance costs via automation, making market entry more feasible.

Consultants leverage these advanced tools or platforms for improved efficiency.

Large medtech organizations benefit similarly, streamlining compliance processes.

The recent EU Medical Device Regulation standardization amplifies these advantages, particularly for EU startups, by providing a unified market, thereby magnifying entry incentives.

In this light, investment in MedTech SaaS compliance, anticipating a 10% annual growth, becomes a lucrative venture. It underscores the indispensable nature of compliance in healthcare, suggesting that contributions to this realm could yield significant dividends, both financially and in healthcare innovation.

Key Players Answering Those Pain Points

In the MedTech space, AI-native startups are disrupting the status quo and enabling a leapfrog in productivity that are innovating

The landscape of medical technology is experiencing seismic shifts thanks to the advent of AI. Where once stood traditional methods, now AI-native startups are paving the way for groundbreaking advancements, streamlining processes that once heavily relied on human labor.

Central to this transformation are behemoths like Medtronic and Veeva Systems, commanding impressive market capitalizations of $96 billion and $33 billion, respectively. They’ve set the stage in MedTech SaaS compliance, but the real game-changers may be the new entrants who are leveraging sophisticated AI tools to revolutionize the sector. These tools, particularly advanced large language models, are automating tasks traditionally performed by consultants, marking a paradigm shift in how operations are run. This change isn’t just about cutting costs; it’s about enhancing accuracy and allowing human experts to concentrate on complex, high-value aspects of regulatory compliance.

Flinn Comply, founded in 2022 in Vienna and backed in their pre-seed by Speedinvest and SquareOne, offers comprehensive compliance and quality management solutions specifically designed to meet the needs of medical device companies.

Formly.ai, founded in 2022 and based in Berlin, provides easy and intuitive certification roadmaps tailored to any type of medical device and allows the creation of certification documents with AI. Their solution is addressed to both companies and certification consultants to streamline their processes.

Rimsys, established in 2017 in Pittsburgh and supported through a series A funding round including Bessemer, specializes in regulatory management software, catering to the specific requirements of medical device manufacturers.

Certivity, established in 2021 in Munich, seed-stage, offers compliance and quality management software that is finely tuned to address the unique needs of life sciences and medical device companies.

Qualio, founded in 2012 in San Francisco and supported through a series B funding round including Frontline Ventures and Tiger Global, delivers cloud-based quality management software uniquely customized for life sciences and medical device companies.

These companies highlight the growing role of AI in streamlining regulatory compliance and enhancing market competition.

Existing players within data governance and access to large data innovation

Innovation in data governance is reshaping how critical information is shared and managed in the healthcare sector. The rise of AI and advanced technologies is addressing long-standing hurdles in data access and collaboration, particularly in the sensitive realm of patient information.

Central to this evolving landscape are various stakeholders: problem owners (such as pharma companies, healthcare providers, or insurance firms seeking data-driven innovation), data custodians (hospitals, clinics, and health facilities managing patient data), and data scientists or problem solvers (experts extracting actionable insights from complex data).

Historically, these groups have faced significant challenges in exchanging information. Regulatory stringency around patient data makes the process not only cumbersome and costly but also fraught with privacy concerns. Most protocols demand a central database, complicating data access and necessitating repetitive, inefficient hoops for each new project.

Enter federated learning, a revolutionary approach where AI models and data tools are brought to the data custodian’s site, eliminating the need for central data storage. This concept is gaining traction, evidenced by the global federated learning market’s anticipated surge from USD 110.82 million in 2021 to USD 266.77 million by 2030. Its advantages are multifold: compliance with data privacy laws, enhanced security, cost-effective data handling, and more accurate machine learning outcomes.

Several pioneering companies are leading this charge:

This Paris-based Owkin, having secured $80 million in its latest funding round, is propelling drug discovery by uniquely integrating health data via federated learning. Its partnership with healthcare facilities enables the creation of exclusive datasets, fortifying its AI-driven precision medicine endeavors.

