Fighting Fossil Fuels: The Green Material Revolution!

Despite a significant rise in policies focused on consumption and behavior changes to decrease polluting fossil fuel use, the world's dependence on fossil fuels remains at unhealthy high levels.

Katharina Neisinger

Summary

It is clear the planet needs more green chemical and material science innovation to fight our dependence on fossil fuels. We believe the private sector is best positioned to make this happen, and have seen a wave of new start-ups emerge in the green chemistry space over the last few months. We are looking forward to rapid adoption by the chemical industry of their novel advanced and greener materials.

Fossil fuel use is ubiquitous. It is used to generate electricity, heat our homes, fuel our vehicles, and power industry and manufacturing (chemicals, plastics, medicines). Despite a significant rise in policies focused on consumption and behavior changes to decrease polluting fossil fuel use, the world’s dependence on fossil fuels remains at unhealthy high levels.

Some good news though, in 2020, total consumption of fossil fuels in the US, including petroleum, natural gas, and coal, fell to 72.9 quadrillion British thermal units (Btu), down 9% from 2019 and the lowest level since 1991 (1). However, the not-so-good news is that petroleum and natural gas will remain the most-consumed energy sources in the US electricity sector by 2050.

Green chemistry, “the design of chemical processes and products to reduce or eliminate the use or generation of hazardous substances,” is attempting to tackle this problem. The concept of Green Chemistry is not a political one. It was born naturally from genuine environmental crises over the last few years. The Environmental Protection Agency (EPA) has even developed 12 principles for green chemistry.

Some major green chemistry goals include reducing our reliance on nonrenewable energy sources, breaking down landfill waste, taking advantage of resources that nobody wants (such as CO2 (2)), and using renewable feedstocks. For green chemicals, this means to use feedstocks (‘starting materials’) that are renewable rather than depletable.

The source of renewable feedstocks is often agricultural products or the waste of other processes. The source of depletable feedstocks, on the other hand, is often fossil fuels (petroleum, natural gas, or coal) or mining operations” (3). Therefore, the green chemistry industry has strong connections with the generation of biobased materials.

Why are there more start-ups in green chemistry now?

Toxic or even hazardous chemicals have been used in our everyday lives but are fortunately being replaced with less harmful and greener solutions. Examples of green chemicals include green ammonia, green methanol, green SNG, and green hydrogen. For the bleaching of paper, conventional methods used chlorine but are now mostly done with H2O2. Pesticides used to be heavy in chlorinated hydrocarbons, but the less toxic neem-based pesticides are nowadays widely adopted.

Yet, traditional chemical companies cannot innovate quickly enough to deliver products beyond a fossil fuel reliance. Their development cycles are long, and they cannot keep up with the dire need for new green chemicals and materials. Start-ups are seizing this opportunity.

