Longevity: Can We Really Live Healthier for Longer?

As life expectancy rises, researchers and startups race to extend not just lifespan but healthspan, exploring innovative approaches to mitigate the impacts of aging and chronic disease. Discover how the longevity sector aims to help people live healthier, longer lives through breakthroughs in science and technology.

Katharina Neisinger

Source: Unsplash Photo by Pawel Czerwinski

Executive Summary

There is a paradigm shift happening in the world’s demographics; people are living longer and there are already over 1 billion people aged over 60

A longer lifespan has not meant a longer healthspan with many people living longer but with poor health

The leading risk factor for death and disease remains increasing age, making it a significant factor in healthcare spending

Researchers and startups are working on various approaches towards longevity, including how to halt mitochondrial dysfunction and senescent cells. The diversity of approaches and business models is also likely to increase further this decade

Investments in longevity are expected to reach $44 billion by 2030, up from $ 8 billion in 2020

The world population keeps growing

The world’s population reached 8 billion this year, and even though the global population growth rate has slowed for the first time in 70 years, it is still predicted to continue to climb to 10.4 billion by 2100(1). That represents an increase from 52 to 68 people for every km2 of land on earth by the year 2080. However, in the short term, it is important to look at what is driving this population growth. A fall in birth rates and a rising average life expectancy have produced a paradigm shift in the world’s demographics.

…and people are living longer

Globally, life expectancy has doubled in the last 100 years. A female born in England this year can expect to live 21 years longer than if they were born in the late 1920s. Boys and girls born in the UK during the 2020s can expect an average life span of 87 and 90 years respectively, with over 13% expected to reach at least 100 years old(4). In fact, the UK over-90 population has steadily been growing for the last 30 years(8).

Source: Office for National Statistics — Estimates of the very old, including centenarians, UK 2002 to 2020 (8)

Improvements in nutrition and public health are not just benefiting the young; in Germany, men and women aged 65 and over can expect a further 18 and 21 years of life respectively(5). Between 1980 and 2017, the world’s over-60 population more than doubled from 382 million to 962 million people. Currently, there are already over a billion people (more than the entire population of Europe) who are aged over 60 across the world.

Source: Longevity Technology — Managing senescent cells to address chronic diseases: Senotherapeutics (9)

The US over-50 population accounted for $8.3 trillion of economic activity through active (purchasing goods and services) and passive (taxes) activities in 2018. This senior population alone would have been the 3rd largest economy in the world by GDP. Older adults also contribute to the economy in numerous unquantified ways such as volunteering or caring. It has been estimated that helping senior people in the UK to remain in the workforce could add an additional 1.3% to the country’s GDP(7).

However, despite people living longer, the period of our lives that we live without disease (healthspan) has noticeably lagged behind. A recent World Health Organisation (WHO) report highlighted that despite an average increase of 6 years in lifespan, between 2000 and 2019, only 5 of those years were spent in good health. Healthy life expectancy has very much stagnated in the last twenty years to around 58 for men and 68 for women. That means the youth today can expect to spend between a quarter and a third of their life in poor health.

Source: UK Health Security Agency — Ageing and health expenditure (10)

This global trend has significant social and economic consequences that cannot be ignored. The leading risk factor for death and disease remains increasing age, making it a significant factor in healthcare spending, due to its correlation with chronic diseases. Around 80% of older adults have at least one chronic disease and a shocking 36% have four or more. It has been estimated that chronic diseases account for over two-thirds of global healthcare spending. In 2019 the US spent the equivalent of one-fifth of its GDP treating chronic diseases alone.

As the average life span steadily increases, we feel it is imperative to strive to understand the mechanisms that underpin the ageing process so that we can decouple biological from chronological ageing. If we can understand the ageing process, this can be used as a platform to build therapies for a wide variety of indications, fundamentally changing the way we manage chronic diseases.