Flower, operating out of Hamburg and backed by a recent $3.6 million investment, Flower stands out with its industry-agnostic federated learning repository. Its plug-and-play solution is a boon for data scientists across sectors, including healthcare.

Los Angeles-based FedML, following an $11.5 million funding announced this August, specializes in integrated MAI models with Federated Learning, specifically Generative AI and LLMs. Its platform streamlines the training, deployment, monitoring, and enhancement of machine learning models, whether on-site or cloud-based.

Bitfount, based in the UK and having raised $3.5 million in 2021, provides a platform for secure, privacy-compliant data collaborations without direct data sharing through Federated Learning. Targeting the healthcare sector, its FL solutions are part of a more end-to-end solution for security and compliance in healthcare.

As this technology continues to mature, even tech giants like AWS and Microsoft are joining the fray, recognizing the transformative potential of federated learning in healthcare data management and beyond. The concerted efforts of these entities are setting the stage for unprecedented levels of secure, efficient, and innovative data collaboration in the years to come.

The Road Ahead

The future of MedTech SaaS compliance is exceptionally promising, marked by a confluence of continuous regulatory changes and rapid technological evolution. As healthcare continues its digital transformation, the role of compliance solutions will become increasingly vital. These solutions will not only safeguard patient data but also play a pivotal role in ensuring the quality and safety of patient care. The road ahead is paved with innovation, as compliance SaaS providers continue to adapt and enhance their offerings to meet the ever-evolving needs of the MedTech industry.

In conclusion, MedTech SaaS compliance represents a high-growth niche with a robust financial outlook and profound societal impact. It is a sector where venture capitalists should undoubtedly set their sights, as it is poised to be at the forefront of transformative changes in healthcare compliance. Capitalizing on the industry’s growth not only presents substantial financial opportunities but also enables active participation in shaping the future of healthcare, where innovation and compliance go hand in hand to deliver better patient outcomes and enhanced data security.

We want to hear from you!We are curious to hear your thoughts and ideas. If you’re working on Compliance and Security applications in MedTech or Health Data, please reach out to us.

We delve into the transformative trends, regulatory challenges, and investment potential in the dynamic world of MedTech SaaS and healthcare compliance.

Overview

Transformative Trends

Generative AI: The models have been used to analyze medical data, assist in diagnostics, and discover new drug candidates. It has also been used as virtual assistants to automate routine back-office tasks which is a time waste for most healthcare practitioners.

Large language models (LLM): Are a crucial part of Generative AI. It is a type of language model notable for its ability to achieve general-purpose language understanding and generation. LLMs acquire these abilities by using massive amounts of data to learn billions of parameters during training and consuming large computational resources during their training and operation.

Federated Learning (FL): A decentralized approach to training AI/ML models. This approach allows models to be trained on the user's device/servers, without exchanging the raw data, which helps address privacy and security concerns. So instead of sending data to train the algo on a central server (traditional approach), an algo is sent to train directly on the user's device.

Regulatory Game-Changers

Two sets of legislation are noteworthy to call out:

The EU’s Medical Device Regulation Act (effective since 2021) has transformed the medical device industry with rigorous regulations.

The General Data Protection Regulation (GDPR) has tightened the reins on health and patient data management, emphasizing data governance.

Investment Potential & Venture Capital’s Interest

Venture capitalists are increasingly drawn to this high-growth niche due to:

SaaS Appeal: SaaS models are favored in uncertain times given their recurring nature.

Robust Regulations: Stringent regulations provide confidence and standardization. New regulations can also create significant barriers to entry for new players.

Explosive Growth: We have a growing aging population. As such, MedTech compliance, spanning medical devices and data management, is booming alongside increasing demographic trends.

The Market and Compliance Nexus: Why Is Now the Right Time?

Three trends have gained importance that have created an ideal compliance junction and opportunity for companies in the space

First, an uptake in data breaches has highlighted the urgent need for stronger compliance standards in healthcare.

Second, recent compliance regulations affect both physical hardware and data management in Europe. These regulations address pressing issues of uniformity in compliance among member states for hardware and more stringent requirements at the data level.