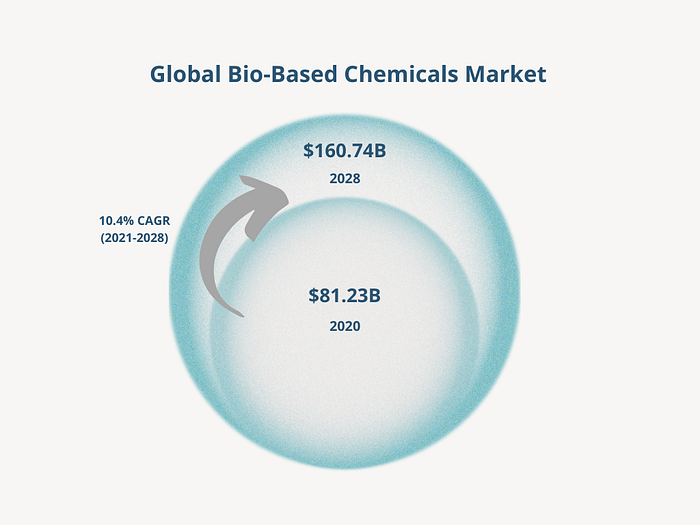

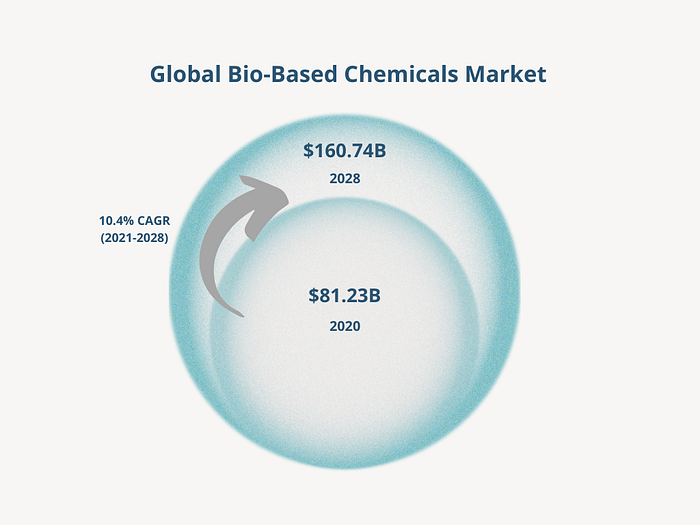

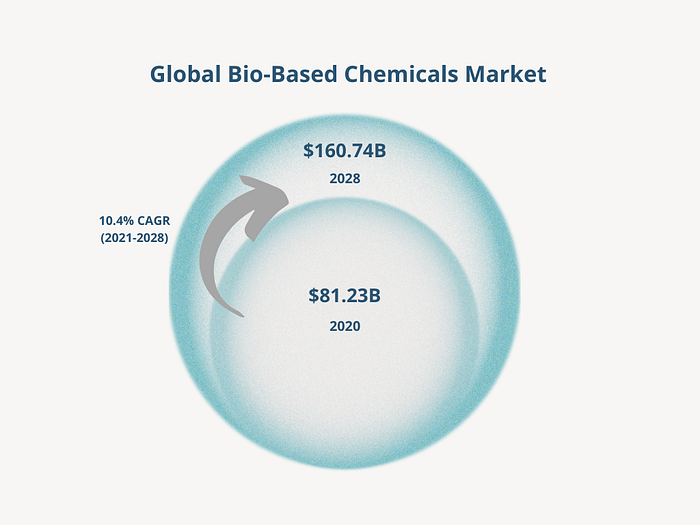

The market is growing

Both the global green chemicals market, as well as the global bio-based materials market, are growing steadily.

Emerging players

We have mapped out an overview of a few players and their approaches operating in the green chemicals and bio-based materials space. Sectors that are seeing a lot of innovation are packaging & plastic alternatives; sustainable building materials; textile & leather alternatives; bio-based fuels; and other biomanufacturing solutions.

Packaging & plastic alternatives

One.Five | est. 2020 Hamburg, Germany

Scaling applied material science through a materials discovery platform to help companies transform their product lines into biodegradable and circular outputs. Undisclosed investors.

Traceless | est. 2020 Hamburg, Germany

Bio-based materials based on biological residues. Traceless creates base materials in granulate form which can be used for a wide range of products, including rigid packaging, single-use products, high-abrasion products, paper and cardboard coatings, and more. Investment including from Planet A, HTGF, EIC (grant).

Shellworks | est. 2019 London, UK

Producer of a variety of materials, e.g. Shellmer, a biopolymer product extracted from seafood waste. Products include cream containers and lipstick packaging. Seed round led by LocalGlobe.

Xampla | est. 2018 Cambridge, UK

Producer of plant-based materials that do not harm the environment, including biodegradable microcapsules, beads and films made from plant protein for food, cosmetics, packaging, and more applications. Backed by Amadeus Capital Partners and Horizons Ventures.

NoIssue | est. 2017 Auckland, New Zealand

Eco-friendly custom packaging platform. Company‘s product range includes custom paper stickers, compostable mailer bags, and tissue wraps. Series A led by Felix Capital.

NotPla | est. 2014 London, UK

Notpla is a revolutionary material made from seaweed and plants that biodegrades in weeks. Investors include Horizons Ventures and Astanor.

Photo by Boxed Water Is Better on Unsplash

Sustainable building materials

Made of Air | est. 2016 Berlin, Germany

Development of carbon-negative materials by taking low-value wood waste and transforming it into high-value, carbon-negative thermoplastics. Besides the built environment also innovate in mobility and consumer goods. Investors include EQT and Tuesday Capital.