Source: Longevity Technology — Managing senescent cells to address chronic diseases: Senotherapeutics (9)

The problem of ageing

According to the WHO, ageing results from the impact of the accumulation of a wide variety of molecular and cellular damage over time(6). This purposefully broad and vague description hints at the complexity of the problem; there have been multiple processes identified that seem to accumulate in the body with ageing. These specific processes not only accelerate ageing when they are promoted, but most interestingly, appear to slow or reverse ageing when they are inhibited. They were titled the Hallmarks of Ageing.

Source: The Hallmarks of Aging, Carlos López-Otín et al. Cell 2013 (11)

The famous 2013 paper, published in the journal Cell, presented the first nine recognised hallmarks of ageing common across a variety of mammals:

1. Genomic instability

2. Telomere attrition

3. Epigenetic alterations

4. Loss of proteostasis

5. Deregulated nutrient-sensing

6. Mitochondrial dysfunction

7. Cellular senescence

8. Stem cell exhaustion

9. Altered intercellular communication

For over a decade, these nine pathways led the charge in ageing biology, with start-ups around the world trying to influence them in order to discover a novel longevity therapeutic. However, research into longevity has expanded with a 94% increase in longevity publications in the last decade. As researchers race to answer the complexity of ageing, these Hallmarks have come under criticism for being insufficient to explain the ageing process alone. Therefore, scientists and start-ups have been promoting additional theories and pathways including:

10. Compromised autophagy

11. Microbiome disturbance

12. Altered mechanical properties

13. Splicing Dysregulation

14. Inflammation

These new hallmarks were voted into the ageing paradigm by an expert panel earlier in 2022. However, it must be stressed that ageing cannot be explained by a singular cellular or molecular pathway. In reality, it is likely that complex combinations of these pathways result in the ageing phenotype. The 15th hallmark published (15. unknown) highlights the fact that despite significant advances in the field of ageing research there remains little certainty.

Source: New hallmarks of ageing: a 2022 Copenhagen ageing meeting summary, Tomas Schmauck-Medina et al. Aging 2022 (12)

Furthermore, unlike traditional drug development companies, longevity start-ups have additional scientific risks to contend with en route to the clinic. Firstly, it is very hard to design a good research study for ageing. It would require a considerable amount of time and funding to fully evaluate therapies greatly exacerbating Eroom’s law. While induced ageing animal models have allowed ageing research to progress, they have not always translated well into ageing in humans. Even if a suitable study design is found, currently there is no clear regulatory pathway for a general longevity therapy, as ageing is not yet recognised as a disease by regulatory bodies.

Uncertainty drives innovation: longevity approaches from science

This uncertainty has not deterred start-ups from continuing to innovate in this space. The longevity market is estimated to grow from $8 billion in 2020 to $44 billion by 2030. This is likely to be a conservative estimate given the logical go-to-market strategies for new longevity companies. We have seen a few business models emerging that allow start-ups to gain traction in this market.

One option is to focus on the huge unmet need within recognised age-related diseases rather than ageing as a whole. Cardiovascular, neurodegenerative, and metabolic chronic diseases, to name a few, are all multi-billion dollar markets in themselves. MitoRx, a UK-based start-up, is targeting mitochondrial dysfunction to halt the progression of neurodegenerative conditions and is currently in the pre-clinical phase with their lead indication Duchenne Muscular Dystrophy. Senisca, a spin-out from the University of Exeter, is targeting Idiopathic Pulmonary Fibrosis by reversing cellular senescence through modulation of RNA splicing. While Curexsys, based in Germany, are using exosomes to modulate the inflammatory state seen in age-related dermatological and eye diseases.

Another strategy adopted, that sidesteps a lot of the regulatory barriers and has a shorter route to commercialisation, is direct to consumer products. Avea produces a range of longevity supplements containing a precursor to the essential coenzyme NAD+. Similarly, OneSkin positions themselve as a skin longevity company with their range of topical supplements that target cellular senescence within skin. Meanwhile, San Francisco-based Cellular longevity is taking a completely different approach with its company named “Loyal” which is developing longevity therapies for dogs. The company believes that it can translate much of the research and development from the $100 billion dollar pet industry to better understand human therapies in the future.

