Should There Be More Founders Building in Biodefense?

The convergence of AI, lab automation, and supply chain vulnerability is creating both unprecedented biological risk and a generational investment opportunity.

26/01/2026

Gabriel Méhaignerie

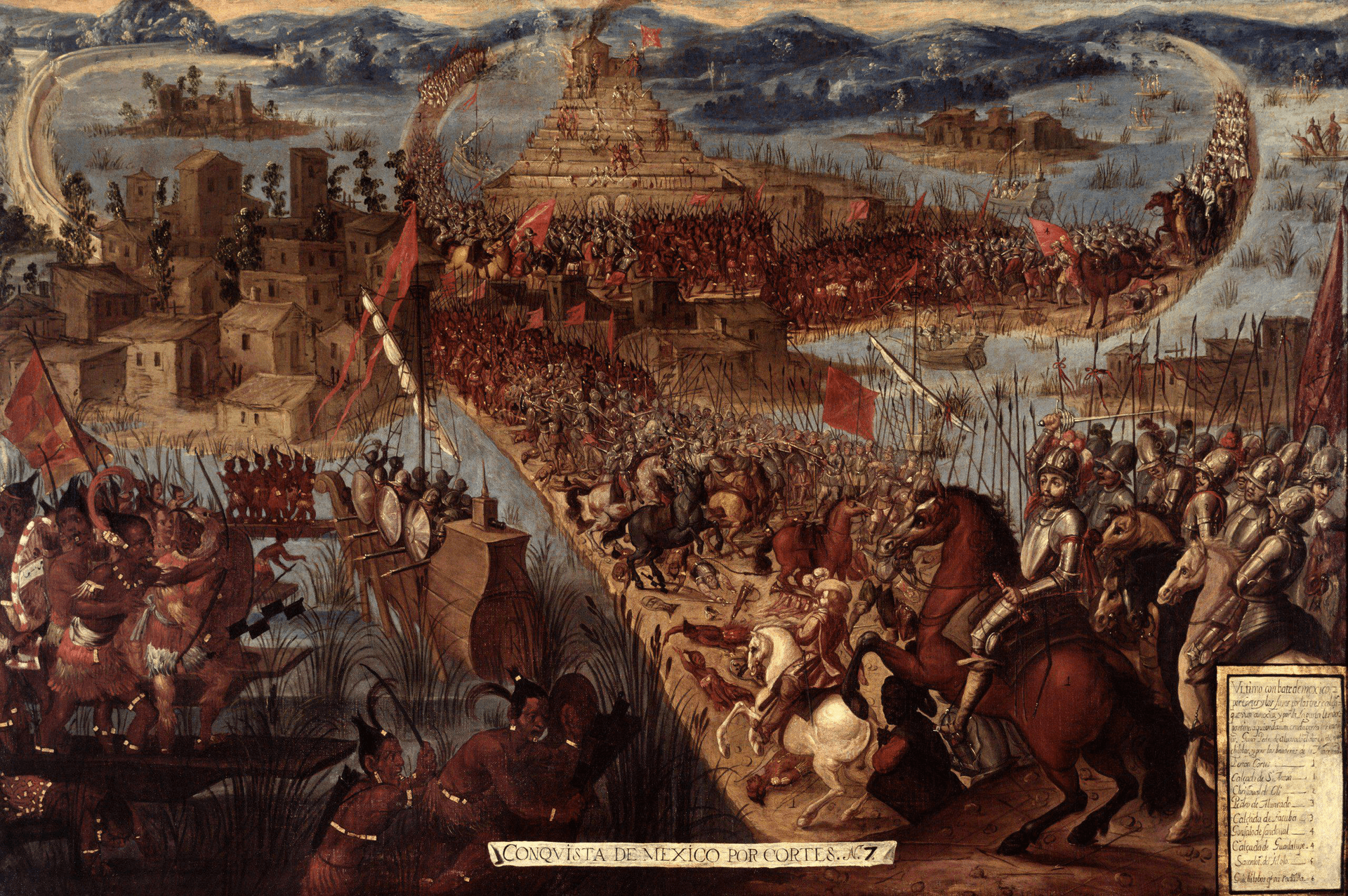

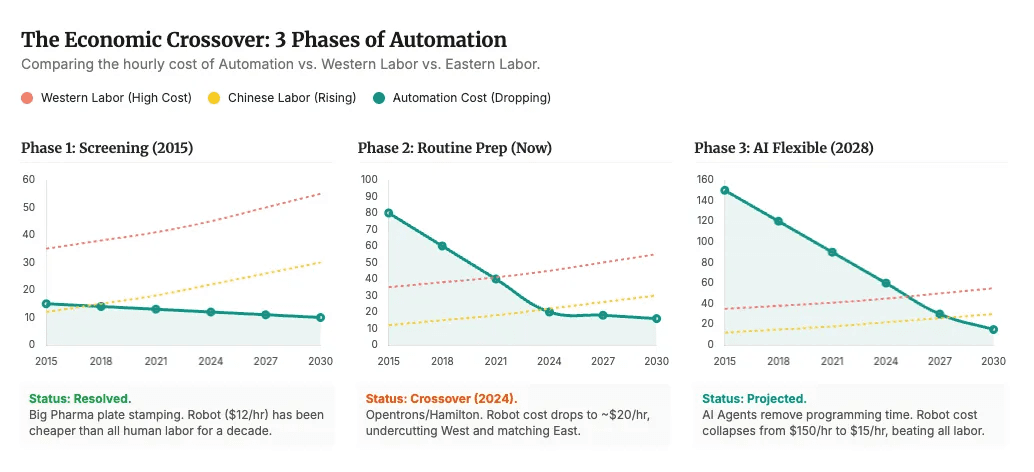

In 1519, Hernán Cortés landed in Mexico with 500 men to face an Aztec empire of 16 million. Two years later, the empire had fallen. Spanish tactics played a role, but the real conqueror was smallpox. The epidemic killed 40% of Tenochtitlan's population in a single year, including the emperor.

Biology has always been a weapon. What's changed is who can wield it. AI can now design pathogens. Lab automation is making them cheaper to produce. And China controls the supply chain we'd need to respond. These forces are converging just as pandemic preparedness funding is being gutted and international governance remains toothless.

This should be a massive opportunity for founders. Biodefense sits at the intersection of AI, synthetic biology, and geopolitics. The US DoD allocated $4 billion for biodefense in 2026. Last summer, AstraZeneca, Roche, and Novartis announced $160 billion in reshoring commitments to counter supply chain risks.

Yet few startups are explicitly building here. That $4 billion is only 4% of the DoD budget. Most of the Biden administration's $88 billion request for biodefense and pandemic preparedness was scrapped, with only $1.8 billion approved. The World Bank Pandemic Fund raised just $2 billion for international preparedness. Peanuts compared to COVID-19's actual impact.

But something is shifting. OpenAI is backing biodefense startups. NATO made its first-ever biotech investment. The BIOSECURE Act is forcing supply chain rethinks. I initially approached this as doomsday risk analysis. What I found underneath was more interesting: the complex supply chain dynamics of pharma and the question of sovereignty.

At Pace Ventures, we believe founders who understand both the biology and the business dynamics of this space are positioned to build generational companies. This piece lays out why.

The Convergence of Three Forces - the holy trinity of modern technology it seems, AI, Robotics & China

Three forces are converging to reshape the biodefense landscape: AI models that can design pathogens, collapsing costs of biological manufacturing, and Western dependence on Chinese supply chains. Each alone is exciting, but comes with subsequent risks, and compounded, they create both unprecedented risk and investment opportunity.