Alcemy | est. 2018 Berlin, Germany

With Alcemy’s AI software, production quality can be controlled predictively. This increases the uniformity of cement and concrete, simplifies work in the laboratory and control room, and reduces production costs. This sets the course for a progressive reduction in the CO2 footprint and significantly simplifies the handling of even the most complex mixtures. Investors include La Famiglia, Firstminute, and Entrepreneur First.

Vestack | est. 2020 Paris, France

Design and manufacture of modular bio-based buildings. Their USP lies on both software and hardware: their digital design system and industrialised pre-assembly of the buildings allows for faster and less emissions-intensive construction.

Additional innovation can be seen in modular construction and fungal mycelium as promising solutions for construction.

Bio-based fuels, textiles and other biomanufacturing solutions

LOVR | est. 2021 Darmstadt, Germany

Leather made from agricultural residues. CO2-neutral, plastic-free and biodegradable alternative made from hemp, leveraging processing technology from the paper industry.

Phycobloom | est. 2019 London, UK

Using algae oil as fuel. Phycobloom’s algae will continually release oils into their surroundings by extracting algae oil using synthetic biology. This makes the oil easier to collect without damaging the algae themselves.

Fabric Nano | est. 2018 London, UK

Replacing fermented and petrochemical products with biomanufactured alternatives using a novel DNA-based flow reactor to produce biochemicals. Investors include Atomico, Hoxton, Backed VC, Pace Ventures.

Business models: chem-as-a-service vs more full-stack

Companies listed above are trying different business models, either focusing on only providing software to help with material discovery (chem as a service) or the more full stack approach where they discover the materials using in silico models (software) but are also responsible for the manufacturing of the finished product, albeit on a small scale (full-stack).

Chemicals as a service has seen an uptake amongst early-stage companies: the idea is to determine the revenue based on the benefits of the chemical usage, in the form of software or R&D process, rather than on the volume of the chemicals/materials. For several B2B customers, this is all that they want and need. Take the food and beverage industry for example; a lack of internal innovation might support the idea to look externally for the development of a new kind of bio-based packaging. This approach requires lighter capex and has faster innovation cycles for the corporate but also has a major drawback. In most instances, any developed IP remains on the customer side and therefore restricts the ability to scale several bio-based packaging compositions that can be useful to reduce our dependence on fossil fuels.

Hence, we prefer the business model where start-ups both discover new materials and produce smaller batches of the finished product, which can then be licensed out to many operators in the chemical or other industrial sectors.

We can’t wait for more innovation taking place in the space!

If you are an early-stage green chem/materials start-up and want to be included in the list above feel free to reach out

Sources

Summary

It is clear the planet needs more green chemical and material science innovation to fight our dependence on fossil fuels. We believe the private sector is best positioned to make this happen, and have seen a wave of new start-ups emerge in the green chemistry space over the last few months. We are looking forward to rapid adoption by the chemical industry of their novel advanced and greener materials.

Fossil fuel use is ubiquitous. It is used to generate electricity, heat our homes, fuel our vehicles, and power industry and manufacturing (chemicals, plastics, medicines). Despite a significant rise in policies focused on consumption and behavior changes to decrease polluting fossil fuel use, the world’s dependence on fossil fuels remains at unhealthy high levels.

Some good news though, in 2020, total consumption of fossil fuels in the US, including petroleum, natural gas, and coal, fell to 72.9 quadrillion British thermal units (Btu), down 9% from 2019 and the lowest level since 1991 (1). However, the not-so-good news is that petroleum and natural gas will remain the most-consumed energy sources in the US electricity sector by 2050.

Green chemistry, “the design of chemical processes and products to reduce or eliminate the use or generation of hazardous substances,” is attempting to tackle this problem. The concept of Green Chemistry is not a political one. It was born naturally from genuine environmental crises over the last few years. The Environmental Protection Agency (EPA) has even developed 12 principles for green chemistry.

Some major green chemistry goals include reducing our reliance on nonrenewable energy sources, breaking down landfill waste, taking advantage of resources that nobody wants (such as CO2 (2)), and using renewable feedstocks. For green chemicals, this means to use feedstocks (‘starting materials’) that are renewable rather than depletable.