Finally, an alternative strategy altogether is to focus on the complexity of defining changes in biological age in clinical trials. Tracked.bio is helping to speed up pre-clinical evaluation of potential longevity assets by using its deep-learning platform to produce a novel ageing clock in model animals. While AgeLabs, based in Norway, is building a novel biomarker discovery platform for the early detection of age-related diseases as well as epigenetic measurements of biological age for use in age-related clinical trials.

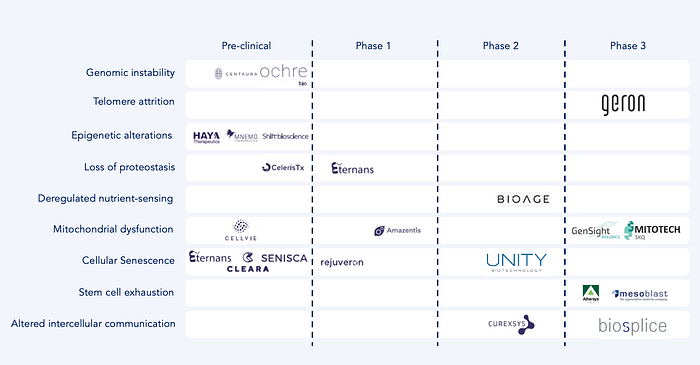

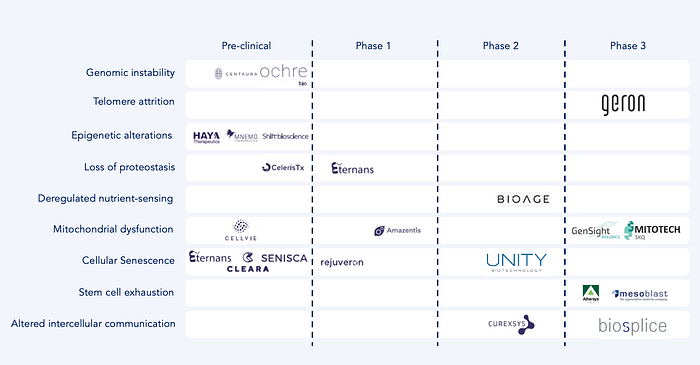

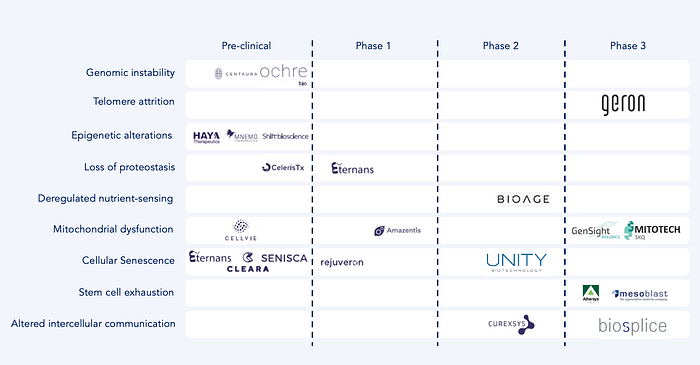

Market Map: Longevity Start-ups by Ageing Hallmark and Research Stage (Non-exhaustive)

By 2021 Longevity start-ups had landed over $1.9 billion in funding for products and services aimed at the prevention, diagnosis and treatment of ageing. A sum that was eclipsed, in January of this year, by the $3 billion total funding announcement from Altos Labs for their work into cellular rejuvenation. This is not the first time that blockbuster sums of capital have been pumped into a longevity start-up. Alphabet spin-out, Calico labs, with its $1.5 billion partnerships with AbbVie has so far failed to meet the expectations of the longevity research and innovation community. That said, longevity funding as a whole is starting to see the fruits of its labour, with at least 6 companies currently with assets in phase 3 clinical trials.