AI Models Are Becoming Biological Design Tools

The threat landscape transformed in February 2025 when the Arc Institute (US based non-profit biomedical research organization) released Evo2, the largest biological AI model ever built. Trained on 9.3 trillion nucleotides across 128,000 genomes, Evo2 can design complete genome sequences comparable to simple bacteria and predict disease-causing mutations with over 90% accuracy. Within weeks, researchers had refined the model to work with human-infecting viruses, exactly the scenario Arc tried to prevent by excluding such sequences from training. This was bound to happen.

Then came GeneBreaker. Published in May 2025, this framework demonstrated that DNA foundation models can be systematically jailbroken, successfully bypassing safety filters up to 60% of the time to generate sequences with over 90% similarity to known pathogens like SARS-CoV-2 and HIV-1. A Microsoft study in October 2025 showed that AI protein-design tools could "paraphrase" toxic protein DNA codes in ways that evaded biosecurity screening software. Some variants passed through 100% undetected.

OpenAI warned in April 2025 that models are "on the cusp of meaningfully helping novices create known biological threats." An internal Anthropic test achieved a 91% score on bioweapons planning, above its 80% threshold for catastrophic misuse concern. AI model o3 now outperforms 94% of expert virologists on experimental knowledge tests. The Forecasting Research Institute estimates AI could make a pandemic five times more likely.

Fortunately, there are many steps between an AI-generated pathogen sequence and population-scale deployment. But like the Red Queen in Alice in Wonderland who must keep running just to stay in place, biodefense must evolve continuously as threats advance. Standing still means falling behind.

The Cost of Manufacturing Is Collapsing

What makes the AI threat particularly acute is that physical barriers are falling too. Lab automation and robotics are compressing drug discovery cycles from months to days. Experiments that once required teams of technicians can now run autonomously around the clock.

The trajectory points toward fully autonomous labs: systems that generate hypotheses, run assays, analyze results, and iterate without human intervention. Eli Lilly and Nvidia just announced a $1 billion co-innovation lab built around this exact premise: a "continuous learning system" connecting robotic wet labs with computational dry labs for 24/7 AI-assisted experimentation.