The source of renewable feedstocks is often agricultural products or the waste of other processes. The source of depletable feedstocks, on the other hand, is often fossil fuels (petroleum, natural gas, or coal) or mining operations” (3). Therefore, the green chemistry industry has strong connections with the generation of biobased materials.

Why are there more start-ups in green chemistry now?

Toxic or even hazardous chemicals have been used in our everyday lives but are fortunately being replaced with less harmful and greener solutions. Examples of green chemicals include green ammonia, green methanol, green SNG, and green hydrogen. For the bleaching of paper, conventional methods used chlorine but are now mostly done with H2O2. Pesticides used to be heavy in chlorinated hydrocarbons, but the less toxic neem-based pesticides are nowadays widely adopted.

Yet, traditional chemical companies cannot innovate quickly enough to deliver products beyond a fossil fuel reliance. Their development cycles are long, and they cannot keep up with the dire need for new green chemicals and materials. Start-ups are seizing this opportunity.

The market is growing

Both the global green chemicals market, as well as the global bio-based materials market, are growing steadily.

Emerging players

We have mapped out an overview of a few players and their approaches operating in the green chemicals and bio-based materials space. Sectors that are seeing a lot of innovation are packaging & plastic alternatives; sustainable building materials; textile & leather alternatives; bio-based fuels; and other biomanufacturing solutions.

Packaging & plastic alternatives

One.Five | est. 2020 Hamburg, Germany

Scaling applied material science through a materials discovery platform to help companies transform their product lines into biodegradable and circular outputs. Undisclosed investors.

Traceless | est. 2020 Hamburg, Germany

Bio-based materials based on biological residues. Traceless creates base materials in granulate form which can be used for a wide range of products, including rigid packaging, single-use products, high-abrasion products, paper and cardboard coatings, and more. Investment including from Planet A, HTGF, EIC (grant).

Shellworks | est. 2019 London, UK

Producer of a variety of materials, e.g. Shellmer, a biopolymer product extracted from seafood waste. Products include cream containers and lipstick packaging. Seed round led by LocalGlobe.

Xampla | est. 2018 Cambridge, UK

Producer of plant-based materials that do not harm the environment, including biodegradable microcapsules, beads and films made from plant protein for food, cosmetics, packaging, and more applications. Backed by Amadeus Capital Partners and Horizons Ventures.

NoIssue | est. 2017 Auckland, New Zealand

Eco-friendly custom packaging platform. Company‘s product range includes custom paper stickers, compostable mailer bags, and tissue wraps. Series A led by Felix Capital.

NotPla | est. 2014 London, UK

Notpla is a revolutionary material made from seaweed and plants that biodegrades in weeks. Investors include Horizons Ventures and Astanor.

Photo by Boxed Water Is Better on Unsplash

Sustainable building materials

Made of Air | est. 2016 Berlin, Germany

Development of carbon-negative materials by taking low-value wood waste and transforming it into high-value, carbon-negative thermoplastics. Besides the built environment also innovate in mobility and consumer goods. Investors include EQT and Tuesday Capital.

Alcemy | est. 2018 Berlin, Germany

With Alcemy’s AI software, production quality can be controlled predictively. This increases the uniformity of cement and concrete, simplifies work in the laboratory and control room, and reduces production costs. This sets the course for a progressive reduction in the CO2 footprint and significantly simplifies the handling of even the most complex mixtures. Investors include La Famiglia, Firstminute, and Entrepreneur First.

Vestack | est. 2020 Paris, France

Design and manufacture of modular bio-based buildings. Their USP lies on both software and hardware: their digital design system and industrialised pre-assembly of the buildings allows for faster and less emissions-intensive construction.

Additional innovation can be seen in modular construction and fungal mycelium as promising solutions for construction.

Bio-based fuels, textiles and other biomanufacturing solutions

LOVR | est. 2021 Darmstadt, Germany

Leather made from agricultural residues. CO2-neutral, plastic-free and biodegradable alternative made from hemp, leveraging processing technology from the paper industry.

Phycobloom | est. 2019 London, UK

Using algae oil as fuel. Phycobloom’s algae will continually release oils into their surroundings by extracting algae oil using synthetic biology. This makes the oil easier to collect without damaging the algae themselves.

Fabric Nano | est. 2018 London, UK

Replacing fermented and petrochemical products with biomanufactured alternatives using a novel DNA-based flow reactor to produce biochemicals. Investors include Atomico, Hoxton, Backed VC, Pace Ventures.