Longevity remains an ever-expanding sector to be active in. We are excited by the breakthrough start-ups that are reimagining chronic disease management, including, Ochre Bio who are using RNA therapies to rejuvenate transplanted livers with the goal to treat fatty liver disease and other metabolic diseases in the future. As well as CelerisTx, who are developing an AI drug discovery platform for protein degradation that helps the loss of proteostasis seen in ageing and age-related diseases.

Concluding thoughts

The consequences of an ageing global population cannot be ignored. While the ageing process is complicated, efforts to solve it are driving incredible innovation for some of humanity’s most burdensome chronic diseases. The goal of longevity therapies should be to enable our society to live healthier for longer, increasing not only lifespan but importantly healthspan.

Sources

Source: Unsplash Photo by Pawel Czerwinski

Executive Summary

There is a paradigm shift happening in the world’s demographics; people are living longer and there are already over 1 billion people aged over 60

A longer lifespan has not meant a longer healthspan with many people living longer but with poor health

The leading risk factor for death and disease remains increasing age, making it a significant factor in healthcare spending

Researchers and startups are working on various approaches towards longevity, including how to halt mitochondrial dysfunction and senescent cells. The diversity of approaches and business models is also likely to increase further this decade

Investments in longevity are expected to reach $44 billion by 2030, up from $ 8 billion in 2020

The world population keeps growing

The world’s population reached 8 billion this year, and even though the global population growth rate has slowed for the first time in 70 years, it is still predicted to continue to climb to 10.4 billion by 2100(1). That represents an increase from 52 to 68 people for every km2 of land on earth by the year 2080. However, in the short term, it is important to look at what is driving this population growth. A fall in birth rates and a rising average life expectancy have produced a paradigm shift in the world’s demographics.

…and people are living longer

Globally, life expectancy has doubled in the last 100 years. A female born in England this year can expect to live 21 years longer than if they were born in the late 1920s. Boys and girls born in the UK during the 2020s can expect an average life span of 87 and 90 years respectively, with over 13% expected to reach at least 100 years old(4). In fact, the UK over-90 population has steadily been growing for the last 30 years(8).

Source: Office for National Statistics — Estimates of the very old, including centenarians, UK 2002 to 2020 (8)

Improvements in nutrition and public health are not just benefiting the young; in Germany, men and women aged 65 and over can expect a further 18 and 21 years of life respectively(5). Between 1980 and 2017, the world’s over-60 population more than doubled from 382 million to 962 million people. Currently, there are already over a billion people (more than the entire population of Europe) who are aged over 60 across the world.

Source: Longevity Technology — Managing senescent cells to address chronic diseases: Senotherapeutics (9)

The US over-50 population accounted for $8.3 trillion of economic activity through active (purchasing goods and services) and passive (taxes) activities in 2018. This senior population alone would have been the 3rd largest economy in the world by GDP. Older adults also contribute to the economy in numerous unquantified ways such as volunteering or caring. It has been estimated that helping senior people in the UK to remain in the workforce could add an additional 1.3% to the country’s GDP(7).

However, despite people living longer, the period of our lives that we live without disease (healthspan) has noticeably lagged behind. A recent World Health Organisation (WHO) report highlighted that despite an average increase of 6 years in lifespan, between 2000 and 2019, only 5 of those years were spent in good health. Healthy life expectancy has very much stagnated in the last twenty years to around 58 for men and 68 for women. That means the youth today can expect to spend between a quarter and a third of their life in poor health.

Source: UK Health Security Agency — Ageing and health expenditure (10)

This global trend has significant social and economic consequences that cannot be ignored. The leading risk factor for death and disease remains increasing age, making it a significant factor in healthcare spending, due to its correlation with chronic diseases. Around 80% of older adults have at least one chronic disease and a shocking 36% have four or more. It has been estimated that chronic diseases account for over two-thirds of global healthcare spending. In 2019 the US spent the equivalent of one-fifth of its GDP treating chronic diseases alone.