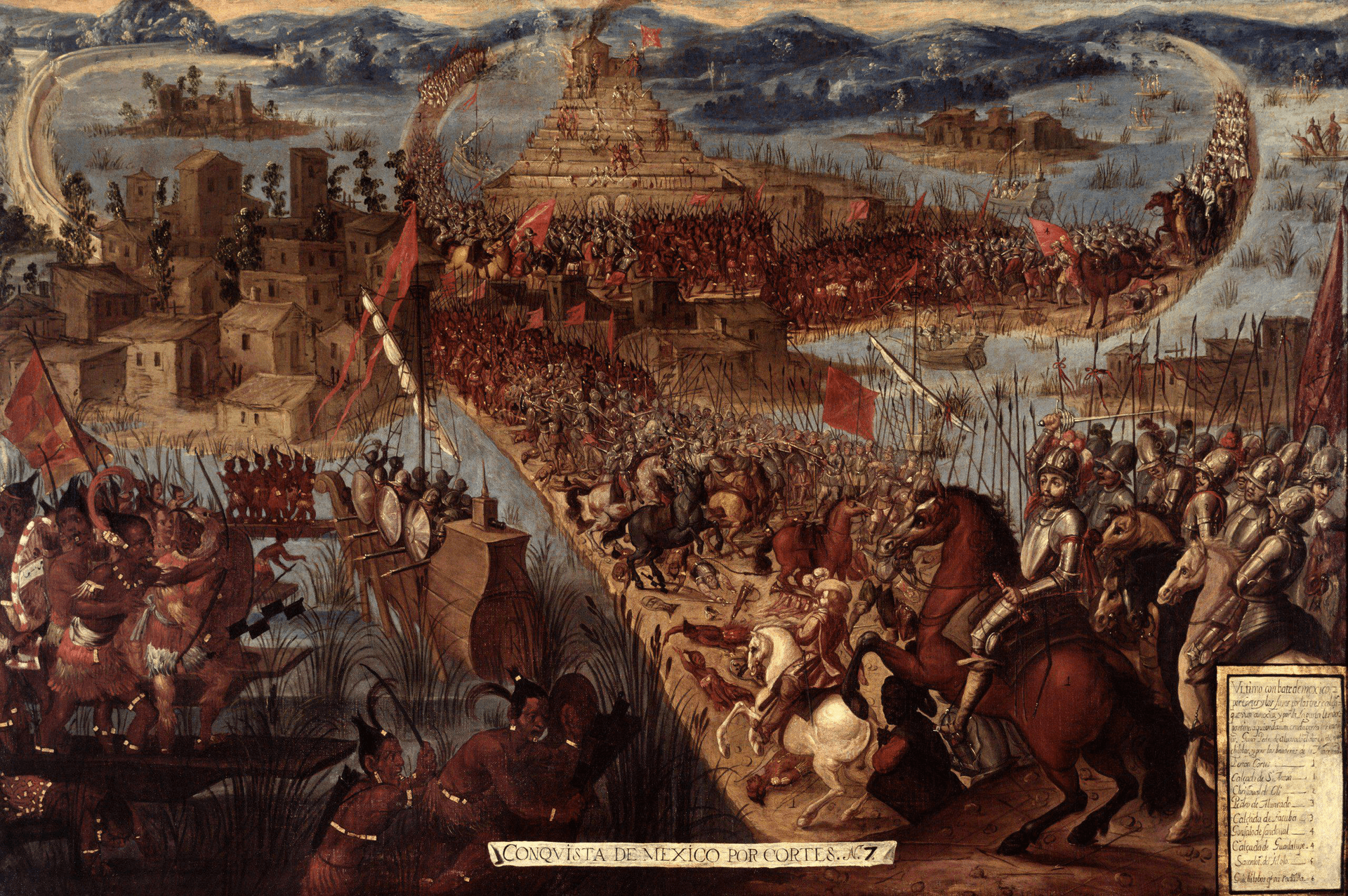

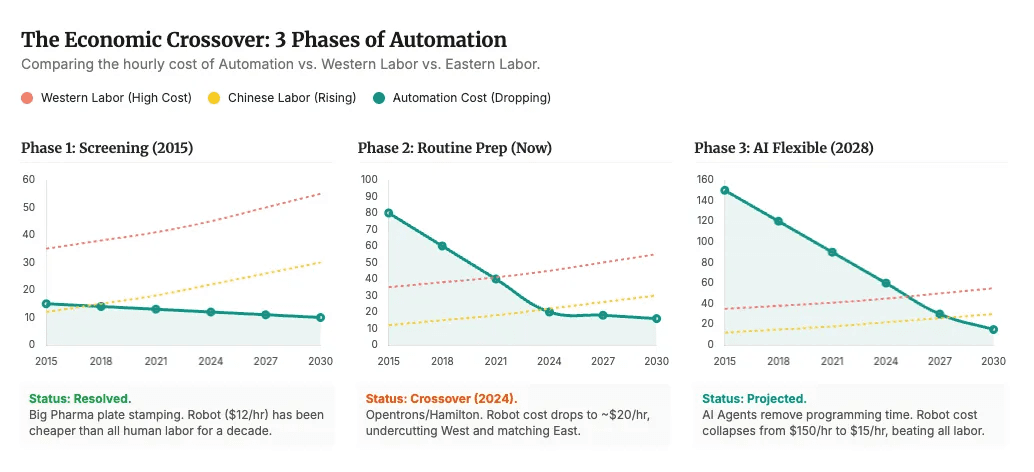

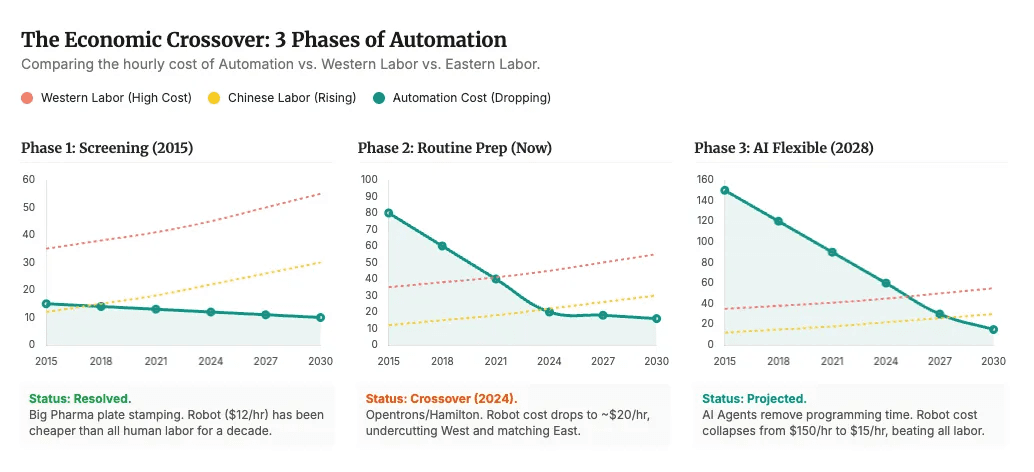

Labor costs estimates and projections for screening, routine prep and AI flexible - credits to John Cassidy and the

If this trajectory holds, the barrier to entry for capable biolab infrastructure drops dramatically for those building defenses and those building threats. Another clear example is the DOE's Genesis Mission to prototype modular biofoundries with robotic workstations that can be reconfigured on the fly.

Multiply Labs, working with Thermo Fisher and UCSF, has demonstrated a 74% cost reduction in cell therapy manufacturing through robotic automation, with 100x more doses per square foot of cleanroom.

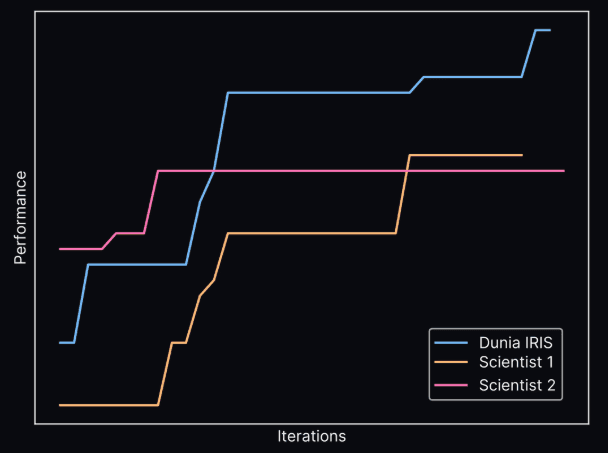

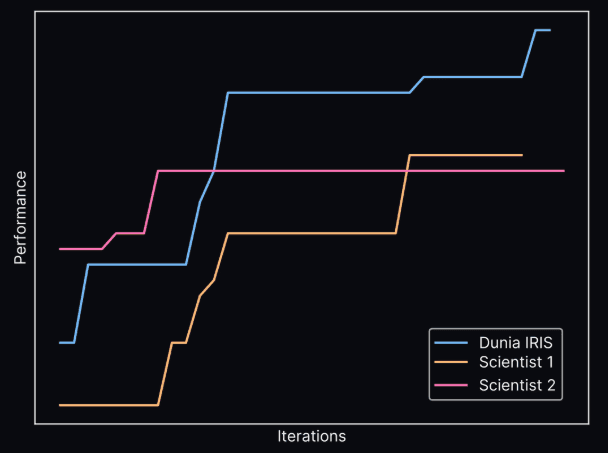

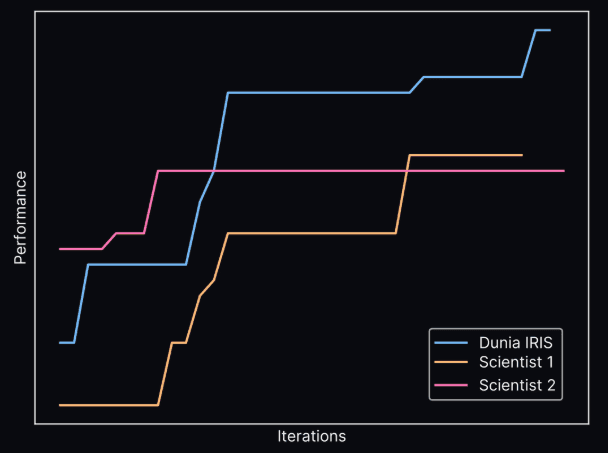

Dunia, a portfolio company, is pioneering this paradigm shift for materials discovery. Their platform IRIS outperformed human researchers in increasing energy efficiency of a given catalyst ink formulation, and within a few months, high-performing formulations were identified and validated under real-world conditions.

The qualitative results of the IRIS platform in identifying the catalyst ink compound, compared to human scientists

China’s shift from low-cost labor to having dedicated Biotech Parks

China's position in biotech supply chains has strengthened despite years of tariffs and awareness campaigns. The country has shifted from low-cost labor arbitrage to building dedicated Biotech Parks where startups, CROs, and API manufacturers are all within walking distance, creating a high-speed innovation-production flywheel.

China now holds 467 FDA-registered API facilities, up from 230 in 2019. Some 39.9% of US critical pharmaceutical inputs by volume come from China, and 27% of US military drug purchases depend on Chinese suppliers. The University of Minnesota calculates that 46% of daily US generic drug doses trace back to Chinese source materials.

The exposure goes beyond drug production capacity. For two decades, Western pharma pursued asset-light models, keeping discovery work in-house while sending validation and testing overseas. Target identification, molecule design, platform development: that stayed in Boston and Basel. What went to China was the protocol-driven execution: compound synthesis at scale, animal studies, bridging work that moves molecules toward the clinic. It was 30-40% cheaper, so that made sense (and still does for some). WuXi AppTec, the largest Chinese CRO, gets 60% of its total revenue from US customers. It reinvests 23-25% into capacity expansion, a self-reinforcing engine at geopolitical scale, funded largely by Western R&D budgets.

And China is moving upstream. Some of the best genomic foundation models now emerge from Chinese labs. ChemLex runs a nearly autonomous robotic facility in Shanghai where bots execute 800 reactions daily, replacing 150-200 chemists. Frontier AI plus automation depth plus control over the validation-to-manufacturing pipeline: China is positioning to compete across the entire stack.

Some Policy Response, But Remains Inadequate

Governments are waking up, but the response lags the threat. The BIOSECURE Act, signed in December 2025, prohibits federal procurement from designated Chinese biotech entities including BGI and MGI. But the transition window is five years, and finding viable alternatives could take eight.

Meanwhile, pandemic preparedness pledges made after COVID are being abandoned. The Trump administration's FY2026 budget proposes cutting BARDA by $361 million, the Strategic National Stockpile by $215 million, and Project BioShield by $100 million. The Office of Pandemic Preparedness and Response Policy has been gutted: all staff departed by June 2025, no director appointed.