Business models: chem-as-a-service vs more full-stack

Companies listed above are trying different business models, either focusing on only providing software to help with material discovery (chem as a service) or the more full stack approach where they discover the materials using in silico models (software) but are also responsible for the manufacturing of the finished product, albeit on a small scale (full-stack).

Chemicals as a service has seen an uptake amongst early-stage companies: the idea is to determine the revenue based on the benefits of the chemical usage, in the form of software or R&D process, rather than on the volume of the chemicals/materials. For several B2B customers, this is all that they want and need. Take the food and beverage industry for example; a lack of internal innovation might support the idea to look externally for the development of a new kind of bio-based packaging. This approach requires lighter capex and has faster innovation cycles for the corporate but also has a major drawback. In most instances, any developed IP remains on the customer side and therefore restricts the ability to scale several bio-based packaging compositions that can be useful to reduce our dependence on fossil fuels.

Hence, we prefer the business model where start-ups both discover new materials and produce smaller batches of the finished product, which can then be licensed out to many operators in the chemical or other industrial sectors.

We can’t wait for more innovation taking place in the space!

If you are an early-stage green chem/materials start-up and want to be included in the list above feel free to reach out

Sources

Summary

It is clear the planet needs more green chemical and material science innovation to fight our dependence on fossil fuels. We believe the private sector is best positioned to make this happen, and have seen a wave of new start-ups emerge in the green chemistry space over the last few months. We are looking forward to rapid adoption by the chemical industry of their novel advanced and greener materials.

Fossil fuel use is ubiquitous. It is used to generate electricity, heat our homes, fuel our vehicles, and power industry and manufacturing (chemicals, plastics, medicines). Despite a significant rise in policies focused on consumption and behavior changes to decrease polluting fossil fuel use, the world’s dependence on fossil fuels remains at unhealthy high levels.

Some good news though, in 2020, total consumption of fossil fuels in the US, including petroleum, natural gas, and coal, fell to 72.9 quadrillion British thermal units (Btu), down 9% from 2019 and the lowest level since 1991 (1). However, the not-so-good news is that petroleum and natural gas will remain the most-consumed energy sources in the US electricity sector by 2050.

Green chemistry, “the design of chemical processes and products to reduce or eliminate the use or generation of hazardous substances,” is attempting to tackle this problem. The concept of Green Chemistry is not a political one. It was born naturally from genuine environmental crises over the last few years. The Environmental Protection Agency (EPA) has even developed 12 principles for green chemistry.

Some major green chemistry goals include reducing our reliance on nonrenewable energy sources, breaking down landfill waste, taking advantage of resources that nobody wants (such as CO2 (2)), and using renewable feedstocks. For green chemicals, this means to use feedstocks (‘starting materials’) that are renewable rather than depletable.

The source of renewable feedstocks is often agricultural products or the waste of other processes. The source of depletable feedstocks, on the other hand, is often fossil fuels (petroleum, natural gas, or coal) or mining operations” (3). Therefore, the green chemistry industry has strong connections with the generation of biobased materials.

Why are there more start-ups in green chemistry now?

Toxic or even hazardous chemicals have been used in our everyday lives but are fortunately being replaced with less harmful and greener solutions. Examples of green chemicals include green ammonia, green methanol, green SNG, and green hydrogen. For the bleaching of paper, conventional methods used chlorine but are now mostly done with H2O2. Pesticides used to be heavy in chlorinated hydrocarbons, but the less toxic neem-based pesticides are nowadays widely adopted.

Yet, traditional chemical companies cannot innovate quickly enough to deliver products beyond a fossil fuel reliance. Their development cycles are long, and they cannot keep up with the dire need for new green chemicals and materials. Start-ups are seizing this opportunity.

The market is growing

Both the global green chemicals market, as well as the global bio-based materials market, are growing steadily.

Emerging players

We have mapped out an overview of a few players and their approaches operating in the green chemicals and bio-based materials space. Sectors that are seeing a lot of innovation are packaging & plastic alternatives; sustainable building materials; textile & leather alternatives; bio-based fuels; and other biomanufacturing solutions.