As the average life span steadily increases, we feel it is imperative to strive to understand the mechanisms that underpin the ageing process so that we can decouple biological from chronological ageing. If we can understand the ageing process, this can be used as a platform to build therapies for a wide variety of indications, fundamentally changing the way we manage chronic diseases.

Source: Longevity Technology — Managing senescent cells to address chronic diseases: Senotherapeutics (9)

The problem of ageing

According to the WHO, ageing results from the impact of the accumulation of a wide variety of molecular and cellular damage over time(6). This purposefully broad and vague description hints at the complexity of the problem; there have been multiple processes identified that seem to accumulate in the body with ageing. These specific processes not only accelerate ageing when they are promoted, but most interestingly, appear to slow or reverse ageing when they are inhibited. They were titled the Hallmarks of Ageing.

Source: The Hallmarks of Aging, Carlos López-Otín et al. Cell 2013 (11)

The famous 2013 paper, published in the journal Cell, presented the first nine recognised hallmarks of ageing common across a variety of mammals:

1. Genomic instability

2. Telomere attrition

3. Epigenetic alterations

4. Loss of proteostasis

5. Deregulated nutrient-sensing

6. Mitochondrial dysfunction

7. Cellular senescence

8. Stem cell exhaustion

9. Altered intercellular communication

For over a decade, these nine pathways led the charge in ageing biology, with start-ups around the world trying to influence them in order to discover a novel longevity therapeutic. However, research into longevity has expanded with a 94% increase in longevity publications in the last decade. As researchers race to answer the complexity of ageing, these Hallmarks have come under criticism for being insufficient to explain the ageing process alone. Therefore, scientists and start-ups have been promoting additional theories and pathways including:

10. Compromised autophagy

11. Microbiome disturbance

12. Altered mechanical properties

13. Splicing Dysregulation

14. Inflammation

These new hallmarks were voted into the ageing paradigm by an expert panel earlier in 2022. However, it must be stressed that ageing cannot be explained by a singular cellular or molecular pathway. In reality, it is likely that complex combinations of these pathways result in the ageing phenotype. The 15th hallmark published (15. unknown) highlights the fact that despite significant advances in the field of ageing research there remains little certainty.

Source: New hallmarks of ageing: a 2022 Copenhagen ageing meeting summary, Tomas Schmauck-Medina et al. Aging 2022 (12)

Furthermore, unlike traditional drug development companies, longevity start-ups have additional scientific risks to contend with en route to the clinic. Firstly, it is very hard to design a good research study for ageing. It would require a considerable amount of time and funding to fully evaluate therapies greatly exacerbating Eroom’s law. While induced ageing animal models have allowed ageing research to progress, they have not always translated well into ageing in humans. Even if a suitable study design is found, currently there is no clear regulatory pathway for a general longevity therapy, as ageing is not yet recognised as a disease by regulatory bodies.

Uncertainty drives innovation: longevity approaches from science

This uncertainty has not deterred start-ups from continuing to innovate in this space. The longevity market is estimated to grow from $8 billion in 2020 to $44 billion by 2030. This is likely to be a conservative estimate given the logical go-to-market strategies for new longevity companies. We have seen a few business models emerging that allow start-ups to gain traction in this market.

One option is to focus on the huge unmet need within recognised age-related diseases rather than ageing as a whole. Cardiovascular, neurodegenerative, and metabolic chronic diseases, to name a few, are all multi-billion dollar markets in themselves. MitoRx, a UK-based start-up, is targeting mitochondrial dysfunction to halt the progression of neurodegenerative conditions and is currently in the pre-clinical phase with their lead indication Duchenne Muscular Dystrophy. Senisca, a spin-out from the University of Exeter, is targeting Idiopathic Pulmonary Fibrosis by reversing cellular senescence through modulation of RNA splicing. While Curexsys, based in Germany, are using exosomes to modulate the inflammatory state seen in age-related dermatological and eye diseases.