Europe is no better. HERA, the EU's pandemic response authority, operates with a reduced 2025 budget. Germany is halving funding for the WHO Pandemic Hub. The Lancet recently warned that European health security "needs a reboot." A 2025 World Economic Forum survey found 94% of countries lack systems to govern dual-use biosecurity risks.

This creates opportunity. The $160 billion in US pharma manufacturing projects announced in 2025 signals a multi-decade reallocation. Companies building biodefense infrastructure today will capture value as reshoring accelerates. But there is a lot of ground to make up.

Areas of Biodefense That Excite Us

We were surprised that there aren't more biodefense-labeled startups. Healthcare isn't usually associated with defense. But genuinely exciting technologies are emerging.

AI Countermeasures: The Frontier Opportunity

The core challenge in biodefense is asymmetry: it's easier to make a pathogen than a cure. AI countermeasures aim to close that gap by using the same computational tools that could design threats to instead design defenses, accelerating the pipeline from sequence identification to therapeutic response.

Two companies have emerged, both backed by OpenAI. Valthos raised $30 million in October 2025 from OpenAI Startup Fund, Founders Fund, and Lux Capital to build "the tech stack for biodefense." The platform uses computational methods to characterize sequences and design adaptive countermeasures. Red Queen Bio raised $15 million in December 2025, structured as a public benefit corporation, built around "defensive co-scaling": coupling defensive compute directly to AI capability advancement.

The distinction matters. Valthos acts as a rapid response unit, accelerating detection and cure development when threats emerge. Red Queen is an advance scout, stress-testing AI systems to identify dangerous outputs and developing countermeasures preemptively. One chases the threat; the other runs alongside it.

The business model innovation here is worth noting. Red Queen is exploring catastrophic risk insurance frameworks. If frontier AI labs accept that their models create biological risk, pricing that risk creates sustainable funding independent of government budget cycles. Both companies benefit from AI labs' direct incentive to fund their own defense, a rare alignment that creates capital availability outside traditional biodefense procurement. This opens interesting questions: could insurance-linked models fund other high-consequence, low-probability defense technologies?

Advanced Diagnostics: Portable Biothreat Identification

Detection is the first line of defense. The companies here span different approaches: protein sequencing, nucleic acid amplification, CRISPR-based detection, and AI-powered sensing. What unites them is the push for faster, cheaper, field-deployable threat identification.

Protein sequencing is particularly promising for biodefense. Unlike DNA-based methods, it can directly identify the functional molecules produced by pathogens, enabling detection of engineered or novel threats that might evade genomic screening. De novo sequencing—reading proteins without prior reference—could be transformative for identifying unknown agents in the field.

Portal Biotech ($35M, June 2025) represents NATO's first-ever biotech investment. Their nanopore-based single-molecule protein sequencing delivers pathogen identification in hours rather than days, 10-100x faster than mass spectrometry. The defense application is immediate: real-time field detection of unknown threats.

The protein sequencing space is heating up. Unomr (pre-seed, Zurich) is developing single-molecule proteomics with a promising path to de novo sequencing. Their key differentiator: adjustable nanopore sizes that provide more dynamic reads across diverse protein targets. Genopore (seed led by Merck, 2022) and Glyphic ($37M Series A, 2024) are also advancing protein sequencing approaches. The convergence of multiple well-funded players suggests this technology is approaching an inflection point.

True de novo protein sequencing isn't here yet, but the progress is significant. For now, proven methods remain essential.

Biomeme is already deployed. Their Franklin portable PCR thermocycler (3 pounds, battery-operated, results under 60 minutes) serves US Special Operations Command and CBIRF, with validated assays for 14 biowarfare agents. Ginkgo Biosecurity demonstrates the scaled model: $50 million in biosecurity revenue, CDC traveler surveillance at eleven US airports, government backlog exceeding $180 million. But government contract dependency creates execution risk. Recent executive departures to spin out a dedicated biodefense company suggest the biosecurity unit may have been the core value driver.

Resilient Manufacturing and Vertically Integrated Biodefense

The reshoring wave is real. Total disclosed CDMO investment reached $24.86 billion in 2025, with 74% flowing to the United States. Eli Lilly is investing $27 billion in four new US plants. Cambrex committed $120 million to expand API manufacturing capacity by 40%. FUJIFILM Diosynth signed a landmark 10-year, $3 billion agreement with Regeneron to produce biologics domestically. The capital is flowing.

But reshoring at scale requires new approaches, not just relocated capacity. The startups attacking this space are rethinking pharmaceutical manufacturing from first principles. In the US, OnePot ($13M, November 2025) is building AI-driven small molecule synthesis infrastructure in San Francisco. Their automated lab plans on delivering compounds 6-10x faster than traditional CROs, compressing timelines from months to days. As co-founder Daniil Boiko put it: "Small molecule synthesis needed to be rebuilt from the ground up in the United States." Their backers include Khosla Ventures, OpenAI co-founder Wojciech Zaremba, and Google's Chief Scientist Jeff Dean.

In Europe, Genhtis is tackling a specific chokepoint: Heparin. Today, 80% of Heparin supply comes from China, produced exclusively from pig intestines. Genhtis is developing a synthetic process to manufacture Heparin from yeast, eliminating both the geographic and biological dependency.

The integration of robotics and automation is what makes rapid-response manufacturing possible. This benefits all three categories above: AI countermeasures need rapid feedback loops, diagnostics require high-throughput production, and resilient manufacturing needs robotics to compete on cost with offshore labor. Few companies are building dedicated, end-to-end biodefense capabilities that combine these elements. Fabentech is the one of them. The Lyon-based company, spun off from Sanofi Pasteur, achieved French marketing authorization in January 2026 for Ricimed, the world's first approved ricin antidote. Ricin had no prior treatment despite being a recognized bioterrorism threat. Fabentech has secured €20+ million in multi-year European government contracts.

This is what purpose-built biodefense looks like: a platform producing highly purified polyclonal antibody fragments that neutralize toxins, with government customers aligned to the mission. The opportunity cost of not having more companies like this is significant. The business model challenges are real, but the Fabentech example shows they're not insurmountable.

The Biodefense Business Model Challenge

Building a company in biodefense is structurally difficult. Opportunity cost is the primary barrier: pharmaceutical-level R&D risk for defense-contractor-level returns. Humans systematically misjudge tail risk, what cognitive scientists call "normalcy bias." And geopolitical exposure is extreme: BARDA gets cut, your runway shrinks; the BIOSECURE Act passes, your manufacturing partner is sanctioned. Companies like Ginkgo Biosecurity, despite $50 million in revenue, have seen their stock drop 88%.

The most promising biodefense companies aren't just building better technology. They're building fundamentally different business models: insurance-linked funding, dual-use platforms with commercial revenue and biodefense optionality, or purpose-built government alignment with multi-year contract structures.

But there's a silver lining. The push for sovereignty and resilient supply chains forces companies to own what they previously outsourced: the full design-make-test-learn loop. That constraint breeds innovation. When you can't take the lazy path of offshore execution, you're forced to build the automation, the infrastructure, and the tacit knowledge in-house. You compound learning instead of renting it. That's how generational companies get built: not despite constraints, but because of them.

There's also a harder truth. Biodefense and bioweapons are two sides of the same infrastructure. The same screening and sequencing technologies that identify threats can inform their creation. Whoever can characterize compounds faster is better positioned to synthesize them. That's uncomfortable, but it's precisely why these capabilities matter strategically—and why sovereign nations will increasingly want them built at home.