Packaging & plastic alternatives

One.Five | est. 2020 Hamburg, Germany

Scaling applied material science through a materials discovery platform to help companies transform their product lines into biodegradable and circular outputs. Undisclosed investors.

Traceless | est. 2020 Hamburg, Germany

Bio-based materials based on biological residues. Traceless creates base materials in granulate form which can be used for a wide range of products, including rigid packaging, single-use products, high-abrasion products, paper and cardboard coatings, and more. Investment including from Planet A, HTGF, EIC (grant).

Shellworks | est. 2019 London, UK

Producer of a variety of materials, e.g. Shellmer, a biopolymer product extracted from seafood waste. Products include cream containers and lipstick packaging. Seed round led by LocalGlobe.

Xampla | est. 2018 Cambridge, UK

Producer of plant-based materials that do not harm the environment, including biodegradable microcapsules, beads and films made from plant protein for food, cosmetics, packaging, and more applications. Backed by Amadeus Capital Partners and Horizons Ventures.

NoIssue | est. 2017 Auckland, New Zealand

Eco-friendly custom packaging platform. Company‘s product range includes custom paper stickers, compostable mailer bags, and tissue wraps. Series A led by Felix Capital.

NotPla | est. 2014 London, UK

Notpla is a revolutionary material made from seaweed and plants that biodegrades in weeks. Investors include Horizons Ventures and Astanor.

Photo by Boxed Water Is Better on Unsplash

Sustainable building materials

Made of Air | est. 2016 Berlin, Germany

Development of carbon-negative materials by taking low-value wood waste and transforming it into high-value, carbon-negative thermoplastics. Besides the built environment also innovate in mobility and consumer goods. Investors include EQT and Tuesday Capital.

Alcemy | est. 2018 Berlin, Germany

With Alcemy’s AI software, production quality can be controlled predictively. This increases the uniformity of cement and concrete, simplifies work in the laboratory and control room, and reduces production costs. This sets the course for a progressive reduction in the CO2 footprint and significantly simplifies the handling of even the most complex mixtures. Investors include La Famiglia, Firstminute, and Entrepreneur First.

Vestack | est. 2020 Paris, France

Design and manufacture of modular bio-based buildings. Their USP lies on both software and hardware: their digital design system and industrialised pre-assembly of the buildings allows for faster and less emissions-intensive construction.

Additional innovation can be seen in modular construction and fungal mycelium as promising solutions for construction.

Bio-based fuels, textiles and other biomanufacturing solutions

LOVR | est. 2021 Darmstadt, Germany

Leather made from agricultural residues. CO2-neutral, plastic-free and biodegradable alternative made from hemp, leveraging processing technology from the paper industry.

Phycobloom | est. 2019 London, UK

Using algae oil as fuel. Phycobloom’s algae will continually release oils into their surroundings by extracting algae oil using synthetic biology. This makes the oil easier to collect without damaging the algae themselves.

Fabric Nano | est. 2018 London, UK

Replacing fermented and petrochemical products with biomanufactured alternatives using a novel DNA-based flow reactor to produce biochemicals. Investors include Atomico, Hoxton, Backed VC, Pace Ventures.

Business models: chem-as-a-service vs more full-stack

Companies listed above are trying different business models, either focusing on only providing software to help with material discovery (chem as a service) or the more full stack approach where they discover the materials using in silico models (software) but are also responsible for the manufacturing of the finished product, albeit on a small scale (full-stack).

Chemicals as a service has seen an uptake amongst early-stage companies: the idea is to determine the revenue based on the benefits of the chemical usage, in the form of software or R&D process, rather than on the volume of the chemicals/materials. For several B2B customers, this is all that they want and need. Take the food and beverage industry for example; a lack of internal innovation might support the idea to look externally for the development of a new kind of bio-based packaging. This approach requires lighter capex and has faster innovation cycles for the corporate but also has a major drawback. In most instances, any developed IP remains on the customer side and therefore restricts the ability to scale several bio-based packaging compositions that can be useful to reduce our dependence on fossil fuels.

Hence, we prefer the business model where start-ups both discover new materials and produce smaller batches of the finished product, which can then be licensed out to many operators in the chemical or other industrial sectors.

We can’t wait for more innovation taking place in the space!

If you are an early-stage green chem/materials start-up and want to be included in the list above feel free to reach out

Sources