Another strategy adopted, that sidesteps a lot of the regulatory barriers and has a shorter route to commercialisation, is direct to consumer products. Avea produces a range of longevity supplements containing a precursor to the essential coenzyme NAD+. Similarly, OneSkin positions themselve as a skin longevity company with their range of topical supplements that target cellular senescence within skin. Meanwhile, San Francisco-based Cellular longevity is taking a completely different approach with its company named “Loyal” which is developing longevity therapies for dogs. The company believes that it can translate much of the research and development from the $100 billion dollar pet industry to better understand human therapies in the future.

Finally, an alternative strategy altogether is to focus on the complexity of defining changes in biological age in clinical trials. Tracked.bio is helping to speed up pre-clinical evaluation of potential longevity assets by using its deep-learning platform to produce a novel ageing clock in model animals. While AgeLabs, based in Norway, is building a novel biomarker discovery platform for the early detection of age-related diseases as well as epigenetic measurements of biological age for use in age-related clinical trials.

Market Map: Longevity Start-ups by Ageing Hallmark and Research Stage (Non-exhaustive)

By 2021 Longevity start-ups had landed over $1.9 billion in funding for products and services aimed at the prevention, diagnosis and treatment of ageing. A sum that was eclipsed, in January of this year, by the $3 billion total funding announcement from Altos Labs for their work into cellular rejuvenation. This is not the first time that blockbuster sums of capital have been pumped into a longevity start-up. Alphabet spin-out, Calico labs, with its $1.5 billion partnerships with AbbVie has so far failed to meet the expectations of the longevity research and innovation community. That said, longevity funding as a whole is starting to see the fruits of its labour, with at least 6 companies currently with assets in phase 3 clinical trials.

Longevity remains an ever-expanding sector to be active in. We are excited by the breakthrough start-ups that are reimagining chronic disease management, including, Ochre Bio who are using RNA therapies to rejuvenate transplanted livers with the goal to treat fatty liver disease and other metabolic diseases in the future. As well as CelerisTx, who are developing an AI drug discovery platform for protein degradation that helps the loss of proteostasis seen in ageing and age-related diseases.

Concluding thoughts

The consequences of an ageing global population cannot be ignored. While the ageing process is complicated, efforts to solve it are driving incredible innovation for some of humanity’s most burdensome chronic diseases. The goal of longevity therapies should be to enable our society to live healthier for longer, increasing not only lifespan but importantly healthspan.

Sources

Source: Unsplash Photo by Pawel Czerwinski

Executive Summary

There is a paradigm shift happening in the world’s demographics; people are living longer and there are already over 1 billion people aged over 60

A longer lifespan has not meant a longer healthspan with many people living longer but with poor health

The leading risk factor for death and disease remains increasing age, making it a significant factor in healthcare spending

Researchers and startups are working on various approaches towards longevity, including how to halt mitochondrial dysfunction and senescent cells. The diversity of approaches and business models is also likely to increase further this decade

Investments in longevity are expected to reach $44 billion by 2030, up from $ 8 billion in 2020

The world population keeps growing

The world’s population reached 8 billion this year, and even though the global population growth rate has slowed for the first time in 70 years, it is still predicted to continue to climb to 10.4 billion by 2100(1). That represents an increase from 52 to 68 people for every km2 of land on earth by the year 2080. However, in the short term, it is important to look at what is driving this population growth. A fall in birth rates and a rising average life expectancy have produced a paradigm shift in the world’s demographics.

…and people are living longer

Globally, life expectancy has doubled in the last 100 years. A female born in England this year can expect to live 21 years longer than if they were born in the late 1920s. Boys and girls born in the UK during the 2020s can expect an average life span of 87 and 90 years respectively, with over 13% expected to reach at least 100 years old(4). In fact, the UK over-90 population has steadily been growing for the last 30 years(8).

Source: Office for National Statistics — Estimates of the very old, including centenarians, UK 2002 to 2020 (8)

Improvements in nutrition and public health are not just benefiting the young; in Germany, men and women aged 65 and over can expect a further 18 and 21 years of life respectively(5). Between 1980 and 2017, the world’s over-60 population more than doubled from 382 million to 962 million people. Currently, there are already over a billion people (more than the entire population of Europe) who are aged over 60 across the world.