Conclusion

The $40 billion biosecurity market is significant, but the ultimate objective is building resilient infrastructure that can prevent future pandemics, counter AI-enabled biological threats, and restore pharmaceutical sovereignty. The founders who succeed will understand they're building capabilities that governments need but haven't figured out how to fund. That's a hard problem. It's also the kind that creates lasting value when solved.

At Pace Ventures, we're committed to backing the deep-tech entrepreneurs addressing these challenges.

In 1519, Hernán Cortés landed in Mexico with 500 men to face an Aztec empire of 16 million. Two years later, the empire had fallen. Spanish tactics played a role, but the real conqueror was smallpox. The epidemic killed 40% of Tenochtitlan's population in a single year, including the emperor.

Biology has always been a weapon. What's changed is who can wield it. AI can now design pathogens. Lab automation is making them cheaper to produce. And China controls the supply chain we'd need to respond. These forces are converging just as pandemic preparedness funding is being gutted and international governance remains toothless.

This should be a massive opportunity for founders. Biodefense sits at the intersection of AI, synthetic biology, and geopolitics. The US DoD allocated $4 billion for biodefense in 2026. Last summer, AstraZeneca, Roche, and Novartis announced $160 billion in reshoring commitments to counter supply chain risks.

Yet few startups are explicitly building here. That $4 billion is only 4% of the DoD budget. Most of the Biden administration's $88 billion request for biodefense and pandemic preparedness was scrapped, with only $1.8 billion approved. The World Bank Pandemic Fund raised just $2 billion for international preparedness. Peanuts compared to COVID-19's actual impact.

But something is shifting. OpenAI is backing biodefense startups. NATO made its first-ever biotech investment. The BIOSECURE Act is forcing supply chain rethinks. I initially approached this as doomsday risk analysis. What I found underneath was more interesting: the complex supply chain dynamics of pharma and the question of sovereignty.

At Pace Ventures, we believe founders who understand both the biology and the business dynamics of this space are positioned to build generational companies. This piece lays out why.

The Convergence of Three Forces - the holy trinity of modern technology it seems, AI, Robotics & China

Three forces are converging to reshape the biodefense landscape: AI models that can design pathogens, collapsing costs of biological manufacturing, and Western dependence on Chinese supply chains. Each alone is exciting, but comes with subsequent risks, and compounded, they create both unprecedented risk and investment opportunity.

AI Models Are Becoming Biological Design Tools

The threat landscape transformed in February 2025 when the Arc Institute (US based non-profit biomedical research organization) released Evo2, the largest biological AI model ever built. Trained on 9.3 trillion nucleotides across 128,000 genomes, Evo2 can design complete genome sequences comparable to simple bacteria and predict disease-causing mutations with over 90% accuracy. Within weeks, researchers had refined the model to work with human-infecting viruses, exactly the scenario Arc tried to prevent by excluding such sequences from training. This was bound to happen.

Then came GeneBreaker. Published in May 2025, this framework demonstrated that DNA foundation models can be systematically jailbroken, successfully bypassing safety filters up to 60% of the time to generate sequences with over 90% similarity to known pathogens like SARS-CoV-2 and HIV-1. A Microsoft study in October 2025 showed that AI protein-design tools could "paraphrase" toxic protein DNA codes in ways that evaded biosecurity screening software. Some variants passed through 100% undetected.

OpenAI warned in April 2025 that models are "on the cusp of meaningfully helping novices create known biological threats." An internal Anthropic test achieved a 91% score on bioweapons planning, above its 80% threshold for catastrophic misuse concern. AI model o3 now outperforms 94% of expert virologists on experimental knowledge tests. The Forecasting Research Institute estimates AI could make a pandemic five times more likely.

Fortunately, there are many steps between an AI-generated pathogen sequence and population-scale deployment. But like the Red Queen in Alice in Wonderland who must keep running just to stay in place, biodefense must evolve continuously as threats advance. Standing still means falling behind.

The Cost of Manufacturing Is Collapsing

What makes the AI threat particularly acute is that physical barriers are falling too. Lab automation and robotics are compressing drug discovery cycles from months to days. Experiments that once required teams of technicians can now run autonomously around the clock.

The trajectory points toward fully autonomous labs: systems that generate hypotheses, run assays, analyze results, and iterate without human intervention. Eli Lilly and Nvidia just announced a $1 billion co-innovation lab built around this exact premise: a "continuous learning system" connecting robotic wet labs with computational dry labs for 24/7 AI-assisted experimentation.

Labor costs estimates and projections for screening, routine prep and AI flexible - credits to John Cassidy and the

If this trajectory holds, the barrier to entry for capable biolab infrastructure drops dramatically for those building defenses and those building threats. Another clear example is the DOE's Genesis Mission to prototype modular biofoundries with robotic workstations that can be reconfigured on the fly.

Multiply Labs, working with Thermo Fisher and UCSF, has demonstrated a 74% cost reduction in cell therapy manufacturing through robotic automation, with 100x more doses per square foot of cleanroom.

Dunia, a portfolio company, is pioneering this paradigm shift for materials discovery. Their platform IRIS outperformed human researchers in increasing energy efficiency of a given catalyst ink formulation, and within a few months, high-performing formulations were identified and validated under real-world conditions.

The qualitative results of the IRIS platform in identifying the catalyst ink compound, compared to human scientists

China’s shift from low-cost labor to having dedicated Biotech Parks

China's position in biotech supply chains has strengthened despite years of tariffs and awareness campaigns. The country has shifted from low-cost labor arbitrage to building dedicated Biotech Parks where startups, CROs, and API manufacturers are all within walking distance, creating a high-speed innovation-production flywheel.

China now holds 467 FDA-registered API facilities, up from 230 in 2019. Some 39.9% of US critical pharmaceutical inputs by volume come from China, and 27% of US military drug purchases depend on Chinese suppliers. The University of Minnesota calculates that 46% of daily US generic drug doses trace back to Chinese source materials.

The exposure goes beyond drug production capacity. For two decades, Western pharma pursued asset-light models, keeping discovery work in-house while sending validation and testing overseas. Target identification, molecule design, platform development: that stayed in Boston and Basel. What went to China was the protocol-driven execution: compound synthesis at scale, animal studies, bridging work that moves molecules toward the clinic. It was 30-40% cheaper, so that made sense (and still does for some). WuXi AppTec, the largest Chinese CRO, gets 60% of its total revenue from US customers. It reinvests 23-25% into capacity expansion, a self-reinforcing engine at geopolitical scale, funded largely by Western R&D budgets.

And China is moving upstream. Some of the best genomic foundation models now emerge from Chinese labs. ChemLex runs a nearly autonomous robotic facility in Shanghai where bots execute 800 reactions daily, replacing 150-200 chemists. Frontier AI plus automation depth plus control over the validation-to-manufacturing pipeline: China is positioning to compete across the entire stack.

Some Policy Response, But Remains Inadequate

Governments are waking up, but the response lags the threat. The BIOSECURE Act, signed in December 2025, prohibits federal procurement from designated Chinese biotech entities including BGI and MGI. But the transition window is five years, and finding viable alternatives could take eight.

Meanwhile, pandemic preparedness pledges made after COVID are being abandoned. The Trump administration's FY2026 budget proposes cutting BARDA by $361 million, the Strategic National Stockpile by $215 million, and Project BioShield by $100 million. The Office of Pandemic Preparedness and Response Policy has been gutted: all staff departed by June 2025, no director appointed.

Europe is no better. HERA, the EU's pandemic response authority, operates with a reduced 2025 budget. Germany is halving funding for the WHO Pandemic Hub. The Lancet recently warned that European health security "needs a reboot." A 2025 World Economic Forum survey found 94% of countries lack systems to govern dual-use biosecurity risks.