And third is the adoption of AI models, which provide a real game-changer and open opportunities for new entrants. Through AI, with LLMs and new ways of accessing data, like Federated Learning (FL), companies are enhancing data treatment and tapping into previously inaccessible data sources. This progress is replacing outdated manual methods and creating secure pathways for data access.

In short, these developments are creating practical, profitable opportunities for businesses savvy enough to navigate the evolving landscape of healthcare compliance.

Strong growth of data and related tools have made compliance and security critical in the healthcare industry

Average cost of data breaches per industry (source)

The healthcare industry is facing increasing cybersecurity threats, with attacks growing by 22% and nearly all organizations experiencing data breaches, largely due to reliance on outdated IT systems. Despite budget hesitations, the need to replace these legacy systems is evident to prevent costly incidents. Healthcare data breaches are the most costly of all industries, costing on average $8 million. In Europe, to add insult to injury, heavy fines are imposed for non-compliance in the event of data breaches, like the healthcare data processing company Dedalus's fine of €1.5 million in France after a data breach. MedTech and Healthcare SaaS are stepping in with efficient compliance tools to mitigate these risks, promising more secure data management and protection against breaches and hefty fines. These advanced tools are becoming essential for healthcare entities aiming to safeguard sensitive data and maintain compliance in a landscape marked by escalating cyber threats.

Landmark compliance regulations in the healthcare space at the physical and at the data governance level

Navigating healthcare compliance is becoming increasingly complex with new regulations at both the physical and data levels, significantly impacting stakeholders and investors. Two key legislations, the EU’s Medical Device Regulation (MDR) and the General Data Protection Regulation (GDPR), have set high compliance bars.

The MDR, active since 2020, mandates strict quality and safety standards for medical devices, aiming to streamline procedures and boost the EU industry’s global competitiveness, mainly through uniform regulation across all member states. It simplifies administrative processes, offers legal clarity, and increases the overall system’s credibility. These changes, particularly beneficial for SMEs, lower the entry barriers for startups.

Meanwhile, GDPR enforces tight control over personal health data processing, although its implementation has resulted in a fragmented approach across EU nations, complicating cross-border healthcare activities. Yet, it’s an essential framework, necessitating robust data governance practices in healthcare.

Recent and upcoming regulations, including the Data Governance Act and the anticipated EU Data Act, aim to reinforce trust in the healthcare data economy. These laws are designed to break data monopolies and democratize data access, favoring a more open, harmonized market. While they pose challenges — like potential constraints on AI innovation — they also represent significant tailwinds for a unified data economy, opening new avenues for startups and investors by fostering a more accessible data landscape in healthcare.

New technologies have unlocked competitive solutions for Compliance and Quality management

The healthcare sector is increasingly embracing artificial intelligence, specifically LLMs and FL, to adhere to compliance and roll out transformative solutions. A notable 70% of healthcare executives are investing in AI for compliance, complemented by a 38% surge in telehealth regulatory platforms during the pandemic.

LLMs are deep learning algorithms capable of recognizing, summarizing, translating, predicting, and generating content using large datasets. They also require very large datasets to train on and are characterized by a very large number of parameters in the model. In the last years, there has been an exponential increase in the number of parameters in a model, from 94 million for the ELMo in 2018 to GPT-3 using 175 billion in late 2020. Able to deliver insights from both large and unstructured data, LLMs facilitate various critical tasks in healthcare. They can quickly and accurately label medical text, which can improve healthcare documentation dramatically. This is essential in medical device regulation, requiring post-market surveillance for related medical devices a company is developing. LLMs can match trial criteria to patient attributes in electronic medical records, expanding patient recruitment. They can also recover missing patient data from unstructured text, reducing dataset bias. They can also provide compliance on privacy regarding patient data through the identification and redaction of protected healthcare information or personally identifiable information effectively.

However, their adoption is not without challenges, requiring substantial investment, extensive expertise, and access to large datasets, usually associated with advanced infrastructure.