Source: Longevity Technology — Managing senescent cells to address chronic diseases: Senotherapeutics (9)

The US over-50 population accounted for $8.3 trillion of economic activity through active (purchasing goods and services) and passive (taxes) activities in 2018. This senior population alone would have been the 3rd largest economy in the world by GDP. Older adults also contribute to the economy in numerous unquantified ways such as volunteering or caring. It has been estimated that helping senior people in the UK to remain in the workforce could add an additional 1.3% to the country’s GDP(7).

However, despite people living longer, the period of our lives that we live without disease (healthspan) has noticeably lagged behind. A recent World Health Organisation (WHO) report highlighted that despite an average increase of 6 years in lifespan, between 2000 and 2019, only 5 of those years were spent in good health. Healthy life expectancy has very much stagnated in the last twenty years to around 58 for men and 68 for women. That means the youth today can expect to spend between a quarter and a third of their life in poor health.

Source: UK Health Security Agency — Ageing and health expenditure (10)

This global trend has significant social and economic consequences that cannot be ignored. The leading risk factor for death and disease remains increasing age, making it a significant factor in healthcare spending, due to its correlation with chronic diseases. Around 80% of older adults have at least one chronic disease and a shocking 36% have four or more. It has been estimated that chronic diseases account for over two-thirds of global healthcare spending. In 2019 the US spent the equivalent of one-fifth of its GDP treating chronic diseases alone.

As the average life span steadily increases, we feel it is imperative to strive to understand the mechanisms that underpin the ageing process so that we can decouple biological from chronological ageing. If we can understand the ageing process, this can be used as a platform to build therapies for a wide variety of indications, fundamentally changing the way we manage chronic diseases.

Source: Longevity Technology — Managing senescent cells to address chronic diseases: Senotherapeutics (9)

The problem of ageing

According to the WHO, ageing results from the impact of the accumulation of a wide variety of molecular and cellular damage over time(6). This purposefully broad and vague description hints at the complexity of the problem; there have been multiple processes identified that seem to accumulate in the body with ageing. These specific processes not only accelerate ageing when they are promoted, but most interestingly, appear to slow or reverse ageing when they are inhibited. They were titled the Hallmarks of Ageing.

Source: The Hallmarks of Aging, Carlos López-Otín et al. Cell 2013 (11)

The famous 2013 paper, published in the journal Cell, presented the first nine recognised hallmarks of ageing common across a variety of mammals:

1. Genomic instability

2. Telomere attrition

3. Epigenetic alterations

4. Loss of proteostasis

5. Deregulated nutrient-sensing

6. Mitochondrial dysfunction

7. Cellular senescence

8. Stem cell exhaustion

9. Altered intercellular communication

For over a decade, these nine pathways led the charge in ageing biology, with start-ups around the world trying to influence them in order to discover a novel longevity therapeutic. However, research into longevity has expanded with a 94% increase in longevity publications in the last decade. As researchers race to answer the complexity of ageing, these Hallmarks have come under criticism for being insufficient to explain the ageing process alone. Therefore, scientists and start-ups have been promoting additional theories and pathways including:

10. Compromised autophagy

11. Microbiome disturbance

12. Altered mechanical properties

13. Splicing Dysregulation

14. Inflammation

These new hallmarks were voted into the ageing paradigm by an expert panel earlier in 2022. However, it must be stressed that ageing cannot be explained by a singular cellular or molecular pathway. In reality, it is likely that complex combinations of these pathways result in the ageing phenotype. The 15th hallmark published (15. unknown) highlights the fact that despite significant advances in the field of ageing research there remains little certainty.