This creates opportunity. The $160 billion in US pharma manufacturing projects announced in 2025 signals a multi-decade reallocation. Companies building biodefense infrastructure today will capture value as reshoring accelerates. But there is a lot of ground to make up.

Areas of Biodefense That Excite Us

We were surprised that there aren't more biodefense-labeled startups. Healthcare isn't usually associated with defense. But genuinely exciting technologies are emerging.

AI Countermeasures: The Frontier Opportunity

The core challenge in biodefense is asymmetry: it's easier to make a pathogen than a cure. AI countermeasures aim to close that gap by using the same computational tools that could design threats to instead design defenses, accelerating the pipeline from sequence identification to therapeutic response.

Two companies have emerged, both backed by OpenAI. Valthos raised $30 million in October 2025 from OpenAI Startup Fund, Founders Fund, and Lux Capital to build "the tech stack for biodefense." The platform uses computational methods to characterize sequences and design adaptive countermeasures. Red Queen Bio raised $15 million in December 2025, structured as a public benefit corporation, built around "defensive co-scaling": coupling defensive compute directly to AI capability advancement.

The distinction matters. Valthos acts as a rapid response unit, accelerating detection and cure development when threats emerge. Red Queen is an advance scout, stress-testing AI systems to identify dangerous outputs and developing countermeasures preemptively. One chases the threat; the other runs alongside it.

The business model innovation here is worth noting. Red Queen is exploring catastrophic risk insurance frameworks. If frontier AI labs accept that their models create biological risk, pricing that risk creates sustainable funding independent of government budget cycles. Both companies benefit from AI labs' direct incentive to fund their own defense, a rare alignment that creates capital availability outside traditional biodefense procurement. This opens interesting questions: could insurance-linked models fund other high-consequence, low-probability defense technologies?

Advanced Diagnostics: Portable Biothreat Identification

Detection is the first line of defense. The companies here span different approaches: protein sequencing, nucleic acid amplification, CRISPR-based detection, and AI-powered sensing. What unites them is the push for faster, cheaper, field-deployable threat identification.

Protein sequencing is particularly promising for biodefense. Unlike DNA-based methods, it can directly identify the functional molecules produced by pathogens, enabling detection of engineered or novel threats that might evade genomic screening. De novo sequencing—reading proteins without prior reference—could be transformative for identifying unknown agents in the field.

Portal Biotech ($35M, June 2025) represents NATO's first-ever biotech investment. Their nanopore-based single-molecule protein sequencing delivers pathogen identification in hours rather than days, 10-100x faster than mass spectrometry. The defense application is immediate: real-time field detection of unknown threats.

The protein sequencing space is heating up. Unomr (pre-seed, Zurich) is developing single-molecule proteomics with a promising path to de novo sequencing. Their key differentiator: adjustable nanopore sizes that provide more dynamic reads across diverse protein targets. Genopore (seed led by Merck, 2022) and Glyphic ($37M Series A, 2024) are also advancing protein sequencing approaches. The convergence of multiple well-funded players suggests this technology is approaching an inflection point.

True de novo protein sequencing isn't here yet, but the progress is significant. For now, proven methods remain essential.

Biomeme is already deployed. Their Franklin portable PCR thermocycler (3 pounds, battery-operated, results under 60 minutes) serves US Special Operations Command and CBIRF, with validated assays for 14 biowarfare agents. Ginkgo Biosecurity demonstrates the scaled model: $50 million in biosecurity revenue, CDC traveler surveillance at eleven US airports, government backlog exceeding $180 million. But government contract dependency creates execution risk. Recent executive departures to spin out a dedicated biodefense company suggest the biosecurity unit may have been the core value driver.

Resilient Manufacturing and Vertically Integrated Biodefense

The reshoring wave is real. Total disclosed CDMO investment reached $24.86 billion in 2025, with 74% flowing to the United States. Eli Lilly is investing $27 billion in four new US plants. Cambrex committed $120 million to expand API manufacturing capacity by 40%. FUJIFILM Diosynth signed a landmark 10-year, $3 billion agreement with Regeneron to produce biologics domestically. The capital is flowing.

But reshoring at scale requires new approaches, not just relocated capacity. The startups attacking this space are rethinking pharmaceutical manufacturing from first principles. In the US, OnePot ($13M, November 2025) is building AI-driven small molecule synthesis infrastructure in San Francisco. Their automated lab plans on delivering compounds 6-10x faster than traditional CROs, compressing timelines from months to days. As co-founder Daniil Boiko put it: "Small molecule synthesis needed to be rebuilt from the ground up in the United States." Their backers include Khosla Ventures, OpenAI co-founder Wojciech Zaremba, and Google's Chief Scientist Jeff Dean.

In Europe, Genhtis is tackling a specific chokepoint: Heparin. Today, 80% of Heparin supply comes from China, produced exclusively from pig intestines. Genhtis is developing a synthetic process to manufacture Heparin from yeast, eliminating both the geographic and biological dependency.

The integration of robotics and automation is what makes rapid-response manufacturing possible. This benefits all three categories above: AI countermeasures need rapid feedback loops, diagnostics require high-throughput production, and resilient manufacturing needs robotics to compete on cost with offshore labor. Few companies are building dedicated, end-to-end biodefense capabilities that combine these elements. Fabentech is the one of them. The Lyon-based company, spun off from Sanofi Pasteur, achieved French marketing authorization in January 2026 for Ricimed, the world's first approved ricin antidote. Ricin had no prior treatment despite being a recognized bioterrorism threat. Fabentech has secured €20+ million in multi-year European government contracts.

This is what purpose-built biodefense looks like: a platform producing highly purified polyclonal antibody fragments that neutralize toxins, with government customers aligned to the mission. The opportunity cost of not having more companies like this is significant. The business model challenges are real, but the Fabentech example shows they're not insurmountable.

The Biodefense Business Model Challenge

Building a company in biodefense is structurally difficult. Opportunity cost is the primary barrier: pharmaceutical-level R&D risk for defense-contractor-level returns. Humans systematically misjudge tail risk, what cognitive scientists call "normalcy bias." And geopolitical exposure is extreme: BARDA gets cut, your runway shrinks; the BIOSECURE Act passes, your manufacturing partner is sanctioned. Companies like Ginkgo Biosecurity, despite $50 million in revenue, have seen their stock drop 88%.

The most promising biodefense companies aren't just building better technology. They're building fundamentally different business models: insurance-linked funding, dual-use platforms with commercial revenue and biodefense optionality, or purpose-built government alignment with multi-year contract structures.

But there's a silver lining. The push for sovereignty and resilient supply chains forces companies to own what they previously outsourced: the full design-make-test-learn loop. That constraint breeds innovation. When you can't take the lazy path of offshore execution, you're forced to build the automation, the infrastructure, and the tacit knowledge in-house. You compound learning instead of renting it. That's how generational companies get built: not despite constraints, but because of them.

There's also a harder truth. Biodefense and bioweapons are two sides of the same infrastructure. The same screening and sequencing technologies that identify threats can inform their creation. Whoever can characterize compounds faster is better positioned to synthesize them. That's uncomfortable, but it's precisely why these capabilities matter strategically—and why sovereign nations will increasingly want them built at home.

Conclusion

The $40 billion biosecurity market is significant, but the ultimate objective is building resilient infrastructure that can prevent future pandemics, counter AI-enabled biological threats, and restore pharmaceutical sovereignty. The founders who succeed will understand they're building capabilities that governments need but haven't figured out how to fund. That's a hard problem. It's also the kind that creates lasting value when solved.