Federated Learning is a promising solution to provide access to large datasets while limiting data sharing due to sensitivity, and privacy concerns, and preserving the business value of healthcare data. FL is a collaborative learning paradigm that addresses data governance and privacy by training algorithms without sharing data.Essentially, FL is a decentralized approach to training machine learning models. It doesn’t require an exchange of data from client devices to global servers. Instead, the raw data on edge devices is used to train the model locally, increasing data privacy. The final model is formed in a shared manner by aggregating the local updates.FL allows to circumvent conventional hurdles associated with data sharing in healthcare due to privacy and regulatory concerns. By allowing algorithm training without direct data access, FL ensures patient data privacy, thereby empowering precision medicine, unbiased medical decisions, and rare disease research without necessitating centralized data repositories.In this dynamic, LLMs leverage intricate healthcare data, ensuring stringent compliance and security measures are met. Concurrently, FL provides the structural backbone for secure, compliant data access, amplifying the effectiveness of LLMs in a mutually reinforcing synergy that marks the future of AI in healthcare compliance.

Venture Capital Opportunities

The AI and healthcare industry is burgeoning, yet its full capabilities hinge on the assurance of compliance and security for large-scale adoption. Currently valued at US$14.6 billion in 2023, the market projects a CAGR of 47.6% through 2028. Simultaneously, the clinical trials sector stands at US$60 billion, highlighting the substantial potential for growth and innovation.

FL emerges as one pivotal force in this scenario, essentially unlocking secure, regulation-adherent AI implementations in healthcare. Its role becomes particularly consequential in the medical device market, a prominent sector employing over 500,000 individuals across 25,000 companies in Europe alone. Despite its significance, the sector faces a major impediment due to reliance on legacy systems and conventional consulting practices for compliance, necessitating a shift towards more advanced, unified solutions.

Here, LLMs stand to revolutionize the compliance landscape, particularly by enhancing continuous post-market monitoring and transitioning the sector from traditional consulting methodologies to automated, platform-based solutions. This technological pivot doesn’t replace professional teams or consultants but optimizes their productivity, allowing focus on intricate, higher-value tasks.

The impacts are manifold:

Startups experience reduced compliance costs via automation, making market entry more feasible.

Consultants leverage these advanced tools or platforms for improved efficiency.

Large medtech organizations benefit similarly, streamlining compliance processes.

The recent EU Medical Device Regulation standardization amplifies these advantages, particularly for EU startups, by providing a unified market, thereby magnifying entry incentives.

In this light, investment in MedTech SaaS compliance, anticipating a 10% annual growth, becomes a lucrative venture. It underscores the indispensable nature of compliance in healthcare, suggesting that contributions to this realm could yield significant dividends, both financially and in healthcare innovation.

Key Players Answering Those Pain Points

In the MedTech space, AI-native startups are disrupting the status quo and enabling a leapfrog in productivity that are innovating

The landscape of medical technology is experiencing seismic shifts thanks to the advent of AI. Where once stood traditional methods, now AI-native startups are paving the way for groundbreaking advancements, streamlining processes that once heavily relied on human labor.

Central to this transformation are behemoths like Medtronic and Veeva Systems, commanding impressive market capitalizations of $96 billion and $33 billion, respectively. They’ve set the stage in MedTech SaaS compliance, but the real game-changers may be the new entrants who are leveraging sophisticated AI tools to revolutionize the sector. These tools, particularly advanced large language models, are automating tasks traditionally performed by consultants, marking a paradigm shift in how operations are run. This change isn’t just about cutting costs; it’s about enhancing accuracy and allowing human experts to concentrate on complex, high-value aspects of regulatory compliance.

Flinn Comply, founded in 2022 in Vienna and backed in their pre-seed by Speedinvest and SquareOne, offers comprehensive compliance and quality management solutions specifically designed to meet the needs of medical device companies.

Formly.ai, founded in 2022 and based in Berlin, provides easy and intuitive certification roadmaps tailored to any type of medical device and allows the creation of certification documents with AI. Their solution is addressed to both companies and certification consultants to streamline their processes.