Source: New hallmarks of ageing: a 2022 Copenhagen ageing meeting summary, Tomas Schmauck-Medina et al. Aging 2022 (12)

Furthermore, unlike traditional drug development companies, longevity start-ups have additional scientific risks to contend with en route to the clinic. Firstly, it is very hard to design a good research study for ageing. It would require a considerable amount of time and funding to fully evaluate therapies greatly exacerbating Eroom’s law. While induced ageing animal models have allowed ageing research to progress, they have not always translated well into ageing in humans. Even if a suitable study design is found, currently there is no clear regulatory pathway for a general longevity therapy, as ageing is not yet recognised as a disease by regulatory bodies.

Uncertainty drives innovation: longevity approaches from science

This uncertainty has not deterred start-ups from continuing to innovate in this space. The longevity market is estimated to grow from $8 billion in 2020 to $44 billion by 2030. This is likely to be a conservative estimate given the logical go-to-market strategies for new longevity companies. We have seen a few business models emerging that allow start-ups to gain traction in this market.

One option is to focus on the huge unmet need within recognised age-related diseases rather than ageing as a whole. Cardiovascular, neurodegenerative, and metabolic chronic diseases, to name a few, are all multi-billion dollar markets in themselves. MitoRx, a UK-based start-up, is targeting mitochondrial dysfunction to halt the progression of neurodegenerative conditions and is currently in the pre-clinical phase with their lead indication Duchenne Muscular Dystrophy. Senisca, a spin-out from the University of Exeter, is targeting Idiopathic Pulmonary Fibrosis by reversing cellular senescence through modulation of RNA splicing. While Curexsys, based in Germany, are using exosomes to modulate the inflammatory state seen in age-related dermatological and eye diseases.

Another strategy adopted, that sidesteps a lot of the regulatory barriers and has a shorter route to commercialisation, is direct to consumer products. Avea produces a range of longevity supplements containing a precursor to the essential coenzyme NAD+. Similarly, OneSkin positions themselve as a skin longevity company with their range of topical supplements that target cellular senescence within skin. Meanwhile, San Francisco-based Cellular longevity is taking a completely different approach with its company named “Loyal” which is developing longevity therapies for dogs. The company believes that it can translate much of the research and development from the $100 billion dollar pet industry to better understand human therapies in the future.

Finally, an alternative strategy altogether is to focus on the complexity of defining changes in biological age in clinical trials. Tracked.bio is helping to speed up pre-clinical evaluation of potential longevity assets by using its deep-learning platform to produce a novel ageing clock in model animals. While AgeLabs, based in Norway, is building a novel biomarker discovery platform for the early detection of age-related diseases as well as epigenetic measurements of biological age for use in age-related clinical trials.

Market Map: Longevity Start-ups by Ageing Hallmark and Research Stage (Non-exhaustive)

By 2021 Longevity start-ups had landed over $1.9 billion in funding for products and services aimed at the prevention, diagnosis and treatment of ageing. A sum that was eclipsed, in January of this year, by the $3 billion total funding announcement from Altos Labs for their work into cellular rejuvenation. This is not the first time that blockbuster sums of capital have been pumped into a longevity start-up. Alphabet spin-out, Calico labs, with its $1.5 billion partnerships with AbbVie has so far failed to meet the expectations of the longevity research and innovation community. That said, longevity funding as a whole is starting to see the fruits of its labour, with at least 6 companies currently with assets in phase 3 clinical trials.

Longevity remains an ever-expanding sector to be active in. We are excited by the breakthrough start-ups that are reimagining chronic disease management, including, Ochre Bio who are using RNA therapies to rejuvenate transplanted livers with the goal to treat fatty liver disease and other metabolic diseases in the future. As well as CelerisTx, who are developing an AI drug discovery platform for protein degradation that helps the loss of proteostasis seen in ageing and age-related diseases.

Concluding thoughts

The consequences of an ageing global population cannot be ignored. While the ageing process is complicated, efforts to solve it are driving incredible innovation for some of humanity’s most burdensome chronic diseases. The goal of longevity therapies should be to enable our society to live healthier for longer, increasing not only lifespan but importantly healthspan.