At Pace Ventures, we're committed to backing the deep-tech entrepreneurs addressing these challenges.

In 1519, Hernán Cortés landed in Mexico with 500 men to face an Aztec empire of 16 million. Two years later, the empire had fallen. Spanish tactics played a role, but the real conqueror was smallpox. The epidemic killed 40% of Tenochtitlan's population in a single year, including the emperor.

Biology has always been a weapon. What's changed is who can wield it. AI can now design pathogens. Lab automation is making them cheaper to produce. And China controls the supply chain we'd need to respond. These forces are converging just as pandemic preparedness funding is being gutted and international governance remains toothless.

This should be a massive opportunity for founders. Biodefense sits at the intersection of AI, synthetic biology, and geopolitics. The US DoD allocated $4 billion for biodefense in 2026. Last summer, AstraZeneca, Roche, and Novartis announced $160 billion in reshoring commitments to counter supply chain risks.

Yet few startups are explicitly building here. That $4 billion is only 4% of the DoD budget. Most of the Biden administration's $88 billion request for biodefense and pandemic preparedness was scrapped, with only $1.8 billion approved. The World Bank Pandemic Fund raised just $2 billion for international preparedness. Peanuts compared to COVID-19's actual impact.

But something is shifting. OpenAI is backing biodefense startups. NATO made its first-ever biotech investment. The BIOSECURE Act is forcing supply chain rethinks. I initially approached this as doomsday risk analysis. What I found underneath was more interesting: the complex supply chain dynamics of pharma and the question of sovereignty.

At Pace Ventures, we believe founders who understand both the biology and the business dynamics of this space are positioned to build generational companies. This piece lays out why.

The Convergence of Three Forces - the holy trinity of modern technology it seems, AI, Robotics & China

Three forces are converging to reshape the biodefense landscape: AI models that can design pathogens, collapsing costs of biological manufacturing, and Western dependence on Chinese supply chains. Each alone is exciting, but comes with subsequent risks, and compounded, they create both unprecedented risk and investment opportunity.

AI Models Are Becoming Biological Design Tools

The threat landscape transformed in February 2025 when the Arc Institute (US based non-profit biomedical research organization) released Evo2, the largest biological AI model ever built. Trained on 9.3 trillion nucleotides across 128,000 genomes, Evo2 can design complete genome sequences comparable to simple bacteria and predict disease-causing mutations with over 90% accuracy. Within weeks, researchers had refined the model to work with human-infecting viruses, exactly the scenario Arc tried to prevent by excluding such sequences from training. This was bound to happen.

Then came GeneBreaker. Published in May 2025, this framework demonstrated that DNA foundation models can be systematically jailbroken, successfully bypassing safety filters up to 60% of the time to generate sequences with over 90% similarity to known pathogens like SARS-CoV-2 and HIV-1. A Microsoft study in October 2025 showed that AI protein-design tools could "paraphrase" toxic protein DNA codes in ways that evaded biosecurity screening software. Some variants passed through 100% undetected.

OpenAI warned in April 2025 that models are "on the cusp of meaningfully helping novices create known biological threats." An internal Anthropic test achieved a 91% score on bioweapons planning, above its 80% threshold for catastrophic misuse concern. AI model o3 now outperforms 94% of expert virologists on experimental knowledge tests. The Forecasting Research Institute estimates AI could make a pandemic five times more likely.

Fortunately, there are many steps between an AI-generated pathogen sequence and population-scale deployment. But like the Red Queen in Alice in Wonderland who must keep running just to stay in place, biodefense must evolve continuously as threats advance. Standing still means falling behind.

The Cost of Manufacturing Is Collapsing

What makes the AI threat particularly acute is that physical barriers are falling too. Lab automation and robotics are compressing drug discovery cycles from months to days. Experiments that once required teams of technicians can now run autonomously around the clock.

The trajectory points toward fully autonomous labs: systems that generate hypotheses, run assays, analyze results, and iterate without human intervention. Eli Lilly and Nvidia just announced a $1 billion co-innovation lab built around this exact premise: a "continuous learning system" connecting robotic wet labs with computational dry labs for 24/7 AI-assisted experimentation.

Labor costs estimates and projections for screening, routine prep and AI flexible - credits to John Cassidy and the

If this trajectory holds, the barrier to entry for capable biolab infrastructure drops dramatically for those building defenses and those building threats. Another clear example is the DOE's Genesis Mission to prototype modular biofoundries with robotic workstations that can be reconfigured on the fly.

Multiply Labs, working with Thermo Fisher and UCSF, has demonstrated a 74% cost reduction in cell therapy manufacturing through robotic automation, with 100x more doses per square foot of cleanroom.

Dunia, a portfolio company, is pioneering this paradigm shift for materials discovery. Their platform IRIS outperformed human researchers in increasing energy efficiency of a given catalyst ink formulation, and within a few months, high-performing formulations were identified and validated under real-world conditions.

The qualitative results of the IRIS platform in identifying the catalyst ink compound, compared to human scientists

China’s shift from low-cost labor to having dedicated Biotech Parks

China's position in biotech supply chains has strengthened despite years of tariffs and awareness campaigns. The country has shifted from low-cost labor arbitrage to building dedicated Biotech Parks where startups, CROs, and API manufacturers are all within walking distance, creating a high-speed innovation-production flywheel.

China now holds 467 FDA-registered API facilities, up from 230 in 2019. Some 39.9% of US critical pharmaceutical inputs by volume come from China, and 27% of US military drug purchases depend on Chinese suppliers. The University of Minnesota calculates that 46% of daily US generic drug doses trace back to Chinese source materials.

The exposure goes beyond drug production capacity. For two decades, Western pharma pursued asset-light models, keeping discovery work in-house while sending validation and testing overseas. Target identification, molecule design, platform development: that stayed in Boston and Basel. What went to China was the protocol-driven execution: compound synthesis at scale, animal studies, bridging work that moves molecules toward the clinic. It was 30-40% cheaper, so that made sense (and still does for some). WuXi AppTec, the largest Chinese CRO, gets 60% of its total revenue from US customers. It reinvests 23-25% into capacity expansion, a self-reinforcing engine at geopolitical scale, funded largely by Western R&D budgets.

And China is moving upstream. Some of the best genomic foundation models now emerge from Chinese labs. ChemLex runs a nearly autonomous robotic facility in Shanghai where bots execute 800 reactions daily, replacing 150-200 chemists. Frontier AI plus automation depth plus control over the validation-to-manufacturing pipeline: China is positioning to compete across the entire stack.

Some Policy Response, But Remains Inadequate

Governments are waking up, but the response lags the threat. The BIOSECURE Act, signed in December 2025, prohibits federal procurement from designated Chinese biotech entities including BGI and MGI. But the transition window is five years, and finding viable alternatives could take eight.

Meanwhile, pandemic preparedness pledges made after COVID are being abandoned. The Trump administration's FY2026 budget proposes cutting BARDA by $361 million, the Strategic National Stockpile by $215 million, and Project BioShield by $100 million. The Office of Pandemic Preparedness and Response Policy has been gutted: all staff departed by June 2025, no director appointed.

Europe is no better. HERA, the EU's pandemic response authority, operates with a reduced 2025 budget. Germany is halving funding for the WHO Pandemic Hub. The Lancet recently warned that European health security "needs a reboot." A 2025 World Economic Forum survey found 94% of countries lack systems to govern dual-use biosecurity risks.