Rimsys, established in 2017 in Pittsburgh and supported through a series A funding round including Bessemer, specializes in regulatory management software, catering to the specific requirements of medical device manufacturers.

Certivity, established in 2021 in Munich, seed-stage, offers compliance and quality management software that is finely tuned to address the unique needs of life sciences and medical device companies.

Qualio, founded in 2012 in San Francisco and supported through a series B funding round including Frontline Ventures and Tiger Global, delivers cloud-based quality management software uniquely customized for life sciences and medical device companies.

These companies highlight the growing role of AI in streamlining regulatory compliance and enhancing market competition.

Existing players within data governance and access to large data innovation

Innovation in data governance is reshaping how critical information is shared and managed in the healthcare sector. The rise of AI and advanced technologies is addressing long-standing hurdles in data access and collaboration, particularly in the sensitive realm of patient information.

Central to this evolving landscape are various stakeholders: problem owners (such as pharma companies, healthcare providers, or insurance firms seeking data-driven innovation), data custodians (hospitals, clinics, and health facilities managing patient data), and data scientists or problem solvers (experts extracting actionable insights from complex data).

Historically, these groups have faced significant challenges in exchanging information. Regulatory stringency around patient data makes the process not only cumbersome and costly but also fraught with privacy concerns. Most protocols demand a central database, complicating data access and necessitating repetitive, inefficient hoops for each new project.

Enter federated learning, a revolutionary approach where AI models and data tools are brought to the data custodian’s site, eliminating the need for central data storage. This concept is gaining traction, evidenced by the global federated learning market’s anticipated surge from USD 110.82 million in 2021 to USD 266.77 million by 2030. Its advantages are multifold: compliance with data privacy laws, enhanced security, cost-effective data handling, and more accurate machine learning outcomes.

Several pioneering companies are leading this charge:

This Paris-based Owkin, having secured $80 million in its latest funding round, is propelling drug discovery by uniquely integrating health data via federated learning. Its partnership with healthcare facilities enables the creation of exclusive datasets, fortifying its AI-driven precision medicine endeavors.

Flower, operating out of Hamburg and backed by a recent $3.6 million investment, Flower stands out with its industry-agnostic federated learning repository. Its plug-and-play solution is a boon for data scientists across sectors, including healthcare.

Los Angeles-based FedML, following an $11.5 million funding announced this August, specializes in integrated MAI models with Federated Learning, specifically Generative AI and LLMs. Its platform streamlines the training, deployment, monitoring, and enhancement of machine learning models, whether on-site or cloud-based.

Bitfount, based in the UK and having raised $3.5 million in 2021, provides a platform for secure, privacy-compliant data collaborations without direct data sharing through Federated Learning. Targeting the healthcare sector, its FL solutions are part of a more end-to-end solution for security and compliance in healthcare.

As this technology continues to mature, even tech giants like AWS and Microsoft are joining the fray, recognizing the transformative potential of federated learning in healthcare data management and beyond. The concerted efforts of these entities are setting the stage for unprecedented levels of secure, efficient, and innovative data collaboration in the years to come.

The Road Ahead

The future of MedTech SaaS compliance is exceptionally promising, marked by a confluence of continuous regulatory changes and rapid technological evolution. As healthcare continues its digital transformation, the role of compliance solutions will become increasingly vital. These solutions will not only safeguard patient data but also play a pivotal role in ensuring the quality and safety of patient care. The road ahead is paved with innovation, as compliance SaaS providers continue to adapt and enhance their offerings to meet the ever-evolving needs of the MedTech industry.

In conclusion, MedTech SaaS compliance represents a high-growth niche with a robust financial outlook and profound societal impact. It is a sector where venture capitalists should undoubtedly set their sights, as it is poised to be at the forefront of transformative changes in healthcare compliance. Capitalizing on the industry’s growth not only presents substantial financial opportunities but also enables active participation in shaping the future of healthcare, where innovation and compliance go hand in hand to deliver better patient outcomes and enhanced data security.

We want to hear from you!We are curious to hear your thoughts and ideas. If you’re working on Compliance and Security applications in MedTech or Health Data, please reach out to us.