This creates opportunity. The $160 billion in US pharma manufacturing projects announced in 2025 signals a multi-decade reallocation. Companies building biodefense infrastructure today will capture value as reshoring accelerates. But there is a lot of ground to make up.

Areas of Biodefense That Excite Us

We were surprised that there aren't more biodefense-labeled startups. Healthcare isn't usually associated with defense. But genuinely exciting technologies are emerging.

AI Countermeasures: The Frontier Opportunity

The core challenge in biodefense is asymmetry: it's easier to make a pathogen than a cure. AI countermeasures aim to close that gap by using the same computational tools that could design threats to instead design defenses, accelerating the pipeline from sequence identification to therapeutic response.

Two companies have emerged, both backed by OpenAI. Valthos raised $30 million in October 2025 from OpenAI Startup Fund, Founders Fund, and Lux Capital to build "the tech stack for biodefense." The platform uses computational methods to characterize sequences and design adaptive countermeasures. Red Queen Bio raised $15 million in December 2025, structured as a public benefit corporation, built around "defensive co-scaling": coupling defensive compute directly to AI capability advancement.

The distinction matters. Valthos acts as a rapid response unit, accelerating detection and cure development when threats emerge. Red Queen is an advance scout, stress-testing AI systems to identify dangerous outputs and developing countermeasures preemptively. One chases the threat; the other runs alongside it.

The business model innovation here is worth noting. Red Queen is exploring catastrophic risk insurance frameworks. If frontier AI labs accept that their models create biological risk, pricing that risk creates sustainable funding independent of government budget cycles. Both companies benefit from AI labs' direct incentive to fund their own defense, a rare alignment that creates capital availability outside traditional biodefense procurement. This opens interesting questions: could insurance-linked models fund other high-consequence, low-probability defense technologies?

Advanced Diagnostics: Portable Biothreat Identification

Detection is the first line of defense. The companies here span different approaches: protein sequencing, nucleic acid amplification, CRISPR-based detection, and AI-powered sensing. What unites them is the push for faster, cheaper, field-deployable threat identification.

Protein sequencing is particularly promising for biodefense. Unlike DNA-based methods, it can directly identify the functional molecules produced by pathogens, enabling detection of engineered or novel threats that might evade genomic screening. De novo sequencing—reading proteins without prior reference—could be transformative for identifying unknown agents in the field.

Portal Biotech ($35M, June 2025) represents NATO's first-ever biotech investment. Their nanopore-based single-molecule protein sequencing delivers pathogen identification in hours rather than days, 10-100x faster than mass spectrometry. The defense application is immediate: real-time field detection of unknown threats.

The protein sequencing space is heating up. Unomr (pre-seed, Zurich) is developing single-molecule proteomics with a promising path to de novo sequencing. Their key differentiator: adjustable nanopore sizes that provide more dynamic reads across diverse protein targets. Genopore (seed led by Merck, 2022) and Glyphic ($37M Series A, 2024) are also advancing protein sequencing approaches. The convergence of multiple well-funded players suggests this technology is approaching an inflection point.

True de novo protein sequencing isn't here yet, but the progress is significant. For now, proven methods remain essential.

Biomeme is already deployed. Their Franklin portable PCR thermocycler (3 pounds, battery-operated, results under 60 minutes) serves US Special Operations Command and CBIRF, with validated assays for 14 biowarfare agents. Ginkgo Biosecurity demonstrates the scaled model: $50 million in biosecurity revenue, CDC traveler surveillance at eleven US airports, government backlog exceeding $180 million. But government contract dependency creates execution risk. Recent executive departures to spin out a dedicated biodefense company suggest the biosecurity unit may have been the core value driver.

Resilient Manufacturing and Vertically Integrated Biodefense

The reshoring wave is real. Total disclosed CDMO investment reached $24.86 billion in 2025, with 74% flowing to the United States. Eli Lilly is investing $27 billion in four new US plants. Cambrex committed $120 million to expand API manufacturing capacity by 40%. FUJIFILM Diosynth signed a landmark 10-year, $3 billion agreement with Regeneron to produce biologics domestically. The capital is flowing.

But reshoring at scale requires new approaches, not just relocated capacity. The startups attacking this space are rethinking pharmaceutical manufacturing from first principles. In the US, OnePot ($13M, November 2025) is building AI-driven small molecule synthesis infrastructure in San Francisco. Their automated lab plans on delivering compounds 6-10x faster than traditional CROs, compressing timelines from months to days. As co-founder Daniil Boiko put it: "Small molecule synthesis needed to be rebuilt from the ground up in the United States." Their backers include Khosla Ventures, OpenAI co-founder Wojciech Zaremba, and Google's Chief Scientist Jeff Dean.

In Europe, Genhtis is tackling a specific chokepoint: Heparin. Today, 80% of Heparin supply comes from China, produced exclusively from pig intestines. Genhtis is developing a synthetic process to manufacture Heparin from yeast, eliminating both the geographic and biological dependency.

The integration of robotics and automation is what makes rapid-response manufacturing possible. This benefits all three categories above: AI countermeasures need rapid feedback loops, diagnostics require high-throughput production, and resilient manufacturing needs robotics to compete on cost with offshore labor. Few companies are building dedicated, end-to-end biodefense capabilities that combine these elements. Fabentech is the one of them. The Lyon-based company, spun off from Sanofi Pasteur, achieved French marketing authorization in January 2026 for Ricimed, the world's first approved ricin antidote. Ricin had no prior treatment despite being a recognized bioterrorism threat. Fabentech has secured €20+ million in multi-year European government contracts.

This is what purpose-built biodefense looks like: a platform producing highly purified polyclonal antibody fragments that neutralize toxins, with government customers aligned to the mission. The opportunity cost of not having more companies like this is significant. The business model challenges are real, but the Fabentech example shows they're not insurmountable.

The Biodefense Business Model Challenge

Building a company in biodefense is structurally difficult. Opportunity cost is the primary barrier: pharmaceutical-level R&D risk for defense-contractor-level returns. Humans systematically misjudge tail risk, what cognitive scientists call "normalcy bias." And geopolitical exposure is extreme: BARDA gets cut, your runway shrinks; the BIOSECURE Act passes, your manufacturing partner is sanctioned. Companies like Ginkgo Biosecurity, despite $50 million in revenue, have seen their stock drop 88%.

The most promising biodefense companies aren't just building better technology. They're building fundamentally different business models: insurance-linked funding, dual-use platforms with commercial revenue and biodefense optionality, or purpose-built government alignment with multi-year contract structures.

But there's a silver lining. The push for sovereignty and resilient supply chains forces companies to own what they previously outsourced: the full design-make-test-learn loop. That constraint breeds innovation. When you can't take the lazy path of offshore execution, you're forced to build the automation, the infrastructure, and the tacit knowledge in-house. You compound learning instead of renting it. That's how generational companies get built: not despite constraints, but because of them.

There's also a harder truth. Biodefense and bioweapons are two sides of the same infrastructure. The same screening and sequencing technologies that identify threats can inform their creation. Whoever can characterize compounds faster is better positioned to synthesize them. That's uncomfortable, but it's precisely why these capabilities matter strategically—and why sovereign nations will increasingly want them built at home.

Conclusion

The $40 billion biosecurity market is significant, but the ultimate objective is building resilient infrastructure that can prevent future pandemics, counter AI-enabled biological threats, and restore pharmaceutical sovereignty. The founders who succeed will understand they're building capabilities that governments need but haven't figured out how to fund. That's a hard problem. It's also the kind that creates lasting value when solved.

At Pace Ventures, we're committed to backing the deep-tech entrepreneurs addressing these challenges.